Gold price rises for fourth straight day with US payrolls in focus

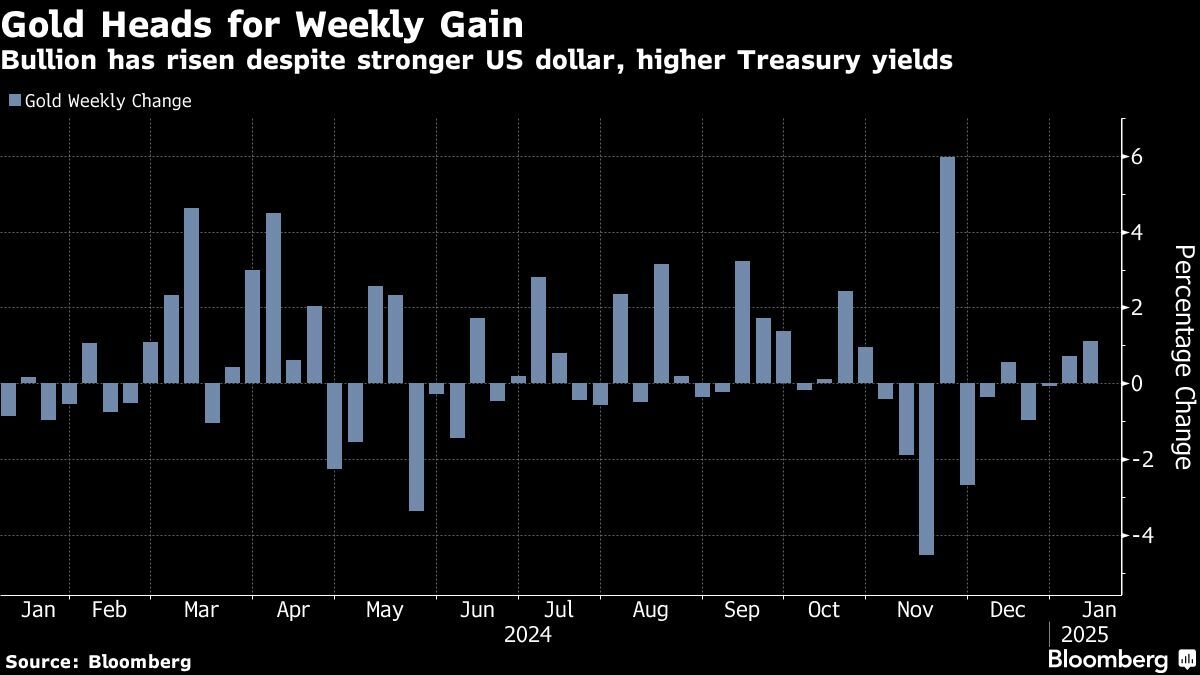

According to me-metals cited from mining.com, Bullion for immediate delivery traded near $2,680 an ounce, set for a gain of more than 1% in the first full trading week of the year.

The employment report for December is expected to show moderating yet still-healthy job growth, which economists expect to carry on in 2025. Fed officials have signaled they’ll likely hold rates at current levels for an extended period, only cutting again when inflation meaningfully cools.

Gold was one of the strongest performing major commodities last year, logging a 27% gain and setting successive records as the Fed cut rates, central banks boosted their holdings, and investors sought a haven from geopolitical tensions. Lower rates tend to benefit the non-yielding metal.

With US President-elect Donald Trump due to take office on Jan. 20, investors are also weighing the likelihood of a potential trade war or other tensions that could disrupt markets and boost haven demand.

Bullion’s rise this week has come despite further strength in the US dollar and Treasury yields, both of which can act as headwinds. With traders scaling back expectations for Fed rate cuts in the first half, a gauge of the greenback is poised to eke out a sixth weekly gain. Ten-year yields, meanwhile, are trading near the highest since April.

“The rally is despite rising global yields,” Kaynat Chainwala, an analyst at Kotak Securities, said in a note. Traders fear a resurgence of inflation due to stimulus measures, fiscal reforms, and trade tariffs, she said.

Spot gold rose 0.5% to $2,680.62 an ounce as of 10:34 a.m. in London, while silver traded above $30 an ounce and was on course for a second weekly gain. Palladium and platinum also climbed.

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook