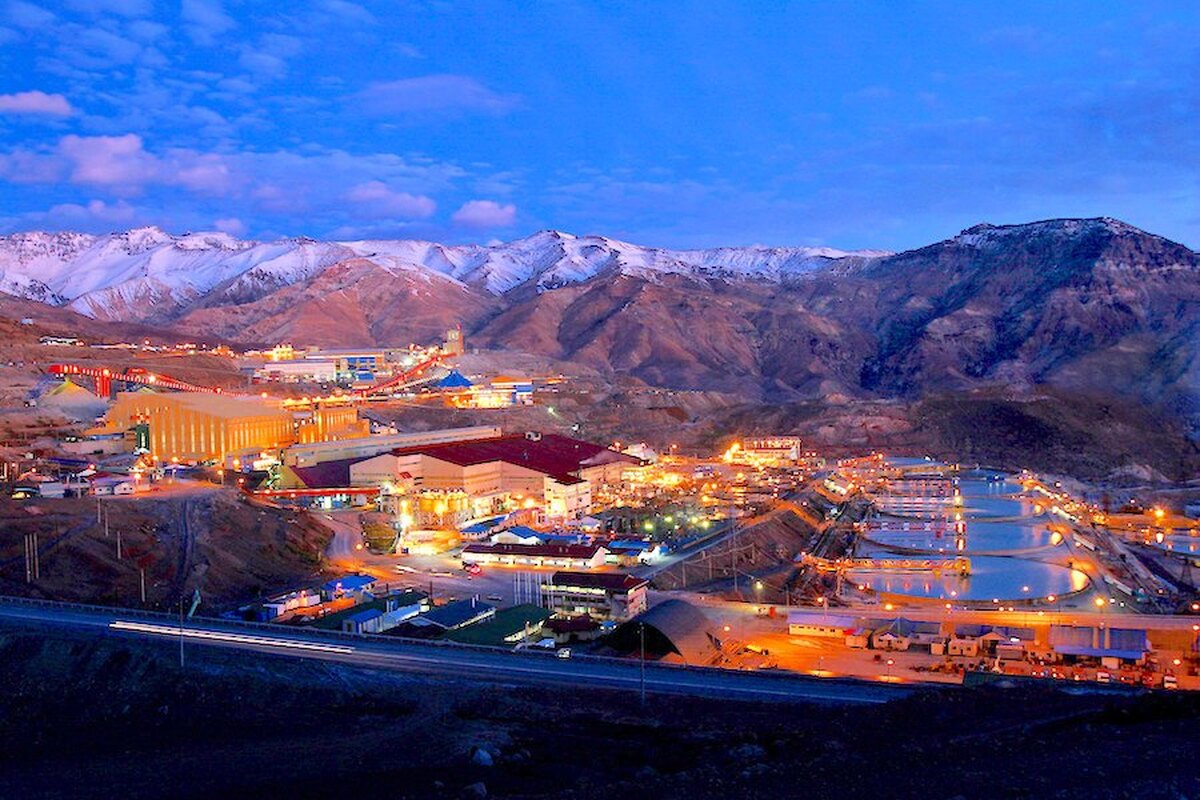

Hudbay snags $600M investment for Arizona copper project

According to me-metals cited from mining.com, The agreement, announced on Wednesday, secures a long-term partner for Hudbay and sharply reduces its upfront funding needs. Mitsubishi will pay $420 million at closing and an additional $180 million within 18 months.

The company will also fund its pro-rata share of future capital costs, deferring Hudbay’s first capital contribution until at least 2028 and trimming its expected outlay to about $200 million based on prefeasibility study (PFS) estimates.

“Securing Mitsubishi as a 30% partner in Copper World is an important milestone for Hudbay as we establish a long-term strategic partnership to advance this high-quality copper project towards sanctioning and to unlock significant value in our copper growth portfolio,” chief executive officer Peter Kukielski said in a statement.

Shares in Hudbay Minerals hit their highest level in more than a decade on the news to trade at C$16.49 in early morning in Toronto. The stock last touched such a high level in 2011 and it was trading at C$15.36 late afternoon, leaving the miner with a market capitalization of C$6.06 billion ($4.4B).

Hudbay began seeking a minority partner for Copper World earlier this year, attracting interest from investors in Saudi Arabia, the United Arab Emirates and Japan.

HudBay discovered Copper World in 2021. The project, located about 50 km southeast of Tucson, is expected to yield 85,000 tonnes of copper per year over a 20 year mine life.

$1.5B investment

Hudbay estimates the development will represent a $1.5 billion direct investment in the US critical minerals supply chain, which has been a policy priority for Washington as it seeks to reduce reliance on foreign sources of key raw materials.

Once in production, Copper World would boost Hudbay’s consolidated copper output by more than 50%. Arizona remains a strategic focus for major copper producers, including Rio Tinto (ASX, LON: RIO), aiming to meet growing US demand.

The transaction is expected to close in late 2025 or early 2026, pending regulatory approvals. Hudbay aims to complete a definitive feasibility study by mid-2026, with a final decision on the proposed mine targeted for later that year.

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo