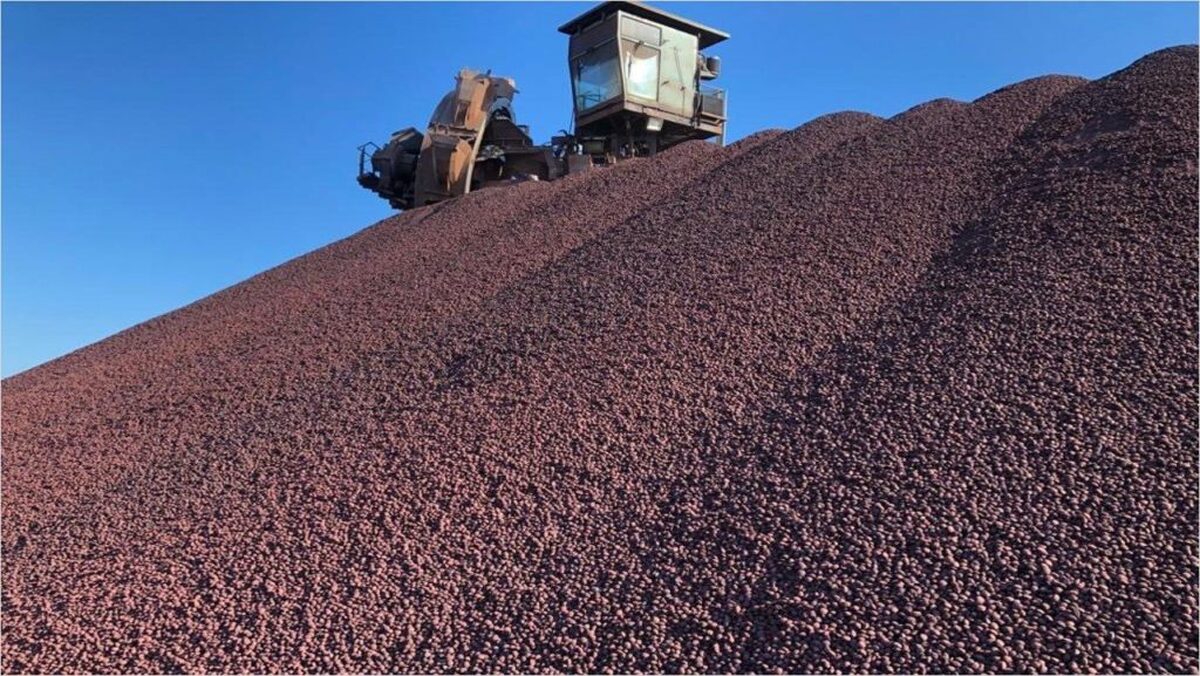

Iron ore price drops to over one-month low on weaker China metal output

According to me-metals cited from mining.com, The most-traded May iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trade 2.21% lower at 751.5 yuan ($102.54) a metric ton, closing at its weakest level since Nov. 19.

The benchmark February iron ore on the Singapore Exchange eased 1.74% to $96.5 a ton, as of 0733 GMT.

“With the Chinese New Year holiday beginning in just four weeks’ time, the pre-holiday stockpiling of iron ore will lend some support to prices of the feedstock this month,” Chinese consultancy Mysteel said.

“But ore prices will face downward pressure as the seasonal decline in hot metal output at mills will see slow ore replenishment.”

Output at Chinese blast-furnace steel producers has continued to decline steadily, driven by increasing maintenance stoppages as Chinese New Year is approaching, Mysteel added.

Meanwhile, global iron ore supply has recently been at a high level, driven by shipments from Australian mines, Chinese consultancy Hexun Futures said.

For the next week, the average daily molten iron output will continue to decline, while iron ore inventory will continue to accumulate slightly, Hexun added.

With two weeks before Trump begins a second US presidency, investors’ concerns about Beijing’s ability to revive its faltering economy sent China’s yuan and stock markets sliding on Monday.

Last month, the country’s services activity expanded on stronger domestic demand, but orders from abroad declined amid growing trade risks to the economy.

Other steelmaking ingredients on the DCE were mixed, with coking coal up 0.3% and coke down 2.1%, respectively.

Most steel benchmarks on the Shanghai Futures Exchange posted marginal losses. Rebar slipped about 0.85%, hot-rolled coil shed almost 1.0% and wire rod dipped 0.03%, while stainless steel gained 0.55%.

($1 = 7.3290 Chinese yuan)

source: mining.com

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming