Gold price steadies after new record high

According to me-metals cited from mining.com, Spot gold touched an all-time peak for the eighth time this year at $2,942.25 per ounce, but had fallen back down to $2,904.54 by 1 p.m. ET. US gold futures also traded flat at $2,932.90 per ounce.

So far this year, bullion has surged about 11%, as Trump’s disruptive moves on trade and geopolitics reinforce its role as a store of value in uncertain time

On Monday, the precious metal surpassed $2,900 for the first time ever after his announcement of tariffs on US steel and aluminum imports, a move that could spark a multi-front trade war and add uncertainty to global markets.

Traders are also trying to get a read on the potential implications for the US economy and monetary policy should the White House’s policies reignite inflation and subdue growth.

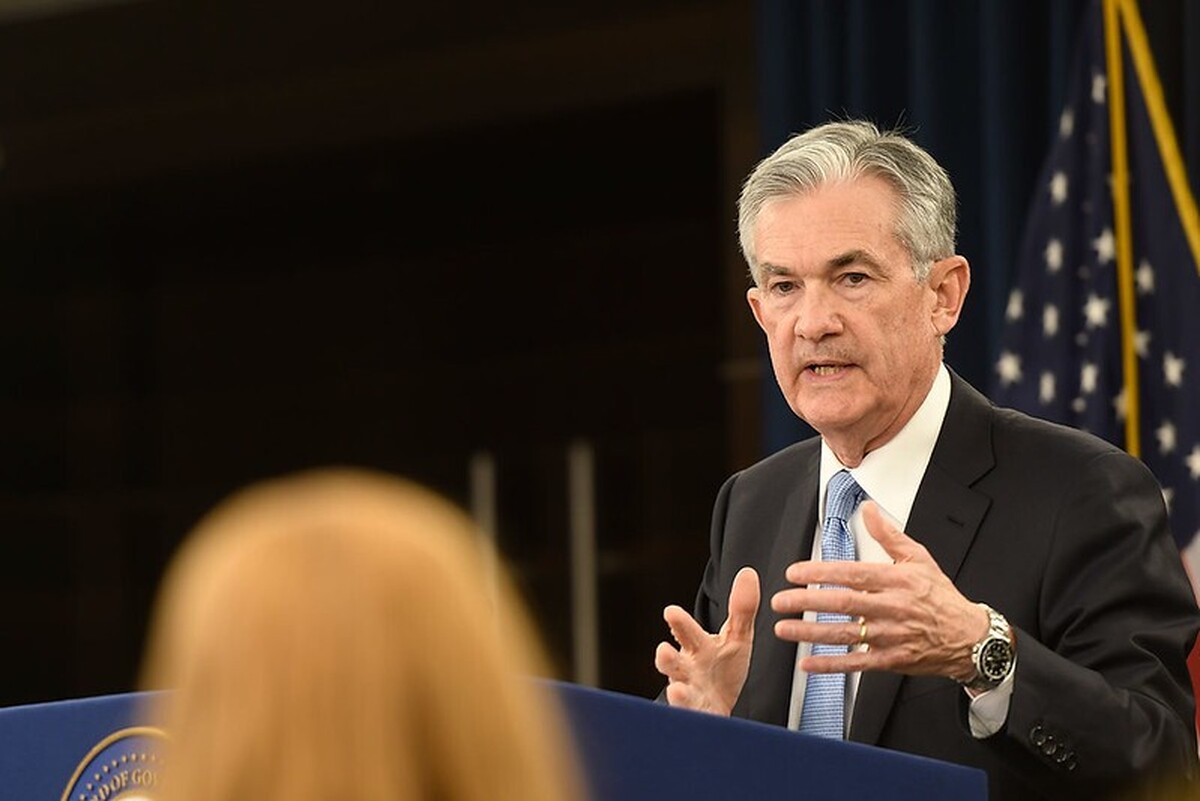

Federal Reserve Chair Jerome Powell is due to speak before Congress, which could provide clues about monetary policy. He has previously said that the US central bank is not in a rush to cut interest rates given an economy that is “strong overall”.

According to Bloomberg, short-term US inflation expectations have risen above longer-term ones to the widest since 2023. That may support the case for a slower pace of easing, a scenario that could be bearish for bullion as it pays no interest.

“Higher than expected inflation readings could extend the rate pause by the Fed, which could cause gold’s performance to moderate in the short term,” Ryan McIntyre, senior portfolio manager at Sprott Asset Management, said in a note.

Gold’s ascent has been accompanied by inflows into bullion-backed exchange-traded funds. Global holdings have risen for six of the past seven weeks, hitting the highest since November, according to a Bloomberg tally.

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo