Seven bidders battle for Chile’s lithium mining contracts

According to me-metals cited from mining.com, The government, which will unveil the successful bidders by the end of March, invited in this initial phase proposals for projects targeting six salt flats across three regions: Coipasa in Tarapacá, Ollagüe and Ascotán in Antofagasta, and Piedra Parada, Agua Amarga, and Laguna Verde in Atacama.

A working group overseen by the mining ministry is set to review the applications over the next 45 business days.

Bidders included a consortium comprising Eramet, Quiborax, and state-owned mining giant Codelco, local paper El Diario reported. CleanTech, a company that recently concluded a pre-feasibility study for developing Laguna Verde, is also vying for a contract.

To win government approval, private companies must have experience in the lithium value chain, adequate financial resources, and hold at least 80% of the mining concessions in the proposed project area.

Deadline for phase two extended

In addition to reviewing the first round of applications, the Chilean government has launched a second phase to allocate contracts for six additional areas deemed suitable for lithium and mineral exploration. This new round, initially set to close earlier, has been extended to March 7 to allow interested bidders more time to prepare their submissions.

The newly available areas include Hilaricos and Quillagua Norte in the Tarapacá and Antofagasta regions, as well as Quillagua Este, Quillagua Sur, and María Elena Este in Antofagasta. These regions were identified based on expressed interest from prospective bidders.

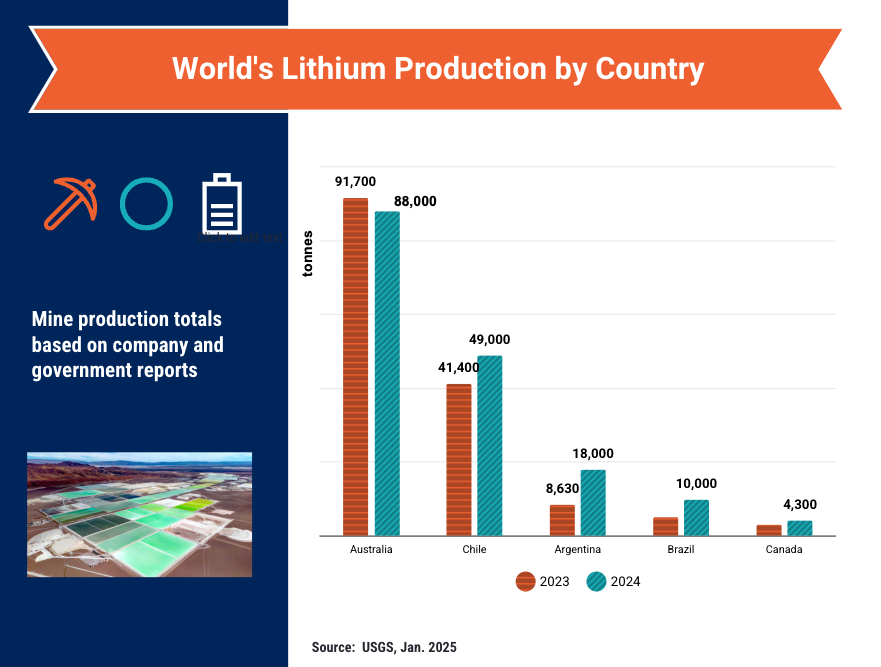

Chile, which holds the second-largest lithium reserves globally after Australia, is implementing a national strategy launched in 2023 to position itself as a top supplier of the battery metal. Despite recent fluctuations in lithium prices, the government is encouraging investors to focus on long-term opportunities in the sector.

Currently, only two companies — SQM and Albemarle — produce lithium in Chile, both from the Salar de Atacama salt flat. Their combined output is expected to increase national production by 7% this year, reaching 305,000 tonnes, according to projections by Chile’s copper and mining agency Cochilco.

Chile’s vast lithium reserves, estimated at 11 million tonnes as of 2024 by the U.S. Geological Survey, are considered some of the most economically viable for extraction. The Salar de Atacama alone hosts approximately 33% of the world’s lithium reserve base. Together with Maricunga, it has been deemed strategic and as such they are reserved to state-controlled partnerships.

Chile’s lithium production reached last year an estimated 49,000 tonnes, marking a significant increase from 41,400 tonnes in 2023. This growth has been fuelled by expansions in production capacity.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts