BHP delays Jansen potash project as costs surge; logs record copper output

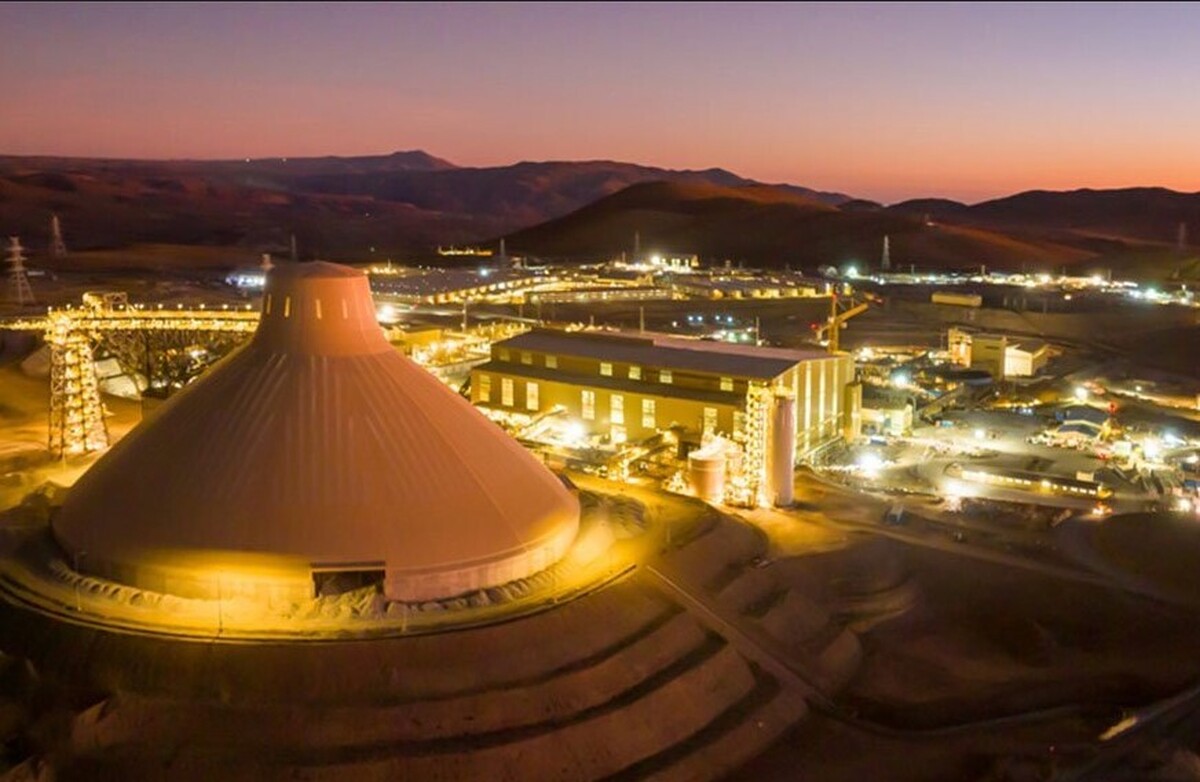

According to me-metals cited from mining.com, The cost blowouts that could be up to $1.7 billion represents a significant setback for BHP, which had accelerated potash production following Russia’s invasion of Ukraine, anticipating higher fertilizer prices due to supply disruptions from sanctioned Russian and Belarusian producers.

The world’s largest listed miner has spent more than a decade trying to break into the potash market as part of its diversification strategy.

BHP attributed the cost blowouts to design and scope changes, inflationary pressures, and lower-than-expected productivity during construction.

BHP said first production from its Jansen Stage 1 potash project in Canada has been pushed back to mid-2027 from the previously targeted end-2026, while capital expenditure estimates have surged to $7.0-$7.4 billion from $5.7 billion.

Adding to the project’s challenges, BHP is considering delaying the second stage of Jansen by two years due to concerns about potential oversupply in the global potash market.

“Given potential for additional potash supply coming to the market in the medium term, and as part of our regular review of the sequencing of capital projects under the capital allocation framework, we are considering a two-year extension for the execution of Jansen Stage 2,” the company said in a statement.

BHP committed $4.9 billion towards Jansen’s second stage development in October 2023, with first production scheduled before June 2029. The company said it had spent only $400 million of the committed funds for the second phase.

The miner reported copper production of 2.02 Mt for fiscal 2025, at the upper end of its forecast range. However, it said it expects output to drop to between 1.8 Mt and 2.0 Mt in fiscal 2026, reflecting planned lower grades at its flagship Escondida mine in Chile.

Shares of the company rose 2.9% to A$40.26 by 0144 GMT, outperforming a 1.6% jump in the mining sub-index.

BHP logged record annual iron ore production of 290 Mt, at the upper end of its guidance, while its fourth-quarter output of 77.5 Mt beat consensus estimates.

BHP is also assessing a potential divestment of its Western Australia Nickel assets as part of a review, citing balance sheet impacts from the nickel business.

source: mining.com

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Pan American locks in $2.1B takeover of MAG Silver

Codelco cuts 2025 copper forecast after El Teniente mine collapse

SQM boosts lithium supply plans as prices flick higher

US adds copper, potash, silicon in critical minerals list shake-up

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Gold price gains 1% as Powell gives dovish signal

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook