US-backed TechMet eyes Ukraine lithium asset

According to me-metals cited from mining.com, TechMet chief executive Brian Menell told the Financial Times his company had been evaluating the Dobra project since 2023. He noted developing the asset would be faster if Washington and Kyiv finalize a minerals deal in the coming days.

The agreement remains in question following a disastrous February 28 meeting between Ukrainian President Volodymyr Zelenskiy and US President Donald Trump. Trump claimed Ukraine had agreed to provide the US with the equivalent of $500 billion worth of rare earth minerals in exchange for military aid and intelligence sharing.

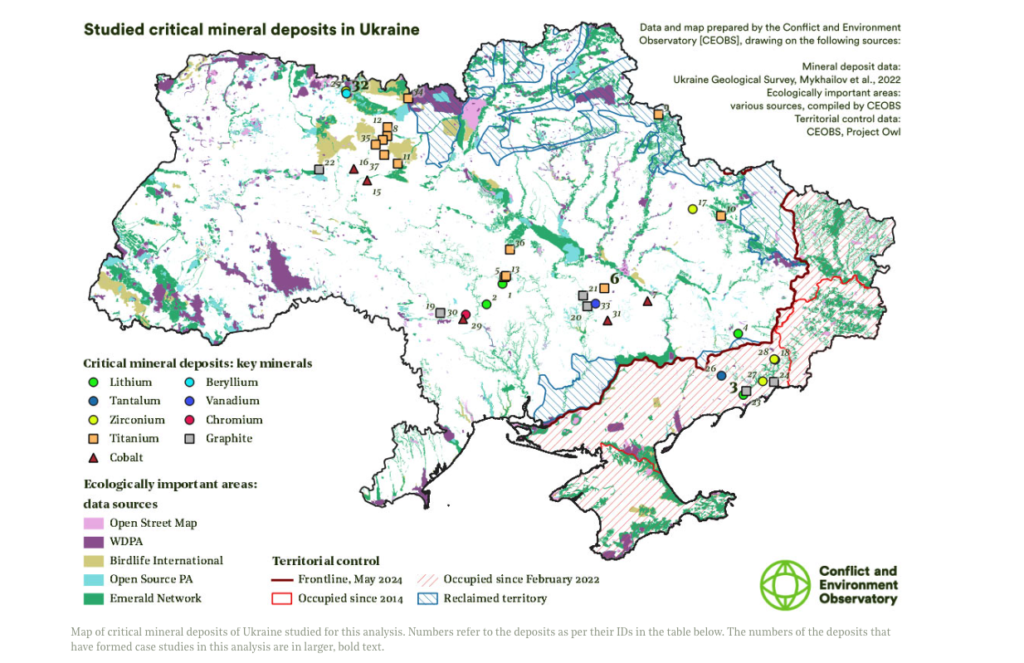

Industry experts have dismissed Trump’s figure as wildly inflated. The entire global rare earths market is valued at roughly $12 billion, according to some estimates. Ukraine does hold significant mineral reserves, with the Kyiv School of Economics estimating the country has one-third of Europe’s lithium and 3% of the world’s total, along with 6% of known global graphite reserves. However, between 20% and 40% of Ukraine’s mineral resources — including up to half of its rare earth deposits — are under Russian occupation.

Menell told the Financial Times that TechMet’s interest in the Dobra project was not contingent on the minerals deal. “However, if the minerals deal were to happen, it would certainly enhance our interest, and would create a framework that would justify doing more, bigger, quicker,” he said.

TechMet’s investment partner in the Dobra project is billionaire Ronald Lauder, a close Trump ally who has previously advocated for US efforts to buy Greenland, according to the FT.

The firm was formed during Trump’s first term when the US International Development Finance Corporation (DFC) invested in the company and became a shareholder. The fund, headquartered in Dublin, is also backed by Qatar’s sovereign wealth fund.

TechMet focuses on securing US and European access to critical minerals while reducing China’s dominance of the supply chain. It already has interests in global assets including in Brazilian Nickel’s Piauí project, Cornish Lithium’s project in the UK and EnergySource Materials’ ILiAD technology.

Beyond lithium, TechMet is open to developing other key minerals in Ukraine, including graphite, uranium, and titanium.

“All of these critical mineral opportunities in Ukraine, require time, investment and management,” Menell said. “I think it [the critical minerals deal] is positive, assuming it now happens, and assuming it is implemented in a way that is effective, which is not going to be easy.”

source: mining.com

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds