Gold price sets new record above $3,050 following Fed verdict

According to me-metals cited from mining.com, By 5 p.m. in New York, spot prices traded 0.4% higher at $3,045.66 an ounce, having earlier reached a high of $3,051.42. US gold futures went up 0.6% to $3,056.20 an ounce.

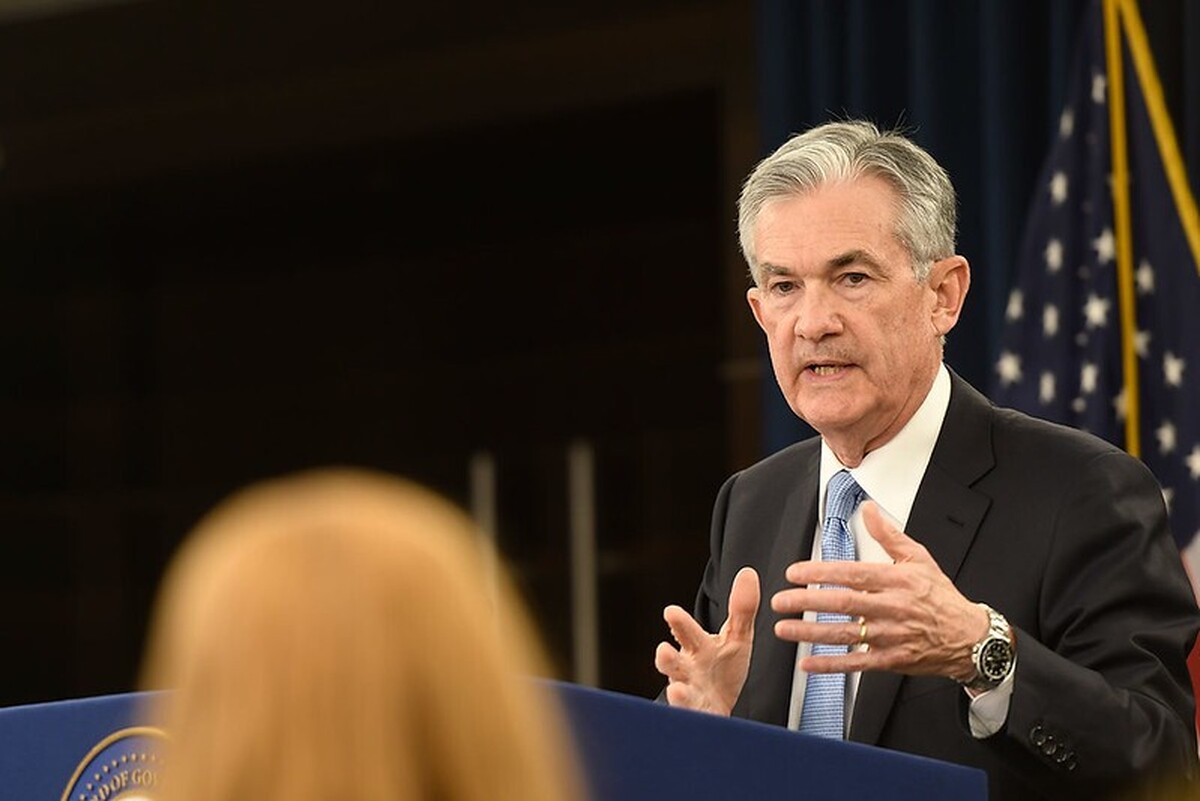

Gold’s new record follows a press conference by US Federal Reserve chair Jerome Powell on Wednesday, in which he acknowledged the “high degree of uncertainty” from President Donald Trump’s significant policy changes.

However, Powell also stressed that the US central bank is not in a hurry to adjust borrowing costs, and policymakers will wait on “greater clarity” before acting.

Despite rising inflation, the Federal Open Market Committee has voted to keep the benchmark federal funds rate in a range of 4.25%-4.5%. Both US dollar and Treasury yields both pushed lower on the decision, lifting gold’s appeal to investors.

“Clearly the market is projecting an easier monetary policy, as the Fed projects higher inflation,” said Bart Melek, global head of commodity strategy at TD Securities.

“We believe that investors should have a 5% to 10% allocation in real assets, like commodities, gold, infrastructure, real estate and natural resources,” said Michael Arone, chief investment strategist at State Street Global Advisors, in a Bloomberg interview, citing the greater uncertainty from Trump’s trade policies.

Bullion has climbed 16% so far in 2025, continuing on its strong performance from the year prior.

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo