Gold price rally hits pause as traders digest data, Powell remarks

According to me-metals cited from mining.com, US inflation picked up broadly at the start of the year, further undercutting chances of multiple Fed interest-rate cuts this year at the same time the Trump administration presses forward with tariffs.

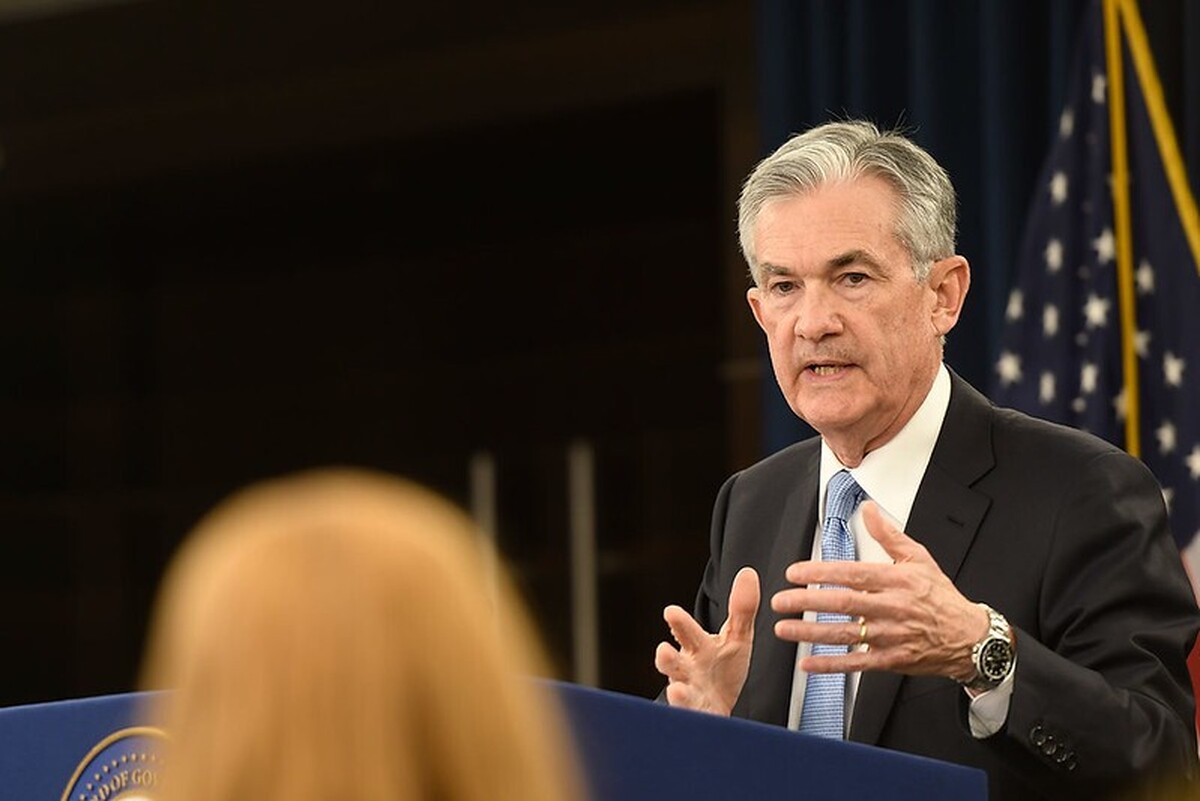

Meanwhile President Donald Trump called for lower interest rates as Powell continued with his second-day testimony before the House Financial Services Committee.

The US central bank “will make decisions about interest rates as we go,” said Powell during the testimony, adding that Wednesday’s inflation print shows “we’re close but not there on inflation.” He told senators on Tuesday the Fed would be patient before easing monetary policy further.

Policymakers held interest rates steady at their first meeting of the year last month as they wanted to see further progress on moderating inflation.

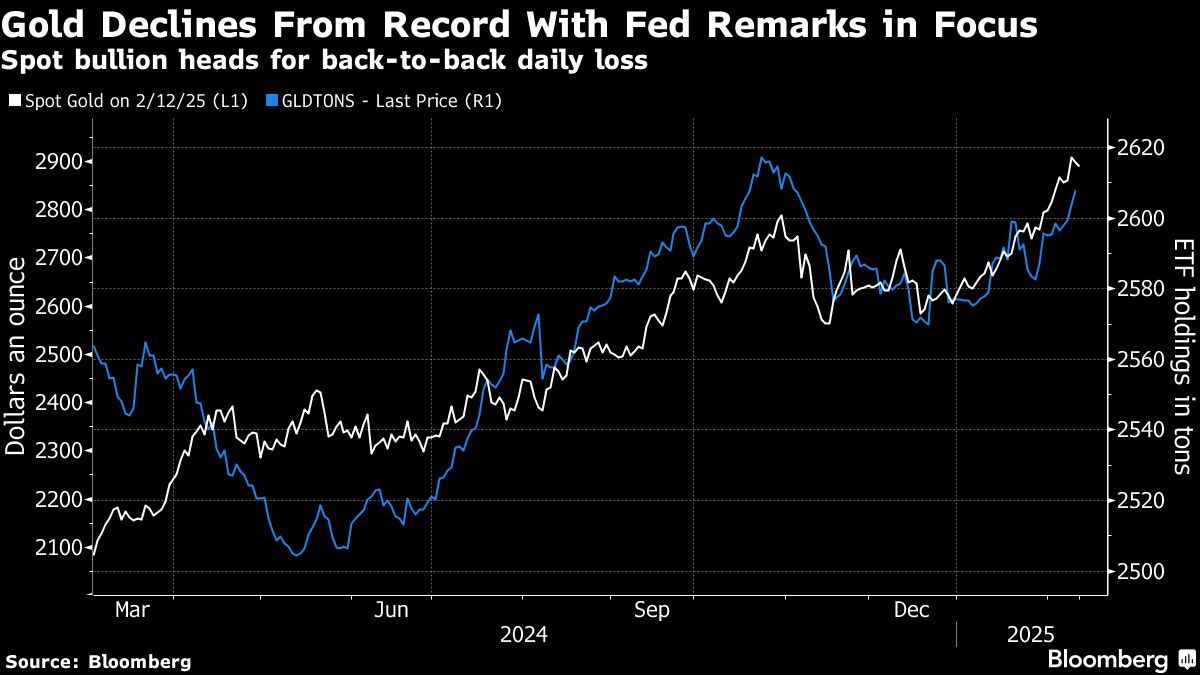

Gold has roared higher this year, setting successive records and potentially lining up a test of $3,000 an ounce. The surge has been powered by increased haven demand as US President Donald Trump unleashed a series of aggressive moves on trade, including a planned levy on steel and aluminum imports.

Traders are trying to get a read on the potential implications for the US economy and monetary policy should the White House’s stance on trade and immigration reignite inflation and impact growth. During his testimony, Powell said it was unwise to speculate on tariff policy.

Gold’s recent ascent has been accompanied by inflows into bullion-backed exchange-traded funds. Global holdings have risen 1.2% so far this year, hitting the highest since November, according to Bloomberg calculations.

Spot gold, which peaked above $2,942 on Tuesday, added 0.2% to $2,902.78 an ounce at 11:57 a.m. in New York. The Bloomberg Dollar Spot Index added 0.1%. Silver was little changed, while platinum rose and palladium fell.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts