Galan Lithium proceeds with $13M financing for Argentina project

According to me-metals cited from mining.com, As previously announced on June 20, Clean Elements will purchase nearly 182 million of Galan’s shares at a price of A$0.11 each, representing a 21% premium at the time. The purchase will be made in two equal tranches of A$10 million, with the first closing within five business days and the second tranche closing no later than Nov. 22.

At market close Monday, the stock traded at A$0.14 apiece, giving the Australian lithium developer a market capitalization of A$135 million ($87.5 million).

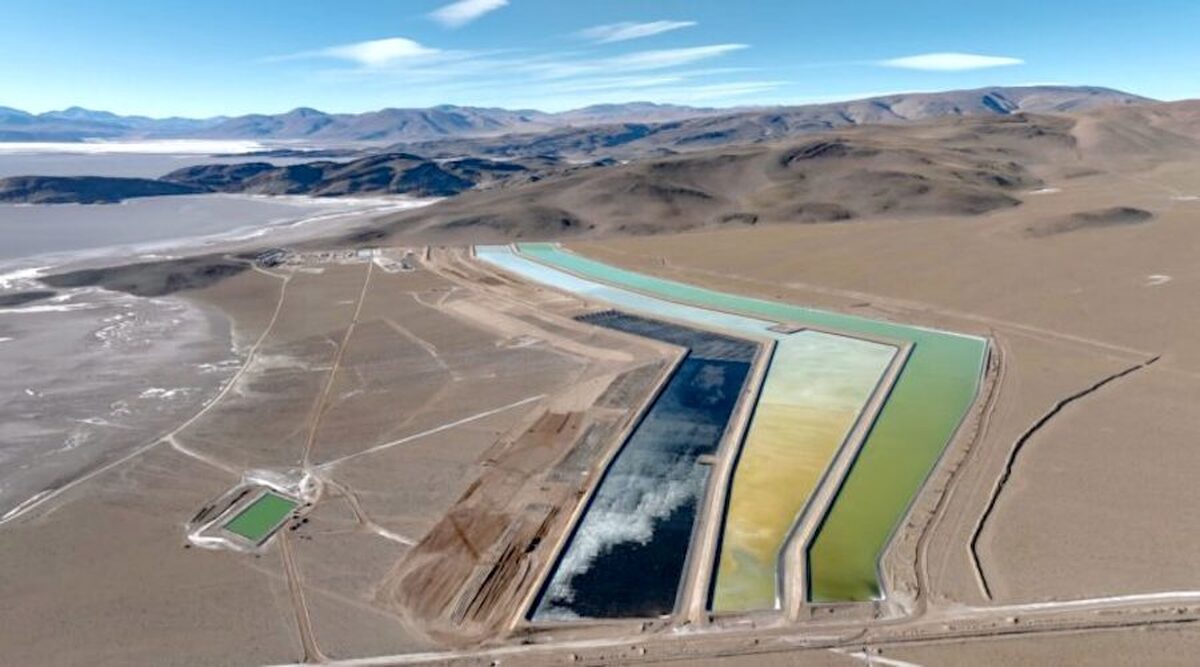

The proceeds are expected to fund the Phase 1 construction activities at the HMW project in Catamarca province, which is targeting a 4,000-tonne-per-annum lithium carbonate equivalent operation capable of producing a 6% lithium chloride concentrate product.

First output is scheduled for the first half of 2026, with a projected mine life of 40 years over four phases. Upon completing the ramp-up, its production capacity would rise to 6,000 tonnes per annum.

First production on track

“With the support of Clean Elements, Galan now has the funding certainty to complete Phase 1 construction at HMW and is firmly on track to deliver first lithium chloride concentrate production in H1 2026,” Galan’s managing director Juan Pablo Vargas de la Vega said in a press release.

The due diligence by Clean Elements – an existing shareholder – has confirmed HMW is “an exceptional lithium project, combining substantial scale and grade with execution capability that places it among the best globally,” he added.

Last month, the $217 million HMW project was approved for the new incentives program in Argentina known as RIGI (Régimen de Incentivo para Grandes Inversiones), which provides a reduced corporate income tax rate of 25% and fiscal stability for 30 years. It is the sixth project to be accepted into the program.

“This is a major milestone for Galan that will further strengthen HMW’s global competitive position as a future low-cost producer,” de la Vega commented in a July 28 press release.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery