Chile’s 2025 vote puts mining sector’s future on the line

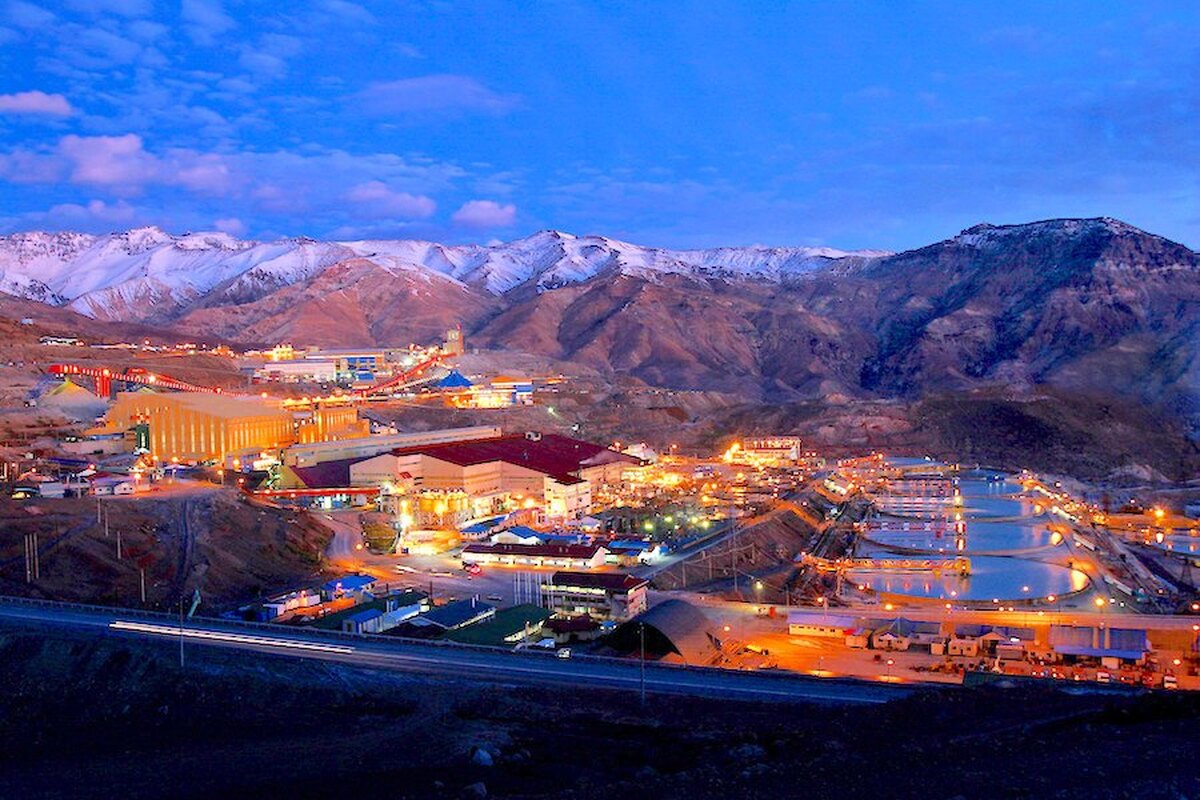

According to me-metals cited from mining.com, At stake is the future of Codelco, the state-owned copper giant that helped build modern Chile but is now drowning in debt, stuck with aging infrastructure and recovering from years of production declines.

Once a source of national pride, Codelco has been teetering on the edge of an industrial crisis. As of December last year, the company’s debt has ballooned to over $20 billion and production was slowly edging higher after hitting a 25-year low in 2022.

Legal obligations to hand over 70% of its profits and 10% of its sales to the government have choked its ability to reinvest in itself, threatening its future and the fiscal stability of the country.

With rival candidates offering radically different solutions, from sweeping privatization to aggressive state reinvestment, this election is shaping up to be more than just a political contest. It’s a make-or-break moment for Chile’s mining future.

As the world’s leading copper producer and a top supplier of lithium, Chile’s supply is essential to the global push for electrification. If its mining engine stalls, the ripple effects won’t stop at its borders.

With the primary season behind them, the final contenders are now locked in a high-stakes battle over the country’s economic core. If no one wins a majority, a runoff on December 14 could extend the uncertainty.

Candidates on both sides of the political spectrum are presenting starkly different paths forward, ranging from state-led modernization to partial privatization. Either way, the path Chile chooses later this year could redefine its role on the global resource map and determine whether its mining sector sinks or rebounds.

Right-wing rivals: privatization and market-oriented policies

On the right, both Evelyn Matthei and José Antonio Kast are pushing for partial privatization of Codelco. They argue that opening the company to private capital and loosening state control would improve efficiency and restore its financial health.

Their plans include selling non-core assets to pay down debt and shifting focus from state revenues to operational performance. While these proposals could generate immediate fiscal relief, they carry political risks. Chileans have historically resisted privatization of strategic assets, and backlash from workers and unions could be fierce.

Still, their market-oriented vision has gained traction among investors frustrated with sluggish permitting, bureaucratic delays and rising costs under the current administration.

Jeannette Jara and the far left: full public control

Jeannette Jara of the Communist Party was chosen in June to represent the ruling coalition. She beat her second-place rival Carolina Tohá, who was proposing a restructuring of Codelco to allow it to retain more profits for reinvestment rather than draining cash to fill government coffers.

Jara opposes the current government’s proposed joint venture between Codelco and lithium miner SQM (NYSE: SQM), citing past scandals and calling for a new public company to co-develop lithium resources. If elected, she says she would honour any deal finalized before her term, but prefers a model akin to Codelco’s role in copper.

On foreign policy, Jara has pledged to focus on diversifying trade ties, including with China, India and within Latin America, especially if US tariff threats escalate.

“We have to act prudently to safeguard our national interest,” she has said.

While polls suggest she could make it to a run-off, most scenarios show her losing to a right-wing contender in the second round.

Tightrope for investors

Chile’s economy has held up well in 2025, buoyed by mining activity. GDP grew 2.3% year-on-year in the first quarter, with further acceleration in April, according to BNP Paribas. But long-term stability will depend on resolving Codelco’s troubles and creating a regulatory environment that attracts investment without sparking social unrest.

John Zadeh, CEO of junior mining investment firm Discovery Alert, said the election could tip the scales for global investors.

“Chile’s election is a referendum on how to balance resource nationalism with economic pragmatism,” Zadeh said. “The status quo, however, guarantees decline.”

Security concerns continue to be a primary issue for voters, as rising crime in what was once a safe and peaceful Chile has emerged as the leading worry in recent polls. That adds another layer of complexity for companies already navigating volatile commodity markets, tightening capital, and global decarbonization pressures.

With the first round of voting set for November and a likely run-off in December, the race is entering a decisive phase. What’s certain is that the direction Chile takes, toward deeper state control, partial privatization or something in between, will ripple across global supply chains and investment flows.

source: mining.com

Adani’s new copper smelter in India applies to become LME-listed brand

Cochilco maintains copper price forecast for 2025 and 2026

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

Gold price stays flat following July inflation data

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects