Copper prices surge as Trump signals 25% tariff on imports

According to me-metals cited from mining.com, Trump’s comments — made in a speech to Congress Tuesday — sparked a frenetic rally in Comex copper prices in Asian hours as traders reacted to the possibility that levies could be larger than expected, and come much sooner.

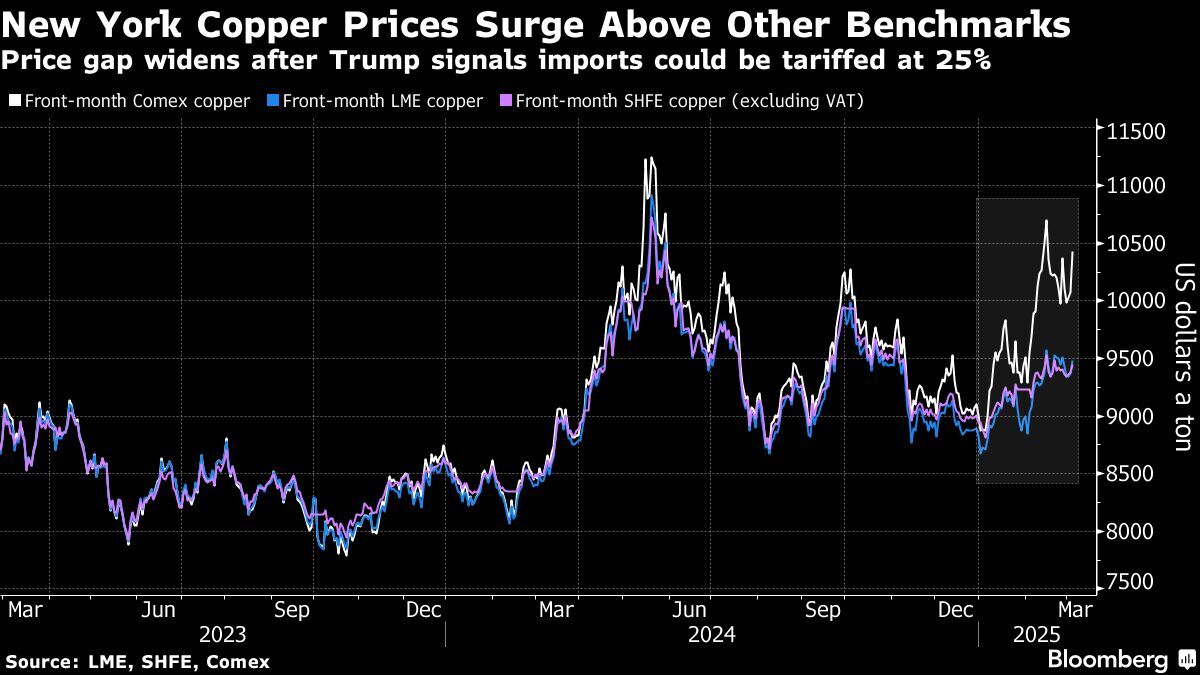

Last week, Trump announced that the Commerce Department would undertake a sweeping investigation that may lead to copper tariffs on national security grounds. That triggered a sharp rally in Comex prices, widening the gap with equivalent prices in London and Shanghai.

It could take months for the department to decide whether tariffs should be imposed, but Trump suggested Tuesday that he’d already enacted a 25% levy. He previously signed an order to impose tariffs at that level on aluminum and steel, due to kick in March 12.

“A 25% tariff was clearly not what the market was expecting before those comments, and now traders are scrambling to price in the correct level, whatever that might end up being,” said Ole Hansen, head of commodity strategy at Saxo Bank AS. “The disruption to global trade flows is very real.”

The surge on the Comex also triggered a smaller rally on the London Metal Exchange, with three-month prices rising as much as 2.5%. New York futures have been trading at a hefty premium to the LME for months as investors price in the growing likelihood of tariffs, and Wednesday’s gain left Comex copper almost 12% higher than the LME, nearing a peak of about 13% seen last month.

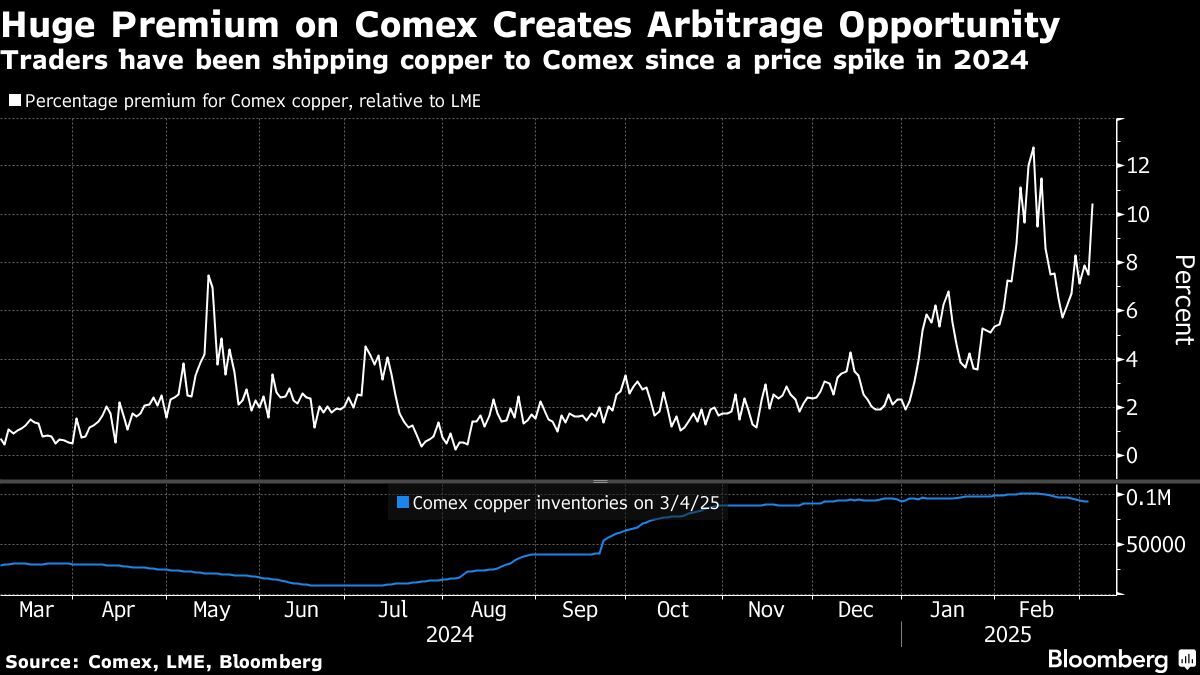

The huge differential has already touched off a worldwide hunt for copper that can be shipped to the US before any tariffs are imposed, and traders are likely to redouble those efforts following Wednesday’s jump.

With LME prices hovering around $9,500 a ton and New York prices trading about $1,000 higher, the arbitrage presents a lucrative opportunity for a market used to operating on razor-thin margins.

Comex copper inventories — which swelled after a similarly large price spike on the exchange last year — have been drawing down in recent days, indicating that US manufacturers may also be looking to stock up before tariffs come into effect. Meanwhile, requests to withdraw the metal from the LME have soared.

Other metals were also higher on the LME on Wednesday, with zinc adding 2.5% and aluminum gaining 1.7%, tracking a sharp rally in industrial metals and mining stocks during European hours.

The rally — part of a broader leg-up in European defense and industrial stocks — came after Germany’s chancellor-in-waiting Friedrich Merz said the government would amend the constitution to exempt defense and security outlays from limits on fiscal spending and do “whatever it takes” to defend the country.

Steelmakers also saw big gains after China pledged to cut output to ease a domestic glut.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts