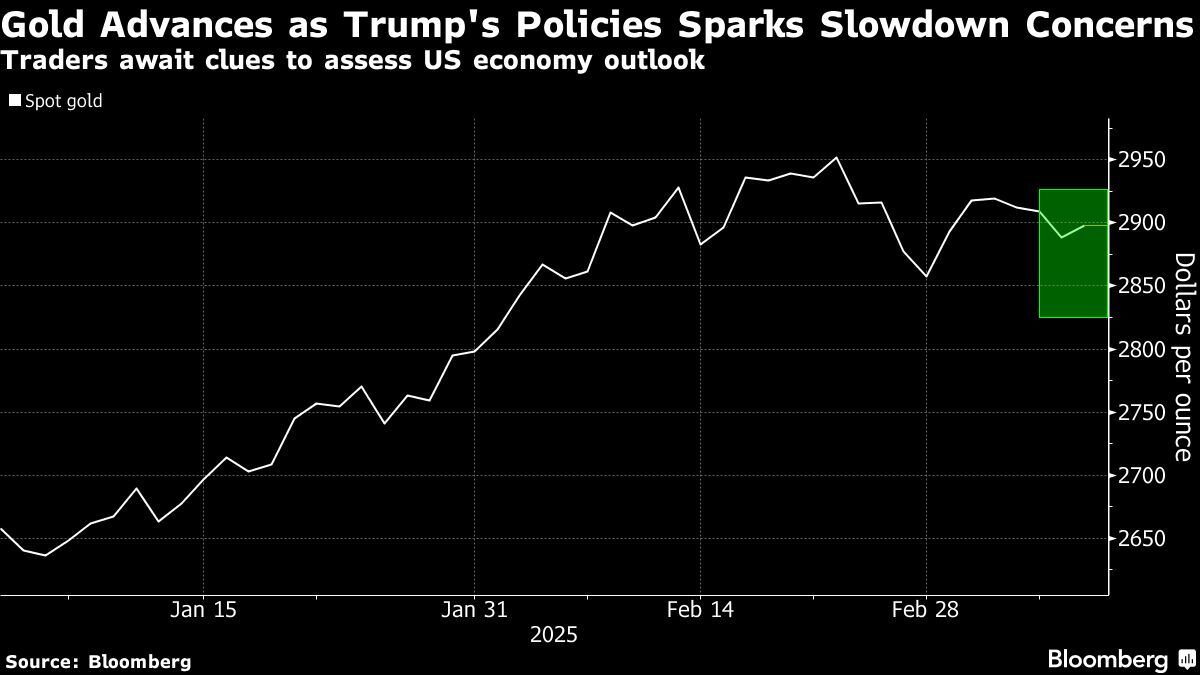

Gold rebounds as investors take stock of outlook for US, tariffs

According to me-metals cited from mining.com, Bullion pushed higher following a small drop Monday, when President Donald Trump’s signalled that the economy could first suffer as he reshapes trade policy with tariffs stoked concerns about a potential recession. The metal, traditionally viewed as a haven asset, can face pressure during sudden market selloffs when investors seek liquidity.

Gold has advanced 11% this year, hitting successive records. The rally has been driven by fears about the disruption caused by the Trump administration, central-bank buying and speculation the Federal Reserve may cut interest rates further. Lower borrowing costs tend to benefit non-yielding gold.

While bullion’s climb has sapped demand for physical metal in some of Asia’s leading economies, it’s been accompanied by steady investment flows into gold-backed, exchange-traded funds. These reached the highest level since December 2023 last week, according to a Bloomberg tally.

“Gold finds itself without a solid physical-market floor” amid lackluster demand in India and China, Standard Chartered Plc analyst Suki Cooper said in a note. Still, prices are expected to hit fresh highs this year, with stronger flows into ETFs needed to offset the decline in physical demand, she said.

Spot gold gained 0.8% at $2,911.08 an ounce at 9:45 a.m. in London. The Bloomberg Dollar Spot Index slid 0.3% lower. Silver, palladium and platinum rose.

source: mining.com