Iron ore price: World steel production shrinking

The 50-year old industry body estimates that crude steel production in China, which is responsible for more than half the global total, declined 0.6% year on year in October. The decline came on the back of capacity cuts during the country’s 70th anniversary celebrations.

China also places curbs on production during the winter months through March, but thanks to surging output earlier in 2019, year to date steel production is still up 7.6% to 746m tonnes.

US protectionism of steel will support US production through rising domestic prices on the back of increasing demand for local steel as tariffs render imported steel far more expensive

US output also fell during October, declining 2% in year on year terms to 7.4m tonnes. Given the nearly 40% drop in steel prices in the country over the past year as the effect of anti-dumping measures against China fade, production declines have been modest.

The US has also imposed imposed tariffs of 25% on steel exports coming from the EU, Canada and Mexico.

The decline in Europe was significant, registering an 8.7% drop. Profitability at steelmakers on the continent have eroded as excess capacity elsewhere ends up in the region which unlike the US has not taken any anti-dumping measures. Year to date EU crude steel output is down 3.6% to 122m tonnes.

World number three producer India, which overtook Japan last year recorded a drop of 3.4% at 9.1m tonnes for October, reducing year to date gains to 3% at 84.2m tonnes.

Japanese production fell nearly 5% in October in part due to typhoons and year to date the country’s output is down 3.9% to 75.6m tonnes.

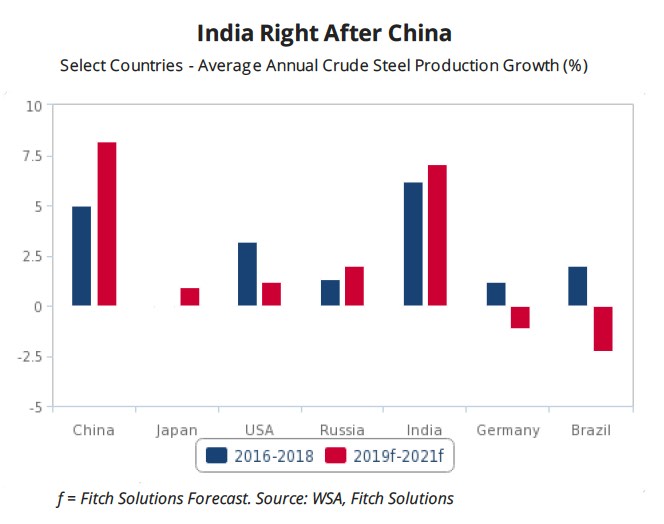

A new report by Fitch Solutions suggests the weak conditions may be temporary.

The macro economic research company in the Fitch ratings agency stable reports global steel production and consumption growth will accelerate in 2019-2020, compared to 2018.

Escalating trade tensions between the US and China will prompt the Chinese government to provide further targeted stimulus to the domestic infrastructure sector, a major consumer of the commodity.

At the same time, US protectionism of steel will support US production through rising domestic prices on the back of increasing demand for local steel as tariffs render imported steel far more expensive.

Benchmark iron ore prices slid on Wednesday with the Chinese import price of 62% Fe content fines exchanging hands for $87.56 per dry metric tonne, according to Fastmarkets MB.

Iron ore remains in a bull market for 2019, up 20% on the back of supply disruptions from top miner Vale following a deadly dam burst in January.

The Australian export price of metallurgical coal (FOB hard coking coal Fastmarkets MB) used in steelmaking eased again on Wednesday to $134.30 a tonne. That’s down more than $50 a tonne compared to the start of the year amid oversupply and import restrictions imposed by Beijing.

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Locksley Resources forms US alliances to establish domestic antimony supply chain

El Salvador buys $50M in gold for reserve diversification

Freeport doubles down on Amarc’s JOY project

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

India considers easing restrictions on gold in pension funds