Explaining the iron ore grade shift

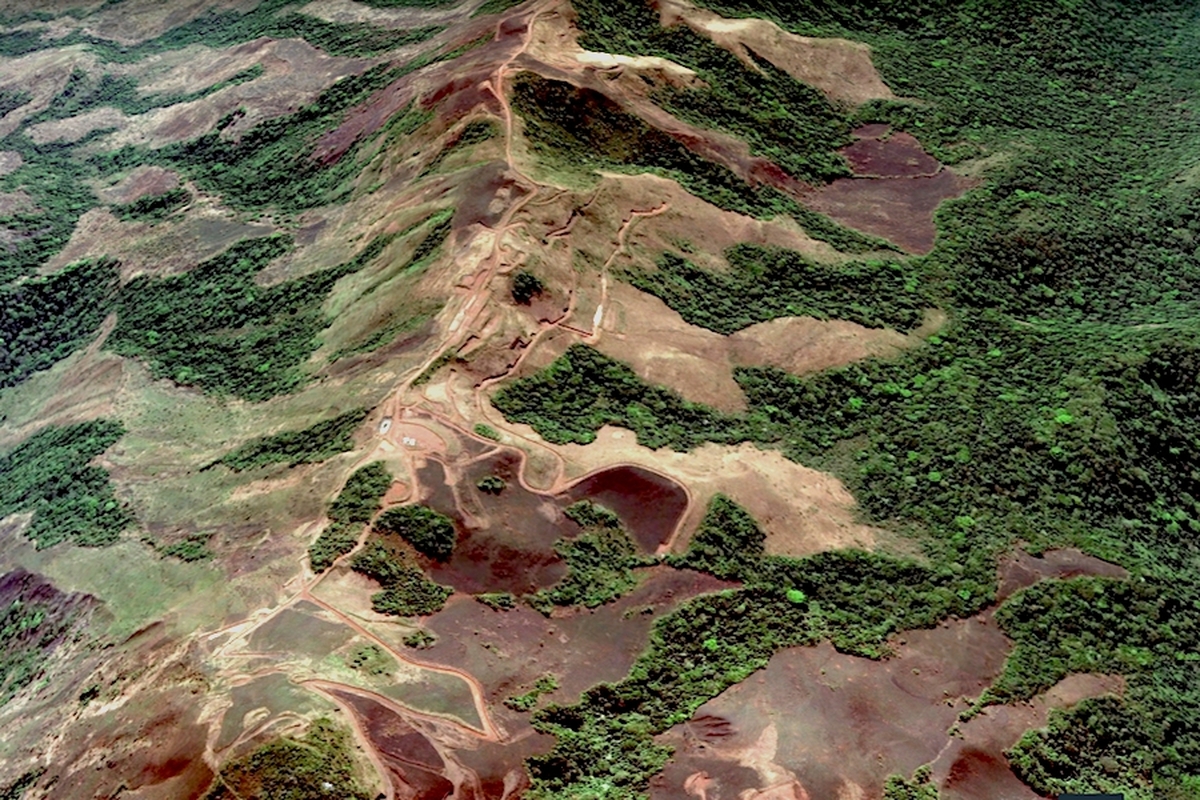

According to me-metals cited from mining.com, The change, driven by a gradual decline in ore grades and higher impurity levels, is reshaping both the physical and financial sides of the industry and raising big questions about how iron ore is valued.

Argus media has launched a dedicated 61% Fe index alongside its 62% Fe benchmark. This allows for direct valuation of the new grade while maintaining clarity around quality differentials.

Why the change matters

For decades, the 62% Fe grade served as the anchor for global pricing, with Pilbara Blend Fines (PBF) acting as the bellwether. But as mined grades have steadily dropped, the 62% benchmark no longer matches what is actually traded. The move to a 61% Fe baseline, effective from 2026, reflects this reality.

The Singapore Exchange (SGX) has proposed iron ore futures — which see volumes more than three times larger than the physical market — to still be tied to the old specification, but with a one-off price adjustment in September to bridge the gap. This would preserve liquidity in the contract, but traders say it complicates valuations and adds basis risk.

Physical market moving faster

The physical market, particularly in China (which buys over two-thirds of seaborne iron ore), has already shifted.

Since May, PBF shipments for July arrival have been trading closer to 61% Fe, leaving the 62% Fe benchmark increasingly disconnected from reality.

A dual-index solution

Price reporting agencies have begun adapting.

Industry voices argue that a dual-index approach — using both 61% and 62% Fe benchmarks — is essential during the transition. It would allow exchanges to launch new financial products, such as a 61% Fe futures contract, that align with the physical market and restore confidence in price discovery.

While the grade shift has created short-term uncertainty, it also offers a rare chance to address long-standing flaws in the pricing system. Moving to a specification that reflects what is actually traded could reduce basis risk, improve transparency, and align financial settlement with physical reality.

source: mining.com

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Locksley Resources forms US alliances to establish domestic antimony supply chain

El Salvador buys $50M in gold for reserve diversification

Freeport doubles down on Amarc’s JOY project

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

India considers easing restrictions on gold in pension funds