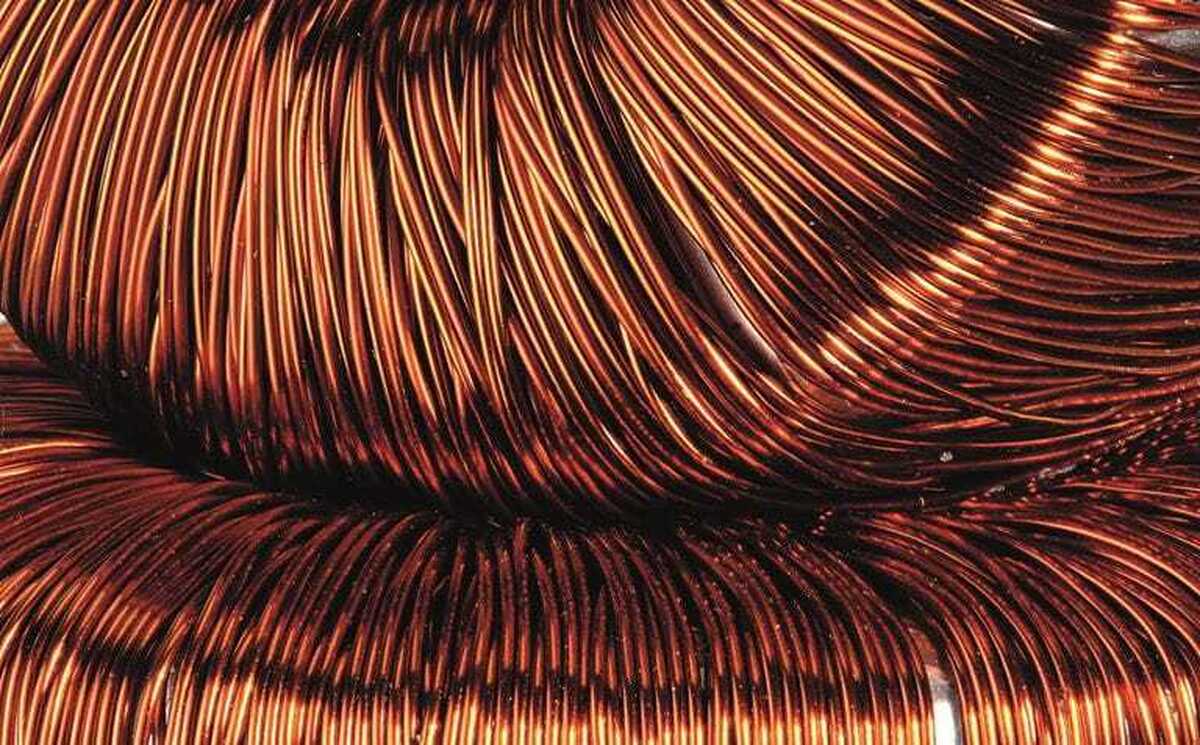

According to me-metals cited from mining.com, The most active September contracts on the CME soared as much as 1.6% to $5.732 per lb., a new all-time high.

Since US President Donald Trump’s tariff announcement earlier this month, copper prices have soared past the $5/lb. level to new heights. Following a double-digit move on July 8 (see chart below), the metal has risen by another 2%.

This takes copper’s year-to-date gains to over 40%, making it one of the best performing commodities of 2025, even surpassing that of gold.

Meanwhile, corresponding contracts in London rose 0.8% to approximately $9,860 a tonne.

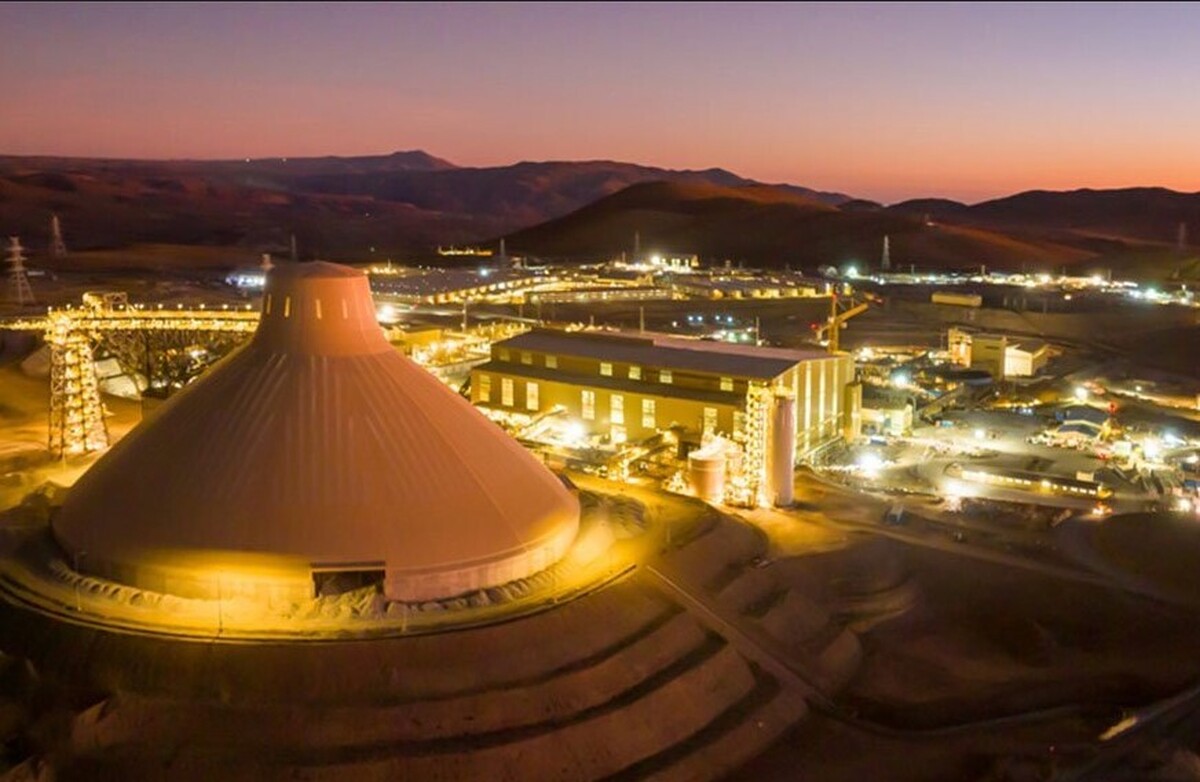

Despite the rally, ANZ Bank analysts told Reuters that the copper tariff is expected to lead the US market to rely more heavily on domestic inventories in the near term, which could place downward pressure on prices in both New York and London.

Meanwhile, copper inflows into the US have slowed as traders prepare for the implementation of tariffs ahead of the August 1 deadline.

source: mining.com