Citigroup predicts LME copper price to hit $10,000 before US tariffs

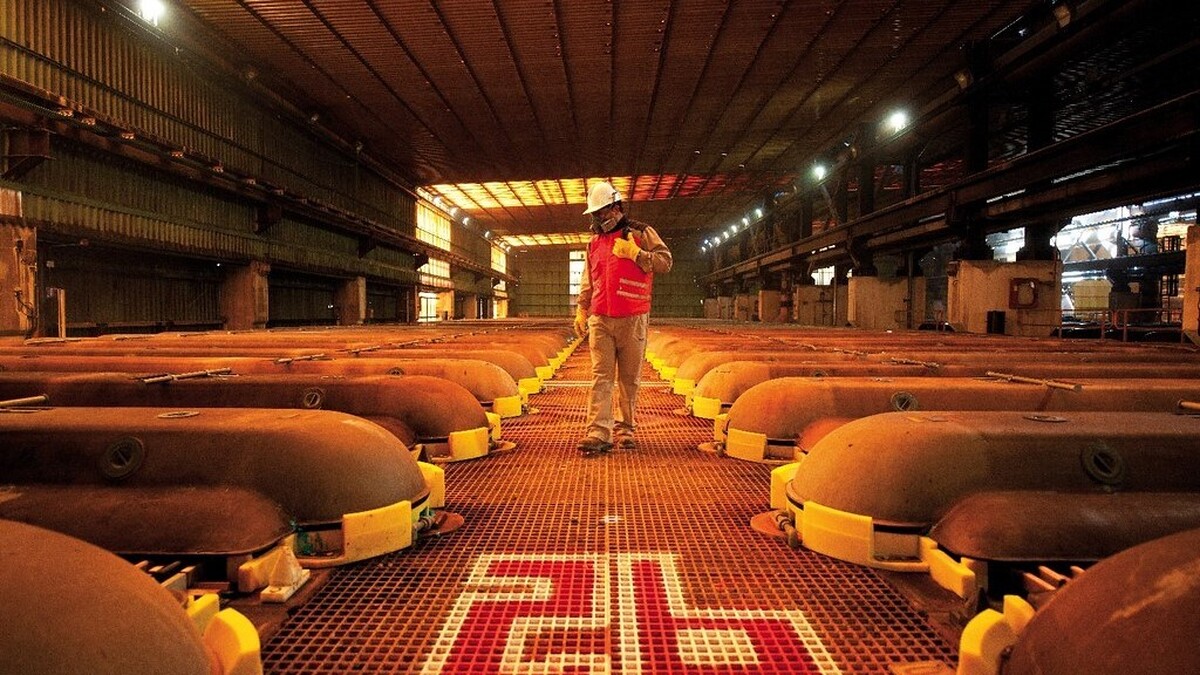

According to me-metals cited from mining.com, Copper prices have risen in recent weeks after President Donald Trump signed an executive order initiating a Section 232 review of copper imports. These investigations assess the impact of imports on national security.

Meanwhile, major commodity traders such as Glencore (LSE: GLEN) and Trafigura are rushing to ship copper to the U.S. ahead of a potential tariff announcement, aiming to maximize profits, Bloomberg reported.

The global benchmark price set on the London Metal Exchange closed at $9,770 per tonne on Wednesday, while futures in New York are already trading above $10,000 per tonne.

On Thursday morning, copper for May delivery was trading 0.6% higher at $4.87 per pound ($10,071 per tonne) on the Comex market in New York.

“We think ex-U.S. physical market tightening is likely to persist through May/June, temporarily offsetting price headwinds from broader U.S. tariff announcements,” Citigroup analysts, including Max Layton, wrote in an emailed note.

Citi’s outlook marks a shift from its February forecast, when the bank predicted copper would fall to $8,500 per tonne in the second quarter. However, Citi still expects a price pullback “once tariff-induced U.S. copper import demand collapses, which we expect as Section 232 copper tariff implementation draws nearer.”

In addition, supply constraints persist. Chile, the world’s largest copper producer, saw its output decline 24% month-over-month in January, marking a nine-month low, while demand from smelters continues to grow.

Morgan Stanley also anticipates further gains in copper prices amid expectations of potential U.S. tariffs.

“With tariffs not yet imposed, there is a strong incentive to send metal to the U.S., tightening markets in the rest of the world as well,” Morgan Stanley noted.

“Being long on a commodity in contango can be challenging, as the futures price ‘rolls down’ to the spot price. However, in backwardation, it can ‘roll up,’ and this shift can often drive investor inflows,” the bank added.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

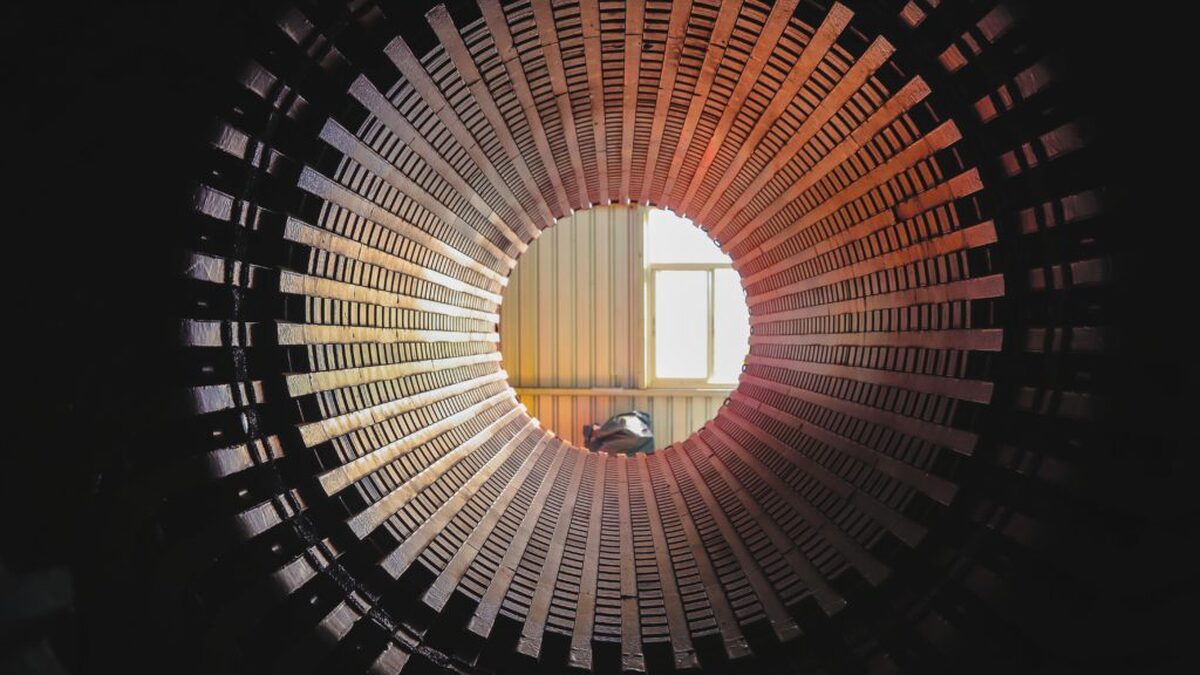

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts