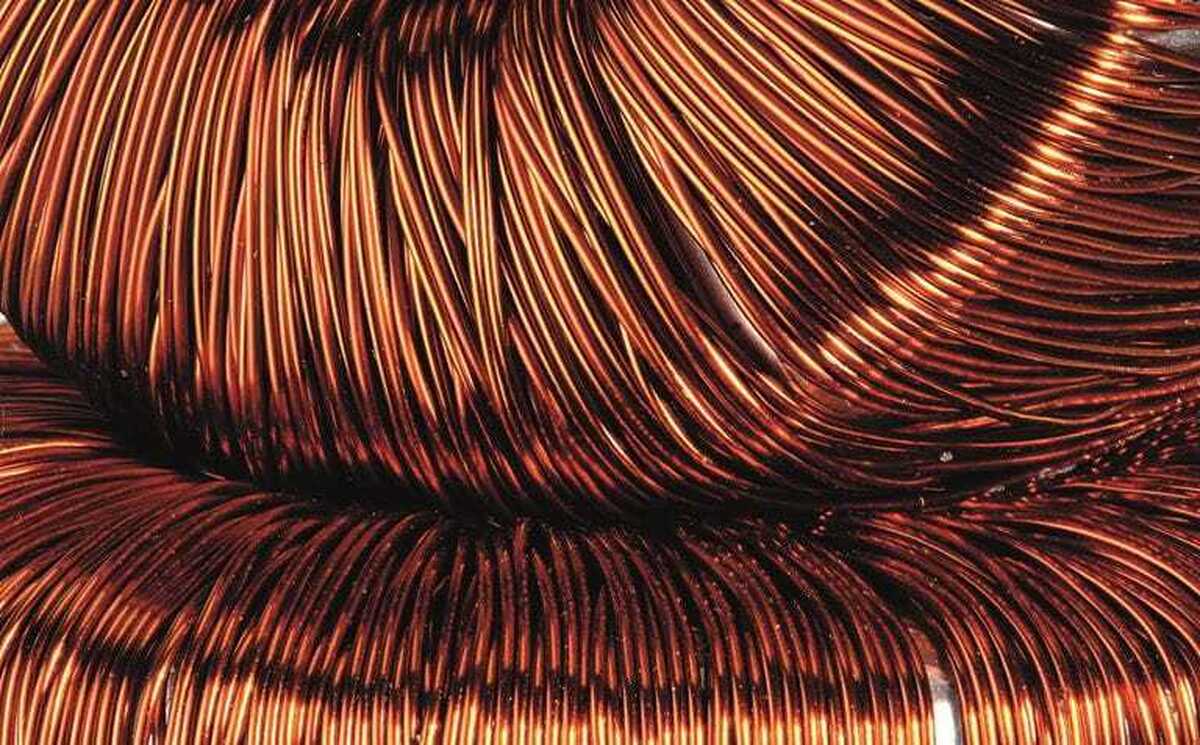

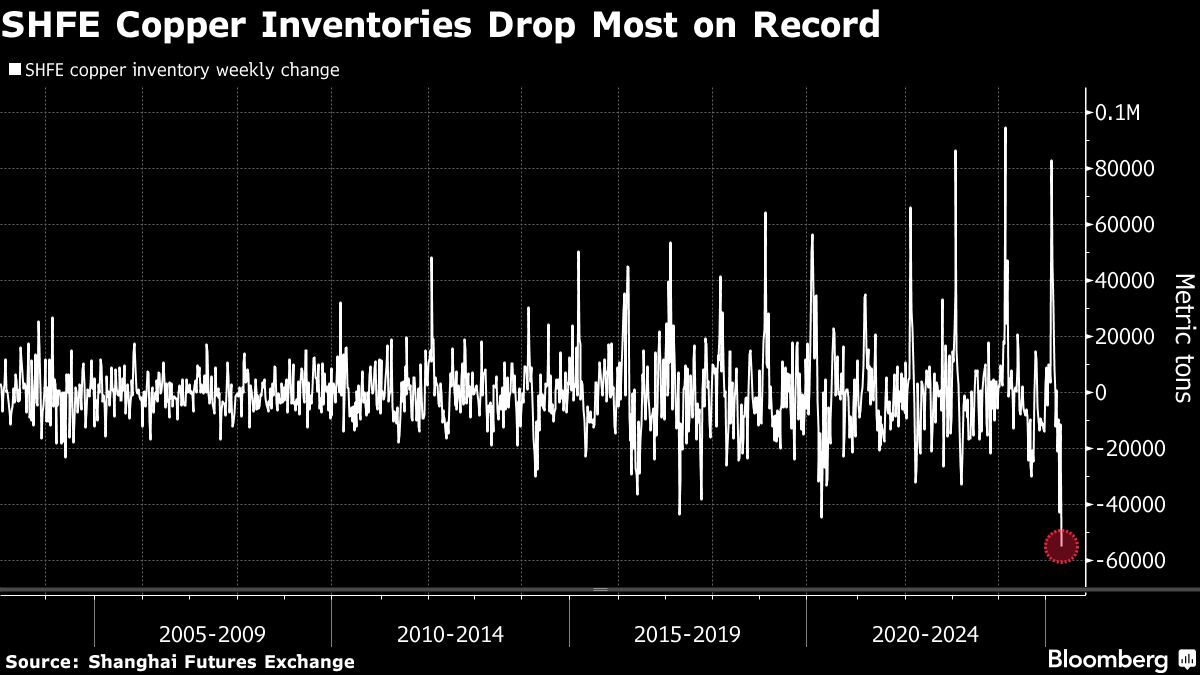

Chinese copper inventories post record weekly drop

According to me-metals cited from mining.com, Inventories in warehouses monitored by the Shanghai Futures Exchange shrank by 54,858 tons, the most in data going back to 2003, to 116,753 tons, according to weekly figures released on Friday.

The sharp drawdown adds to evidence that China’s physical copper market is tightening up, with buyers also paying more to import cargoes and spot prices trading at steep premiums. Shanghai-tracked inventories more than halved in the past month amid an opportunistic buying spree that followed a pullback in prices.

“Demand from fabricators has been very good,” Wanqiu Xu, an analyst with Cofco Futures Co., said by phone. “There is no impact seen from the tariffs yet.”

The global copper market has been rocked this year by the evolving trade war — which may see Washington place tariffs on copper imports — as well as China’s efforts to sustain growth.

On Friday, China vowed to “fully prepare” emergency plans to ward against increasing external shocks, taking a patient approach in defending growth as deepening tensions with the Trump administration in the US pile pressure on the world’s No. 2 economy.

Copper prices have snapped back strongly from an initial selloff as President Donald Trump rolled out tariffs on China and other nations. London Metal Exchange contracts are up more than 15% from lows seen in early April.

The metal was trading 0.4% down at about $9,358 a ton on the LME as of 10:50 a.m. local time on Friday. Most other metals also drifted lower.

source: mining.com