Iron ore price dips on China blast furnace cuts, US trade restrictions

According to me-metals cited from mining.com, The most-traded January iron ore contract on China’s Dalian Commodity Exchange (DCE) traded 0.19% lower at 769 yuan ($107.09) a metric ton.

The benchmark September iron ore on the Singapore Exchange was 0.25% lower at $100.8 a ton, as of 0710 GMT.

Ahead of the military parade in Beijing on September 3 commemorating the end of World War Two, China has mandated blast furnace production cuts aimed at improving air quality, a move that is weighing on raw material prices, broker Galaxy Futures said in a note on Wednesday.

Still, the planned cuts are less severe than earlier market rumours of a full shutdown, limiting the impact on actual demand, ANZ analysts said in a note on Wednesday.

Meanwhile, the US said on Tuesday that it was targeting more imports of Chinese goods, including steel, copper, and lithium, for high-priority enforcement over alleged human rights abuses involving the Uyghurs.

At the same time, the US announced that it was widening the 50% tariff on steel and aluminum to more than 400 products to support American industries.

Appeals from companies like Tesla, which argued that available US steel production capacity was not sufficient for its electric vehicles, were unsuccessful.

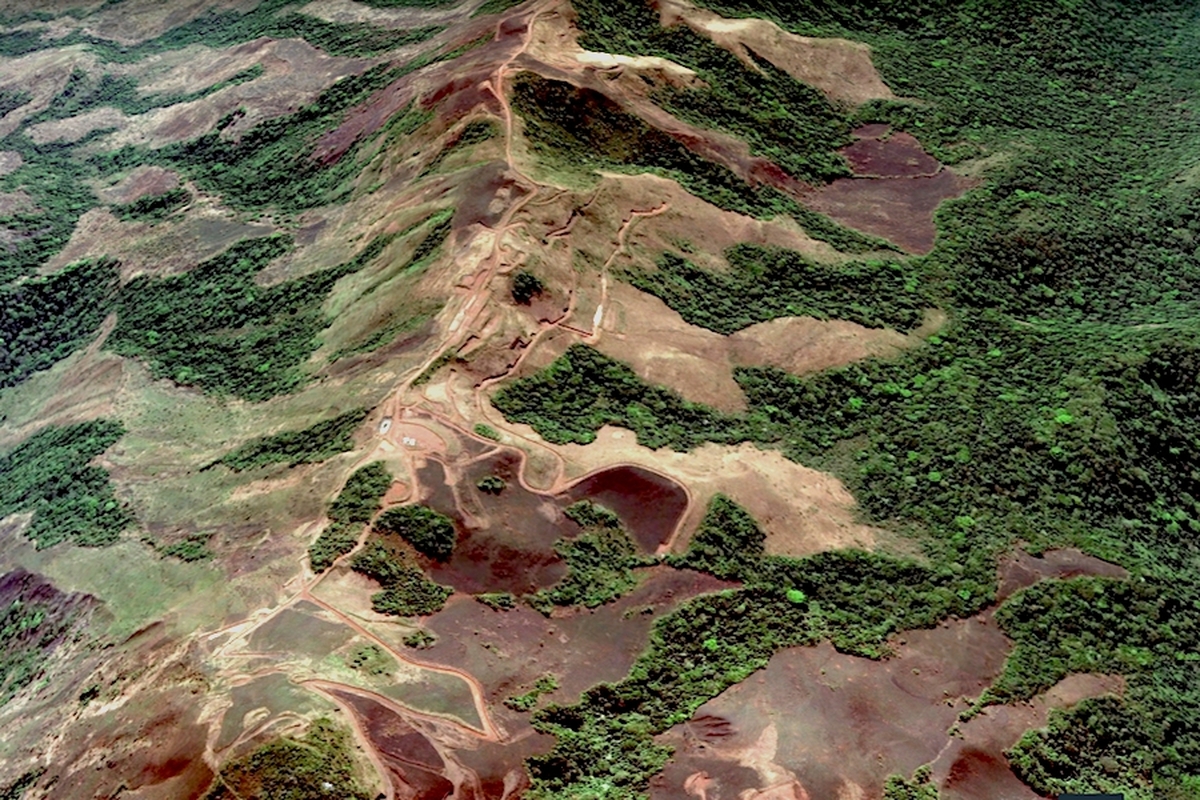

On the supply front, iron ore shipments from top producers Australia and Brazil rebounded week-on-week, with Brazilian mining giant Vale leading the charge, according to data from Chinese consultancy Mysteel.

Other steelmaking ingredients on the DCE fell, with coking coal and coke down 2.6% and 2.33%, respectively.

Steel benchmarks on the Shanghai Futures Exchange mostly lost ground. Rebar fell 0.38%, hot-rolled coil decreased 0.61%, and stainless steel dipped 0.81%, while wire rod gained 0.15%.

($1 = 7.1807 Chinese yuan)

source: mining.com

Adani’s new copper smelter in India applies to become LME-listed brand

Cochilco maintains copper price forecast for 2025 and 2026

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

Gold price stays flat following July inflation data

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects