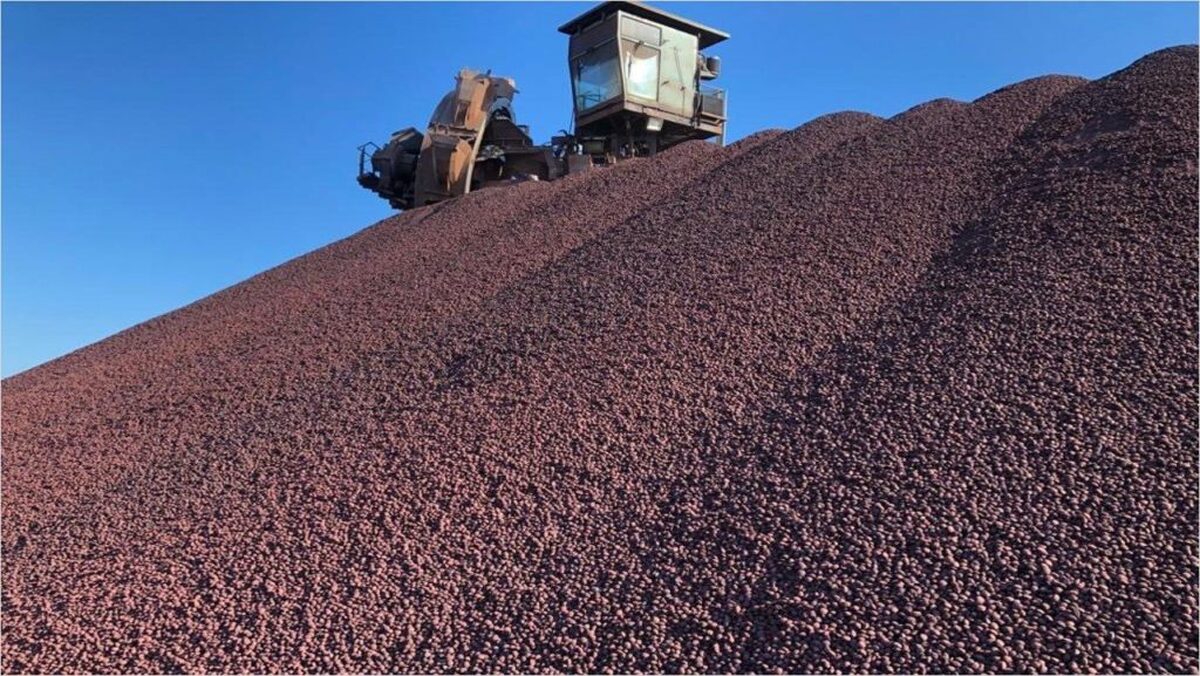

Vale sees iron ore prices above $85 a ton despite tariff turmoil

According to me-metals cited from mining.com, “Below $90 a ton there will be a very significant percentage of global production that will be under water, that will lose money, and probably stop producing,” Chief Financial Officer Marcelo Bacci said in a press conference Friday after the company reported first-quarter earnings that missed estimates. “This generates a price improvement effect.”

Analysts from Goldman Sachs Group Inc. and data provider Mysteel Global have said prices could slip below $85 a ton by the end of the year as tariff-related uncertainties put further pressure on prices.

Vale still sees solid demand for its flagship product from China, a market that accounts for 60% of its sales. Bacci said he’s confident that iron ore prices will stay around $100 per ton with stable supply and consumption.

Rio de Janeiro-based Vale has been adopting a strategy of maximizing value by offering a flexible portfolio to suit its clients’ demands. With steel mills navigating a challenging moment, customers aren’t always paying a premium to buy higher-quality ore. The Brazilian company said it plans to launch a mid-grade product using iron ore out of Carajas, a region of Brazil where the company has its most prized operations.

“This is much more appropriate to what the market is looking for,” Rogerio Nogueira, Vale’s commercial executive vice president, told investors on the call Friday. The company expects to present the new product to the market in the next 12 months.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts