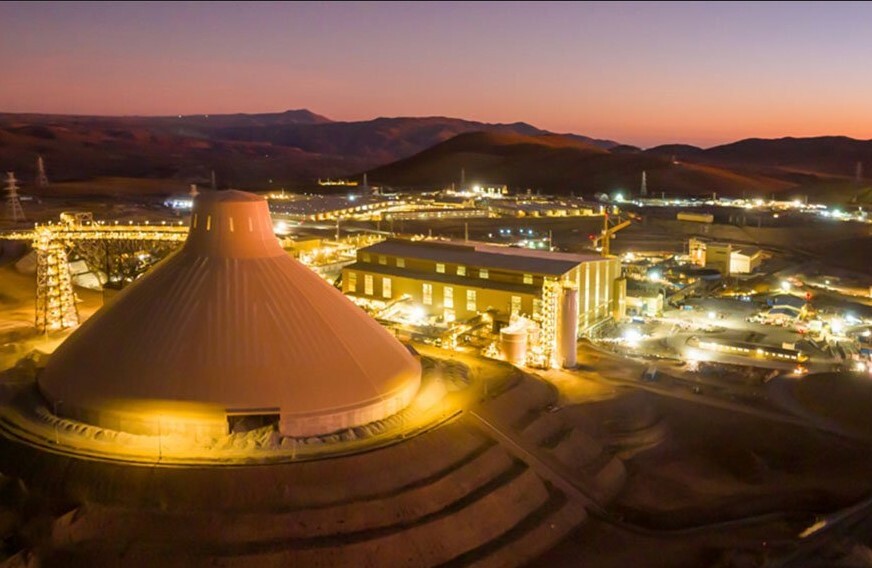

Teck approves $2.4B expansion of Highland Valley Copper

According to me-metals cited from mining.com, Construction on the mine life extension (MLE) is set to begin in August. The Vancouver-based miner expects the expansion to support average annual production of 137,000 tonnes of copper through the remainder of the mine’s life.

“This extension is foundational to our strategy to double copper production by the end of the decade,” President and CEO Jonathan Price said in a statement.

“Given the strong demand for copper as an energy transition metal, the HVC MLE will generate a robust internal return rate (IRR) and secure access to this critical mineral for the next two decades,” Price said.

The board’s green light follows the province’s approval of the project’s environmental assessment certificate last month.

The project includes a major pushback of the Valley pit to access higher-grade ore, along with infrastructure upgrades: an expanded mine fleet, grinding circuit enhancements, increased tailings capacity, and improved power and water systems.

Teck says the project will create roughly 2,900 construction jobs and support 1,500 ongoing roles once operational. Price also emphasized the project’s role in strengthening Canada’s critical minerals sector and stimulating economic activity in the region.

The fresh capital estimate reflects current construction risks, inflation, potential impact of tariffs, and early procurement of mobile equipment. It includes built-in contingencies and opportunities for cost optimization as work progresses, Teck said.

The HVC expansion forms part of Teck’s broader $3.9 billion investment plan to boost copper output to 800,000 tonnes annually by 2030.

Revised copper guidance

The company made the announcement alongside its second-quarter results, which showed a sharp improvement from the same period last year. Profit before tax surged to C$125 million from just C$20 million, while net profit jumped to C$206 million, or $0.42 per share, compared to C$21 million, or $0.04 per share, in Q2 2024. Revenue rose to C$2.02 billion from C$1.80 billion a year earlier.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) came in at C$722 million, beating BMO Capital Markets’ forecast of C$661 million. Copper output totalled 109,000 tonnes, exceeding BMO’s estimate but falling short of the broader analyst consensus.

Despite the strong quarterly performance, Teck lowered its 2025 copper production guidance to between 470,000 and 525,000 tonnes, down from a previous range of 490,000 to 565,000 tonnes. The revision stems mainly from lower-than-expected output at its Quebrada Blanca mine in Chile. BMO had forecast 479,000 tonnes, with the consensus at 502,000 tonnes.

The Vancouver-based miner ended the quarter with a net debt of C$211 million. It noted that elevated capital spending at Quebrada Blanca and Highland Valley weighed on cash flow.

source: mining.com

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

China limits supply of critical minerals to US defense sector: WSJ

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift