Fresnillo lifts gold forecast on strong first-half surge

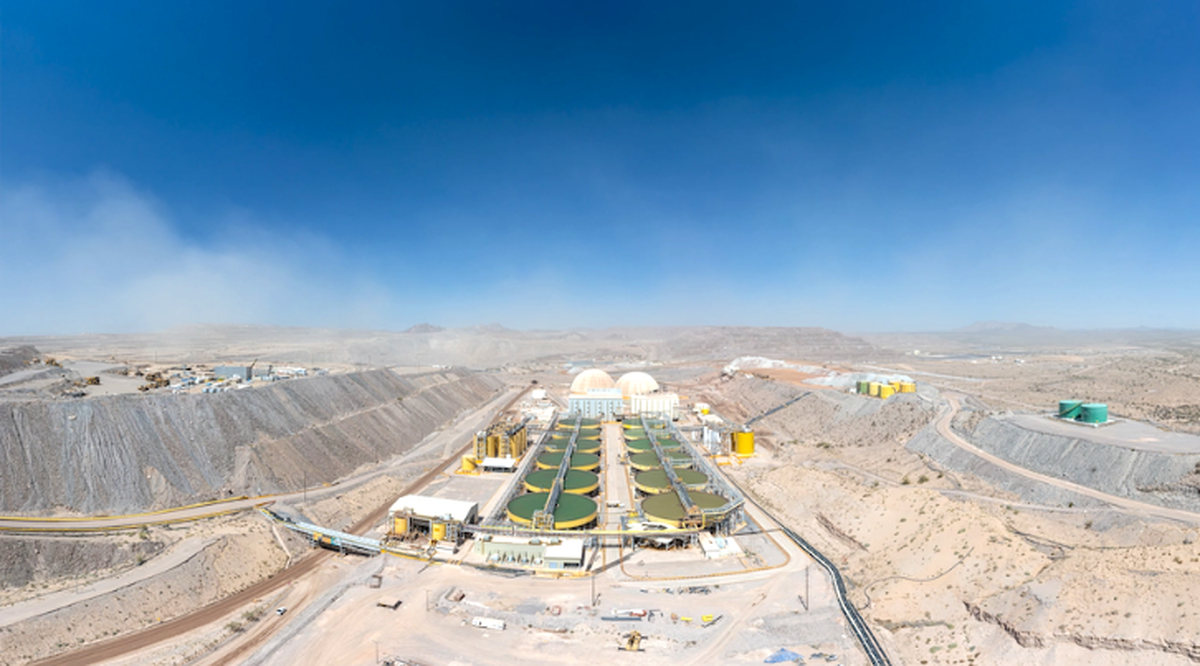

According to me-metals cited from mining.com, For the six months ending June 30, gold production rose 16% to 314,000 ounces, fuelled by operational gains at the Herradura mine in Sonora. In contrast, silver output fell 12% year-over-year to 24.9 million ounces, weighed down by mine closures and lower ore grades.

The company responded to the performance by revising its full-year guidance. Fresnillo now expects to produce between 550,000 and 590,000 ounces of gold, up from a previous range of 525,000 to 580,000 ounces. The upward revision reflects both operational improvements and stronger metal prices, along with continued cost discipline, the company said.

Silver guidance was lowered slightly to a range of 47.5 million to 54.5 million ounces, down from 49 million to 56 million. Fresnillo attributed the cut to the end of silverstream contributions following a buyback agreement with Peñoles, the planned closure of the San Julián DOB mine, and lower grades across several operations.

Revenue rose 30% year-over-year to $1.94 billion, while EBITDA more than doubled to $1.1 billion, up 103%.

Fresnillo also scaled back its capital expenditure for 2025 to $450 million, signalling a move away from aggressive expansion towards focused reinvestment. Project delays at Saucito and Juanicipio prompted a reshuffling of priorities, with the company now aiming to optimize its existing asset base.

Fresnillo’s shares closed at 1,520p in London, giving it a market cap of nearly £11.2 billion ($14.9 billion).

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook