EnergyX expands US Smackover acreage to cut lithium costs

According to me-metals cited from mining.com, Analysts estimate the Smackover could contain more than 4 million metric tons of lithium, enough to power millions of electric vehicles and other electronic devices.

EnergyX’s latest acquisition places it among heavyweights in the region. Its holdings are surrounded by 125,000 net acres controlled by Chevron and 120,000 gross acres held by Exxon.

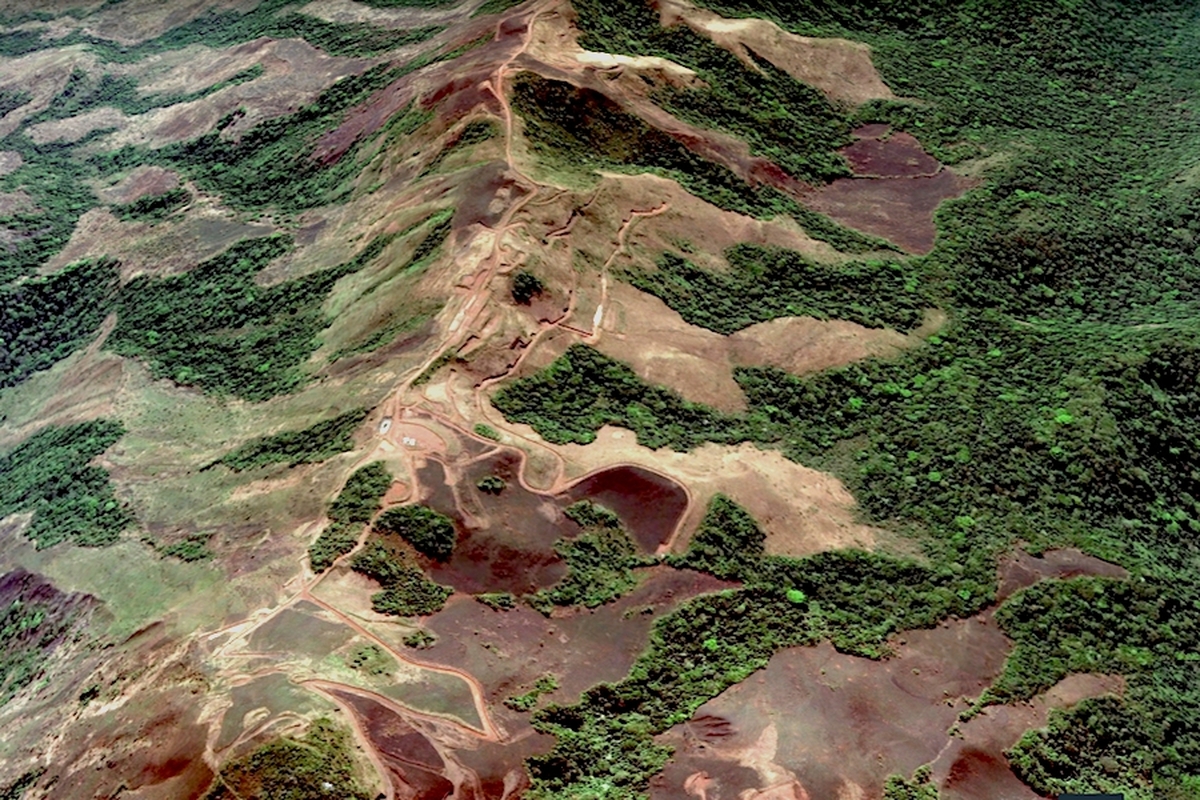

The privately-held company has been on a growth tear. Its recent moves include securing a Chilean lithium resource comprising 90,000 acres of mining concessions in 2023, and in 2024 acquiring a 40,000-square-foot production facility in Austin, Texas.

The acquisitions are also pivotal for the firm, which grabbed headlines in 2022 for being disqualified from a race to mine Bolivian lithium, along with Argentine energy firm Tecpetrol, on a technicality.

Bolivia has tried to tap its vast resources in partnership with foreign companies. The Latin American country has the world’s largest lithium resources, but it has struggled for decades to mine them commercially. This week, Bolivia ranked last on mining jurisdiction policies in the Fraser Institute’s latest Annual Survey.

Looking back, EnergyX founder and CEO Teague Egan sees the silver lining.

“It was the best thing that could have happened to us. We wouldn’t be where we are now if we hadn’t experienced Bolivia,” Egan told MINING.com in an interview.

Ever since, the company has been laser focused on advancing its two projects, Lonestar Lithium in the US and Black Giant in Chile. Black Giant is estimated to produce 40,000 tonnes of lithium per year, while its planned project Lonestar Lithium is projected at 25,000 tonnes.

Both leverage the company’s direct lithium extraction (DLE) technology platform, LITAS. EnergyX owns an exclusive, worldwide license to commercialize a process that uses an advanced nanomaterial filtering membrane.

“LITAS was the original ideation of the company, since 2018. But we just started acquiring assets in 2023,” Egan said. “We spent the first five years developing the technology. Not that that stopped – there’s always ongoing R&D,” Egan said.

Egan said the company is still looking for more land acquisitions in the Smackover, as well other areas of the United States.

“There’s a lot of competition in the Smack Over. But we think that there’s equally good assets that we have our eye on in a few other parts of the United States.”

Domestic supply chain strategy

Egan said key to the strategy to supply lithium to the North American market not exposing the company to risk, such as dependency on China for processing.

“It’s a vertically integrated strategy. We’ve been able to accomplish being the lowest cost producer, which is the most critical thing,” Egan said. ” We’re producing kilograms every day that we’ve actually shipped out and got qualified by cathode makers on our pilot scale. We’re shipping samples from our pilot plants that are hitting spec and getting qualified..now we’re building two demonstration plants.”

While DLE has yet to be proven commercially at scale, Egan is confident in his company’s heavily patented technology.

“We’ve proved that this process works. Now it’s just about having all the pieces in place to go build a billion-dollar plant,” Egan said. “It’s not a question anymore of if technologies work. It’s a question of who is going to be the lowest cost producer or ensuring that you’re in the bottom quartile, the lowest 25% of cost.”

EnergyX’s strategy includes owning its resources, technology, and then producing the consumables and supply chain in-house.

“The fact that we now own our own resources, developed our own technology, but also produce our own materials, like the adsorbents, membranes, has led to us being the lowest cost producer,” Egan said.

“For our Chile project, Black Giant, our target for our first train of 7,500 tons is 2027. We’re starting with one train of 7,500 tons, and then we’re adding six more trains. So, an additional 45,000 tons to hit a total capacity of 52,500 tons by the end of 2029. And then for the U.S., similar, but one year after,” he said.

“As the price fluctuates we can still be profitable because we’re the lowest cost producer. That’s our goal.”

Egan joined MINING.com host Devan Murugan to discuss wider lithium market dynamics, and why commercial production—not speculation—is his priority.

Watch the full interview.

source: mining.com

Gold price stays flat following July inflation data

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Gold Fields nears $2.4B Gold Road takeover ahead of vote

Metal markets hold steady as Trump-Putin meeting begins

Explaining the iron ore grade shift

Glencore trader who led ill-fated battery recycling push to exit

Trump to offer Russia access to minerals for peace in Ukraine

Gold price edges up as market awaits Fed minutes, Powell speech

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions