AI data centers to worsen copper shortage – BNEF

According to me-metals cited from mining.com, BNEF analysts said copper demand from the sector will average around 400,000 tonnes annually over the next decade, peaking at 572,000 tonnes in 2028. The cumulative total in use by data centers could top 4.3 million tonnes by 2035. That comes on top of surging demand from other sectors, such as power transmission and wind energy, where copper usage is expected to almost double by 2035.

The AI capacity additions put pressure on a market that is already tight, which is exacerbated by years of underinvestment in new copper supply, the analysts noted.

Meanwhile, the price of copper is in a slump after it plunged 20% at the end of July amid United States President Donald Trump’s tariff announcement on copper. It traded for $4.49 per lb. on Tuesday afternoon.

With demand accelerating and supply growth lagging, BNEF expects copper prices to peak at $13,500 per tonne in 2028. The shortfall is worsened by a projected global copper supply of just 29 million tonnes by 2035, well below the 35 million tonnes needed to meet demand.

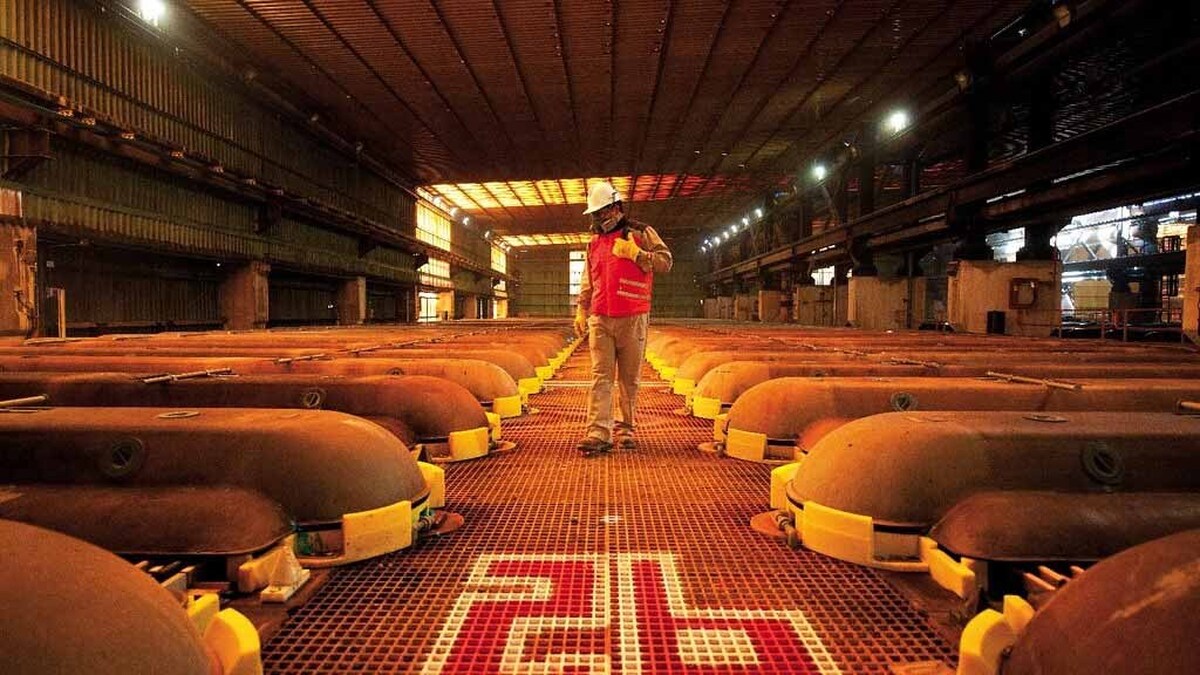

Copper-hungry centers

Copper can account for nearly 6% of the capital expenditure of a data center project. Its role is critical in electrical conductivity as it maximizes efficiency in transmitting and distributing electricity and in thermal conductivity due to its support for high-performance heat exchangers, which are vital for cooling servers. The red metal’s ductility and malleability allows it to be shaped into compact components like connectors.

Data centers rely on copper for a wide range of applications, including power cables, busbars, electrical connectors, heat exchangers and sinks, and power distribution strips

Microsoft’s $500 million data center in Chicago alone required 2,177 tonnes of copper during construction.

Meanwhile, North American data center infrastructure alone is expected to grow from a $33 billion business in 2020 to $70 billion in 2030 and $185 billion in 2040.

source: mining.com

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Critical Metals signs agreement to supply rare earth to US government-funded facility

Kyrgyzstan kicks off underground gold mining at Kumtor

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility