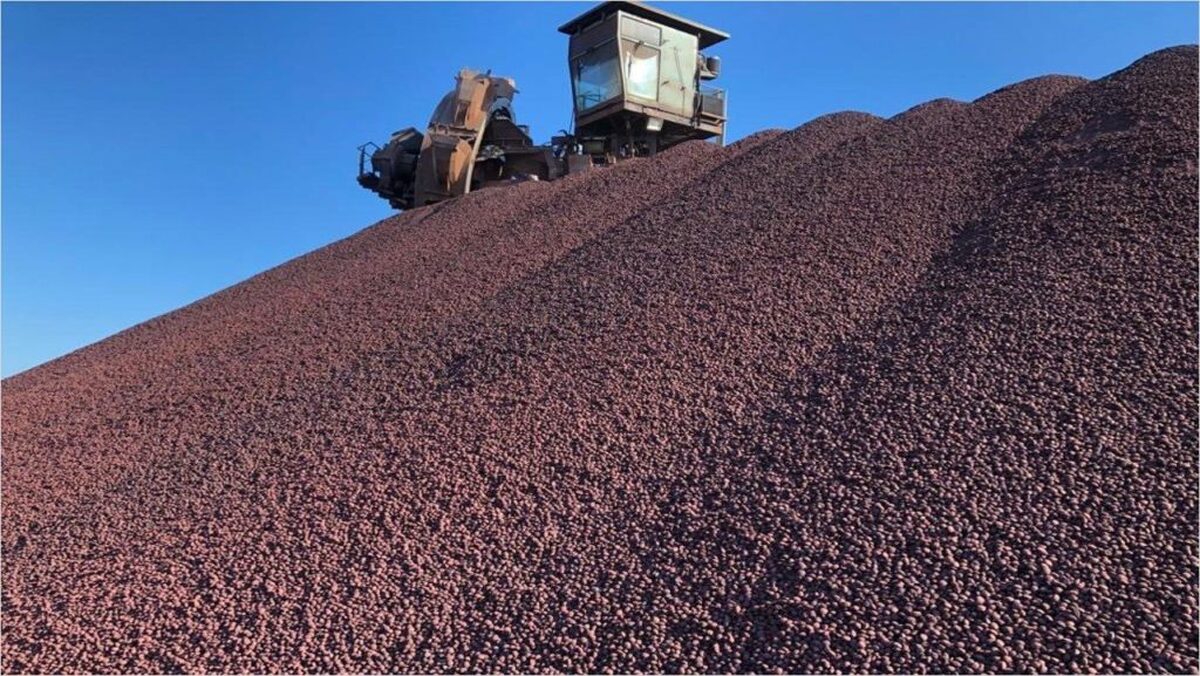

Iron ore price at more than 6-week low on mounting tariff tensions

According to me-metals cited from mining.com, The most-traded May iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trade 2.81% lower at 779.5 yuan ($106.91) a metric ton.

Earlier in the session, prices hit 777.5 yuan, the lowest since January 14.

The benchmark April iron ore on the Singapore Exchange shed 2.53% to $99.85 a ton.

US Treasury Secretary Scott Bessent said on Friday that Mexico has proposed matching US tariffs on China after US President Donald Trump vowed another 10% tariffs on Chinese imports last week.

Trump also announced plans to impose 25% tariffs on all steel and aluminum imports from March 4, stirring a new wave of trade frictions against Chinese steel.

Also weighing on iron ore prices were resumed market talks of China’s possible plans of slashing crude steel output by 50 million tons in 2025.

China’s state planner and the state-backed China Iron and Steel Association did not respond to Reuters‘ request for comment.

Still, China’s factory activity grew at a faster pace in February, driven by stronger supply and demand and a rebound in export orders, a private-sector survey showed on Monday.

The positive trend in the survey aligned with the official PMI data released on Saturday, which showed February’s manufacturing activity expanding at the fastest pace in three months.

The reading should reassure officials that stimulus measures launched last year are helping the economy recover amid sluggish demand and a struggling property sector.

Other steelmaking ingredients on the DCE gained ground, with coking coal and coke rising 0.96% and 0.24%, respectively.

Steel benchmarks on the Shanghai Futures Exchange traded sideways. Rebar ticked down 0.66%, stainless steel edged up 0.04%, wire rod lost around 0.1%, while hot-rolled coil traded flat.

($1 = 7.2911 Chinese yuan)

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts