US gold stockpiles hit record high in wake of Trump tariff trade

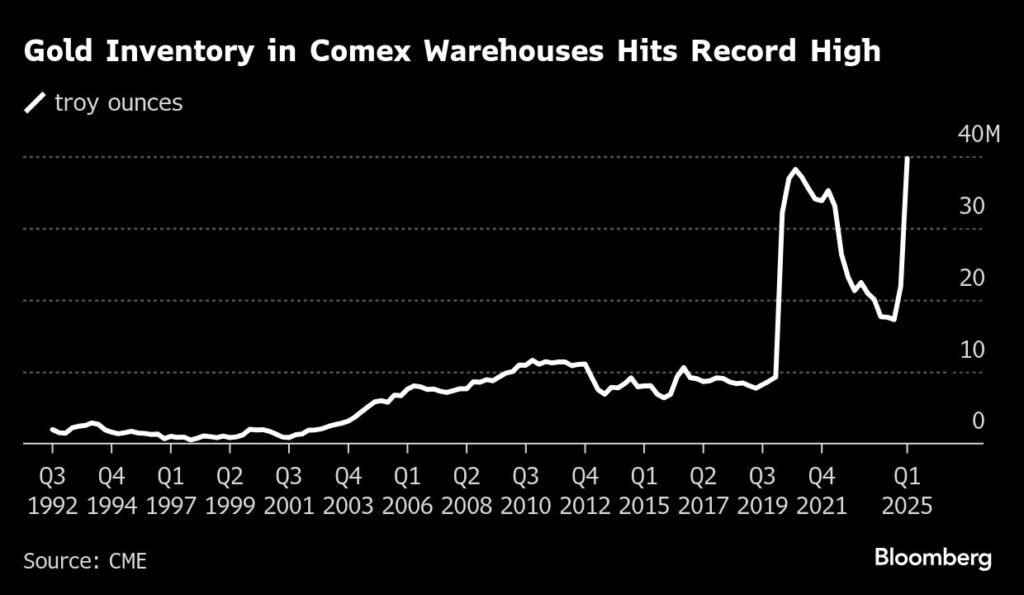

According to me-metals cited from mining.com, Inventories for New York’s Comex bourse hit 39.7 million ounces on Wednesday, the most in data going back to 1992 and worth about $115 billion. The hoard has more than doubled since early December, driven by a surge in US prices over international benchmarks that created a lucrative arbitrage opportunity for traders who could transport gold there.

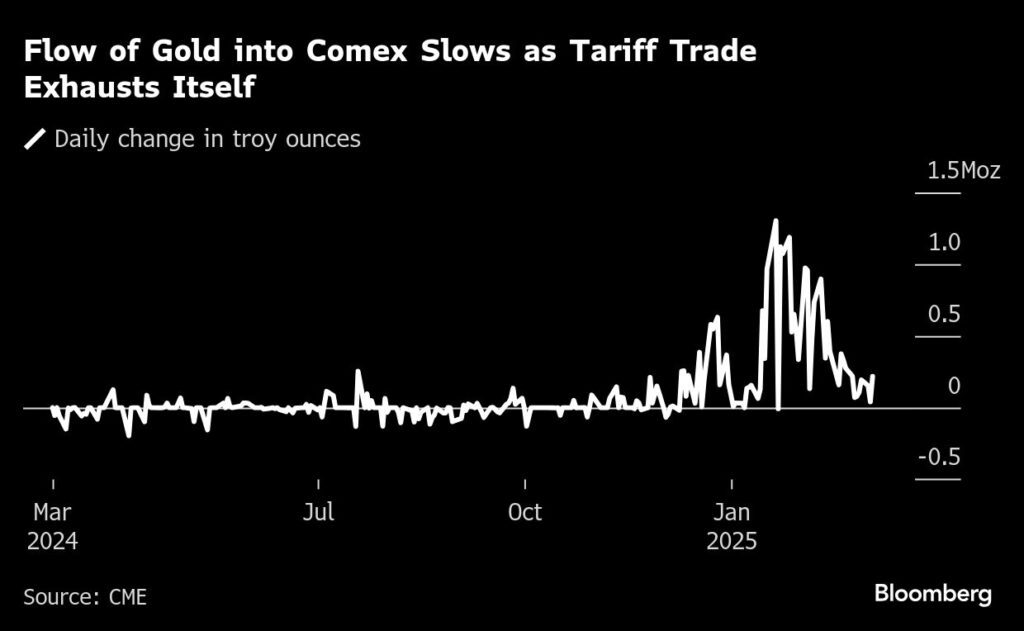

Premiums between New York futures and the dominant London spot market are typically modest, reflecting the cost of shipping, storing and financing metal. But that changed late last year, when fears that gold could be included in President Donald Trump’s sweeping tariff measures prompted some traders to close out short positions on Comex, driving futures well above London spot prices.

Gold then flowed into the US as traders rushed to profit from the unusually large price gap.

The current stockpile in Comex-registered warehouses now exceeds a previous record set in February 2021, which marked the peak of a buildup of inventories sparked by the market fallout of the pandemic.

Still, the current dislocation now appears to be fading as tightness in the physical market eases and premiums fall. Daily gold inflows into depositories have fallen from peaks of more than 1 million ounces in late January to roughly 200,000 ounces or less in the past week or so.

In normal times, traders who sell futures on the Comex typically buy out of their positions by settling in cash. But they can also deliver gold into Comex-registered depositories to close out their positions.

The amount of gold now held in the warehouses is equivalent to about 80% of the aggregate open interest — the number of outstanding contracts — in Comex gold futures. Before 2020, it was typically around 20%, as banks tended to hold gold in London and hedge it by selling futures in New York.

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo