Arcadium Lithium investors sue miner over Rio Tinto takeover

According to me-metals cited from mining.com, Arcadium is countering the claims – filed in four separate US courts – with supplemental disclosures to avoid litigation delays and ensuring the transaction proceeds as planned.

The identities of the complainants who filed cases in the New York Supreme Court, including one in Suffolk County and two in New York County, as well as the size of their shareholdings, have not been disclosed.

Arcadium said it has also been hit with 19 demand letters making similar allegations of misrepresentation, concealment and negligence regarding the high-profile deal.

Despite the disputes, the firm’s board continues to recommend shareholder approval of the buyout, scheduled for a vote on December 23.

The legal challenges contrast with the stance of other investors who have voiced their support for the deal. Two major US investment managers — Calvert and the California State Teachers’ Retirement System (CalSTRS)— have stated they will vote in favour.

Among world’s top three

Rio Tinto’s offer, announced in mid-October, represents a 90% premium over Arcadium’s market value two days before the bid. However, it remains below the $10.6 billion valuation Arcadium reached in May 2023, shortly after the merger of its predecessors, Livent and Australia’s Allkem.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

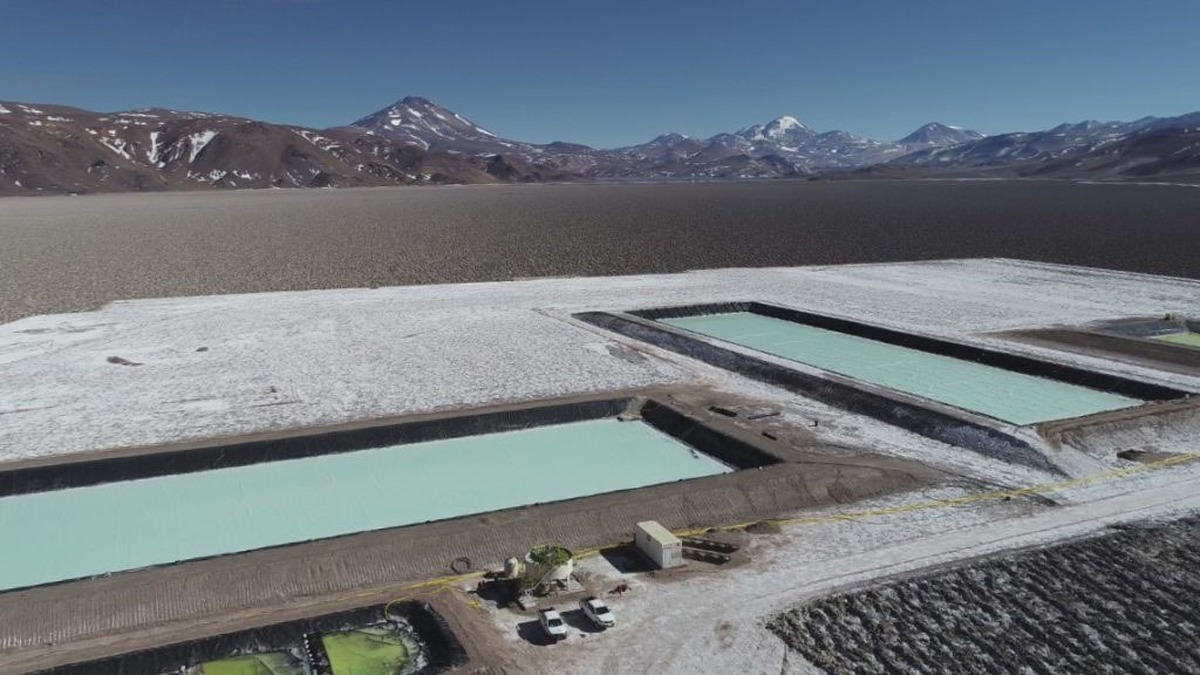

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts