Column: Iron ore tells a different story to the China tariff pain narrative

According to me-metals cited from mining.com, Iron ore is the major commodity most exposed to China, given that the world’s second-biggest economy buys more than 70% of all seaborne volumes, which it uses to produce just over half of global steel.

But iron ore prices and import volumes have been largely resilient since US President Donald Trump launched his trade war against China, which has escalated to the point where the United States imposes a tariff of 145% on its hitherto biggest trading partner.

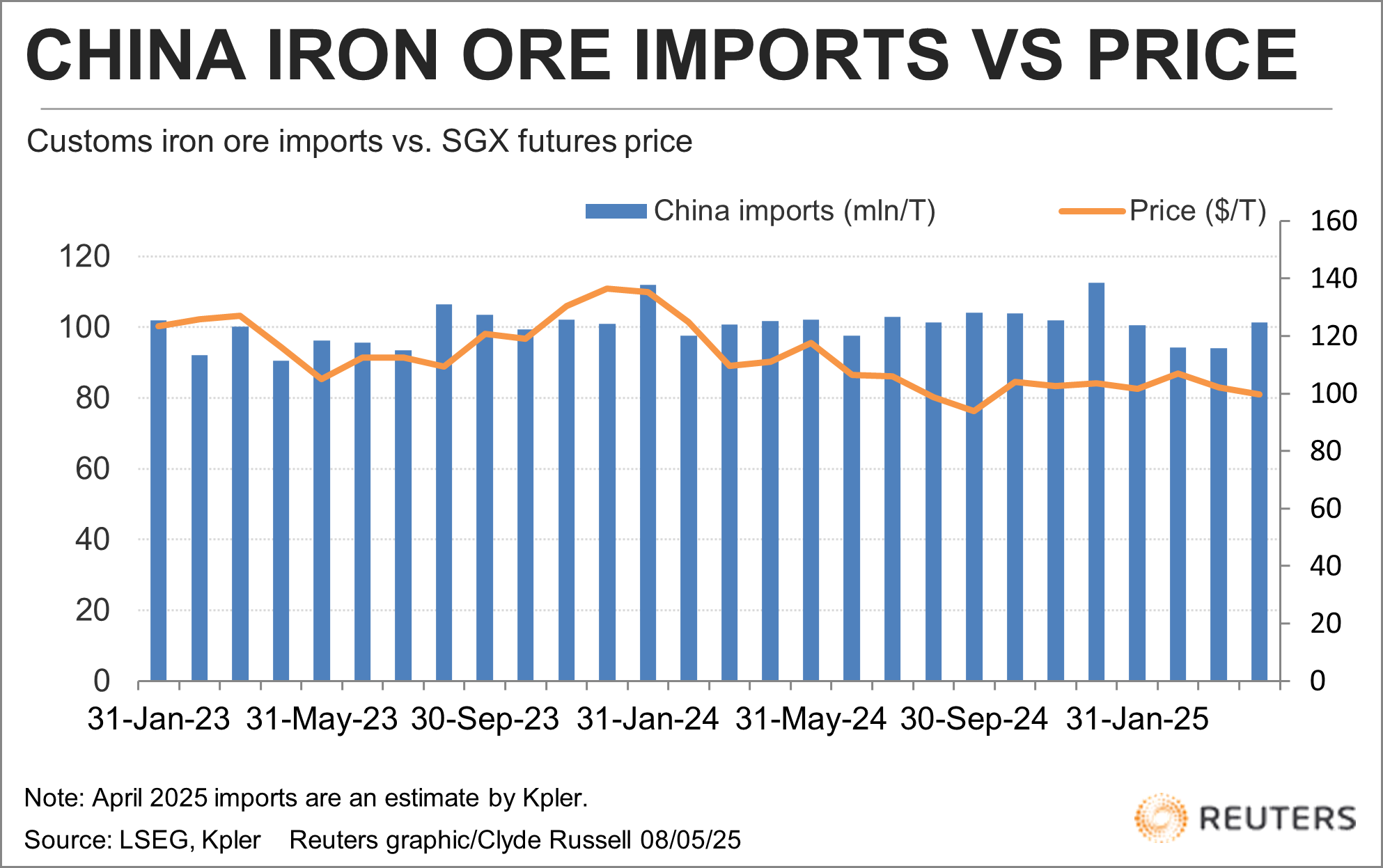

Iron ore contracts traded on the Singapore Exchange ended at $99.35 a metric ton on Wednesday, having climbed since hitting a seven-month low of $96.20 on May 1.

The price has been trading in a relatively narrow range since October, with a high of $110.55 early in that month and the low at the start of May.

At the same time China’s imports of iron ore have eased slightly, with customs data showing first quarter arrivals down 7.8% from the same period a year earlier to 285.31 million tons.

But while that figure may look soft, it’s largely because supply was constrained by weather events in Australia, which cut shipments from China’s top supplier.

The supply disruption is evident in China’s port inventories , with data from consultants SteelHome showing they fell to a 14-month low of 133.8 million tons in the week to April 25.

Stockpiles were as high as 147.5 million tons in mid-February, showing that steel mills have drawn on inventories in order to keep production going during the period of supply disruption from Australia.

China’s imports of the key steel raw material are expected to have recovered in April, with commodity analysts Kpler tracking arrivals of 101.4 million tons, up from the March customs figure of 93.97 million.

China’s steel output is also holding up, with March’s 92.84 million tons being a 10-month high and up 4.6% from the same month in 2024, according to official data.

The overall picture so far this year for iron ore is that any import weakness is down to supply disruptions, and that China’s demand has remained relatively solid.

If China’s inventories are to show the usual seasonal build heading into the northern summer peak demand for steel, it’s also reasonable to expect that iron ore imports will hold up beyond April.

Steel demand

The question then becomes if there is so much concern about the negative impact of US tariffs on China’s economy, why are iron ore and steel holding up, and are they poised to decline?

The answer most likely lies in the fact that a substantial portion of China’s steel demand is in sectors less exposed to trade.

By far the two biggest steel-consuming sectors are property and infrastructure, which account for nearly 60% of total demand.

While the property sector has struggled in recent years, there are early signs that Beijing’s stimulus efforts are starting to at least stabilize it.

The trade-exposed parts of steel demand include machinery, automotive and household appliances, which together are almost a third of consumption.

But even here China isn’t overly reliant on exports to the United States, with the bulk of vehicle and machinery exports heading to markets in Asia, Europe, South America and Africa.

Sectors that are more exposed to the United States include manufacturing of data-x-items such as toys, clothing and other goods that don’t really use much steel but depend more on materials such as chemicals, plastics and rubber.

This helps explain why the official purchasing managers’ index (PMI) contracted at the fastest pace in 16 months in April, dropping to 49.0 from 50.5 in March.

The slump in PMI was also likely a factor in Beijing’s latest stimulus measures, with announcements on Wednesday of a cut in interest rates and boosts to liquidity.

There is little question that parts of the Chinese economy are starting to feel the tariff pain, but it’s also equally clear that other parts are managing quite well.

The problem is that the narrative of pain is the one likely to reach the ears of the US administration, while Beijing focuses on the positives in its messaging.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts