PDAC: Gold, copper prices bound to increase: analysts

According to me-metals cited from mining.com, After modest copper surpluses this year and next, global demand will likely start exceeding supply in 2027, according to a forecast shared by CRU Consulting vice president Frank Nikolic on Sunday. Gold should benefit from inflationary pressures, strong central bank buying and massive US deficits for the foreseeable future, Osisko Gold Royalties (TSX:OR; NYSE: OR) CEO Jason Attew said.

The pair were part of a panel discussion at the annual Prospectors & Developers Association of Canada conference that focused on prospects for both metals.

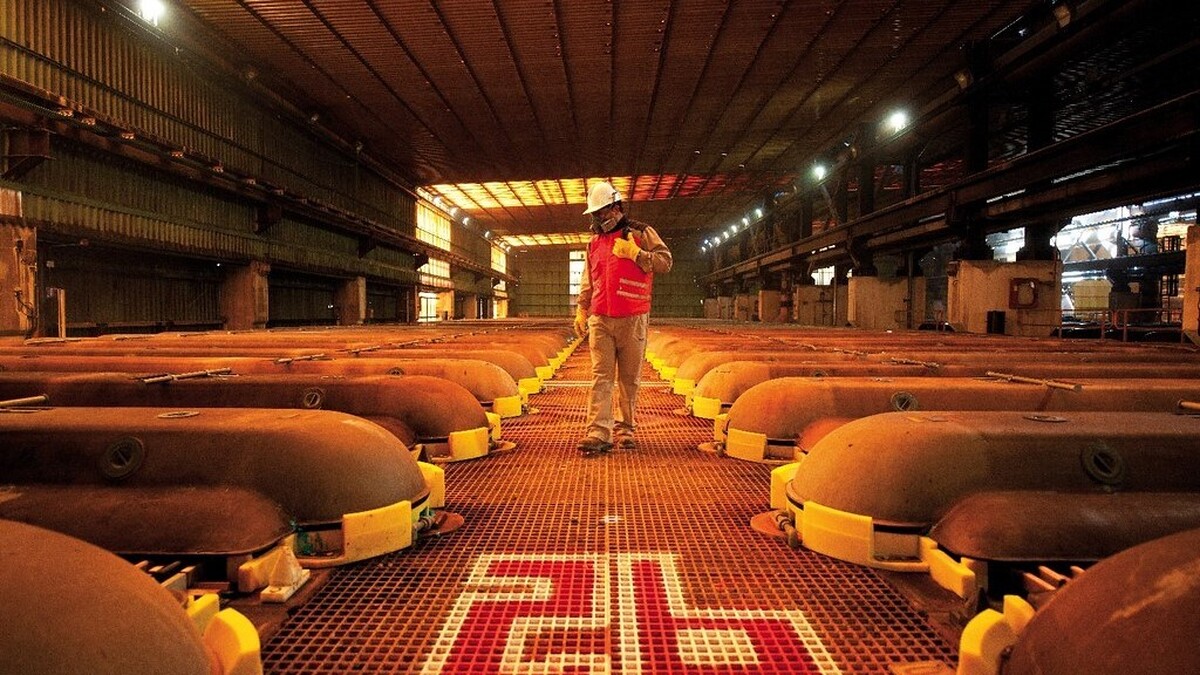

“Copper is in crisis,” Ero Copper (TSX: ERO; NYSE: ERO) CEO David Strang said during the discussion. “If the world is going to continue to where it needs to be, we need to find more copper. Two things are going to affect that – one is technology, and the other is the metal price. It has to go up.”

Double digits

Copper has gained about 18% in the past year, rising to about $4.53 per lb. Friday, according to Trading Economics data. Gold has done even better, gaining 40% in 12 months to $2,856.91 per oz. as of Friday. It has set several all-time highs along the way.

Annual supply deficits, ranging from 6 million to 8 million tonnes of copper, could become commonplace over the next 10 years as artificial intelligence usage skyrockets, Nikolic said. As copper’s electrical and thermal conductivity makes it a key material in the design of AI systems, the metal is used in building computers, servers and data centres.

“Copper is tied to our civilization and human advancement,” Nikolic said. “The world wants to catch up with our standard of living.”

Some $100 billion in capacity increases will be needed in the next decade just to keep up with copper demand, CRU estimates. Unfortunately, copper mines are becoming costlier to build and operate just as grades are declining.

A new copper mine costs about $25,000 per tonne of capacity to bring online, Strang said. Together, mining companies would need to invest some $450 billion in new capacity over the next 25 years – far exceeding the $250 billion combined revenue of global copper producers, he said.

Inflation

Gold’s case, meanwhile, is underpinned by inflation, growing fears over the state of government finances in the US and the possibility of the world’s biggest economy slipping into recession. Sustained gold purchases by global central banks and retail buyers in India and China also offer support, said Bank of America Securities analyst Lawson Winder.

US federal government debt has soared 80% since the Covid-19 pandemic to reach about $36.5 trillion – dwarfing the country’s $29.1 trillion gross domestic product. The 125% debt-to-GDP ratio is the highest since the end of World War II, Attew said.

Attempts to curb federal spending through a new entity called the Department of Government Efficiency, or DOGE – headed by Tesla CEO Elon Musk – may not even be enough to avoid US bankruptcy, he said.

Money printing

“No amount of DOGE can fix this debt-to-GDP disparity,” Attew said. “These are facts. The obvious solution to the problem is to print more money, which everyone knows will lead to a devaluation of the US dollar. US dollar strength has an inverse correlation with the price of gold – all of which is very constructive for gold.”

Demand for gold is also benefiting from strong central bank interest. They have been buying gold in the last three years at higher levels than at any point in the previous 50 years, “and we think that this will continue,” Winder said.

And if Western investors start turning to gold the way Indian and Chinese customers have, prices should keep climbing, he added. A 10% increase in physical gold purchases and exchange-traded fund assets could push the metal to $3,500 per oz., he said.

“We’re going to be in a highly inflationary environment,” Attew said. ”Guess what commodity does the best in an inflationary environment over the long term? It’s gold.”

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo