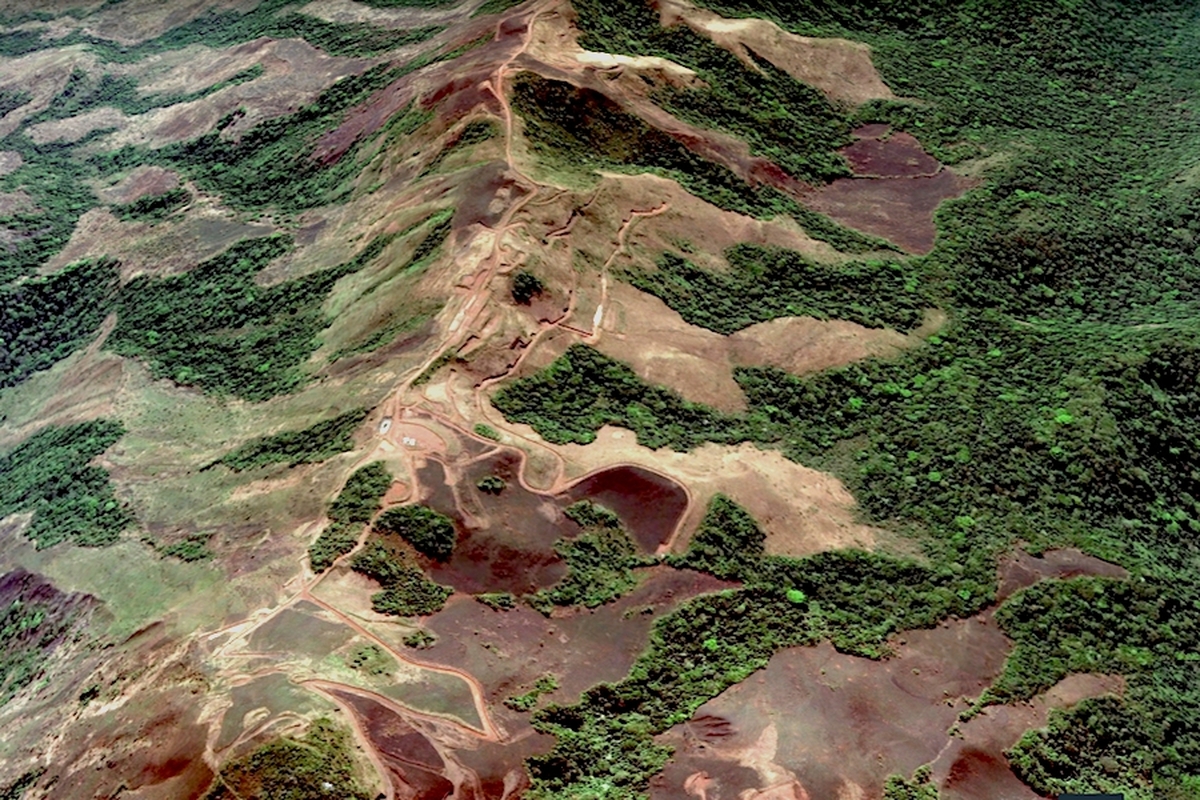

Iron ore price falls with BHP results, soft China demand in focus

According to me-metals cited from mining.com, The steelmaking ingredient lost as much as 0.6% in Singapore, declining for a fifth straight session.

BHP blamed weaker iron ore and coal prices for its sliding profits, but chief executive officer Mike Henry also expressed confidence in an earnings statement in the “long-term fundamentals of steelmaking materials, copper and fertilizers.”

China’s export growth may slow, but it will likely remain elevated due to the country’s competitiveness, BHP said in the company’s economic and commodity outlook published Tuesday. Recent infrastructure announcements, including a major dam project in Tibet, also underscore Beijing’s policy flexibility, it said.

This outlook from BHP is a positive sign for the steel market, which has stuttered as the Chinese economy matures and a years-long property slump there shows no sign of ending. The miner said rising earnings from its copper assets offset the pressure on iron ore and coal.

Infrastructure spending and manufacturing expansion in India are expected to drive a sharp rise in metals demand, Graham Slack, BHP’s head of market analysis and economics, said in the outlook report. India, which exported an average of 30 million tons of iron ore annually over the past nine years, is likely to become an “opportunistic importer,” particularly during periods of domestic supply disruption, he said

Iron ore fell 0.5% to $100.95 a ton in Singapore as of 12:05 p.m. local time, while yuan-priced futures on the Dalian exchange and steel contracts in Shanghai declined. Copper rose 0.3% on the London Metal Exchange, while aluminum dropped 0.3% and nickel was also lower.

source: mining.com

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Trump says gold imports won’t be tariffed in reprieve for market

Discovery Silver hits new high on first quarterly results as producer

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%