Storied Peruvian executive resurfaces at Canadian copper startup

According to me-metals cited from mining.com, Gobitz stepped down as chief executive officer of a mine owned by BHP Group and Glencore Plc to lead Quilla Resources Inc., a firm he set up along with one family based in the UK and another in Peru.

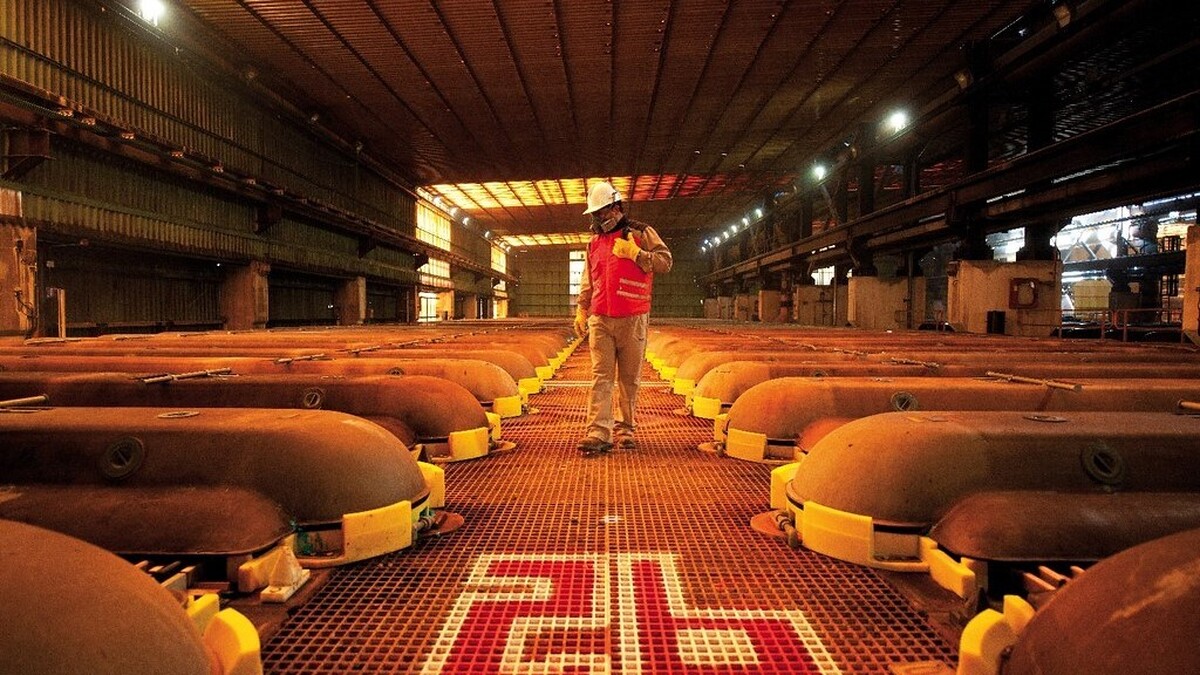

Quilla acquired a company from Nexa Resources SA in a bid to restart the Chapi copper mine in Peru. The new owner plans to start producing cathode in the first half of next year at an annual rate of about 10,000 metric tons.

The mine, south of the Peruvian city of Arequipa, was halted in 2012 due to declining metal prices and operational challenges. Average copper prices have risen about 15% since then, partly due to additional demand from the shift away from fossil fuels, when big new deposits are getting harder to find, develop and finance.

Gobitz, whose two daughters are also involved in his new Toronto-based venture, looks to use cash from the Chapi restart to finance work on other opportunities for the 26,000-hectare (64,000-acre) land package — which isn’t far from a giant mine owned by Freeport-McMoRan Inc.

“We’ll be a closely held company for a time — until we restart operations — and then we’ll evaluate going public,” he said in an interview Wednesday. “We believe the potential is there to find a deposit of large dimensions.”

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts