Mercuria partners with Zambia on metals trading venture

According to me-metals cited from mining.com, Mercuria will join forces with Zambia’s Industrial Development Corp., it said in a statement on Thursday. The Geneva-based company, which hired Trafigura Group veteran Kostas Bintas to build out a metals trading unit this year, is pushing to increase its exposure to copper.

The joint venture will buy and sell copper domestically and for export, and over time will take responsibility for trading Zambia’s share of copper output from the mines in which a state-controlled firm is a shareholder, according to people familiar with the matter. That could eventually represent more than 250,000 tons of copper a year if various ramp up and mine expansion plans are successful, according to a Bloomberg calculation.

Mercuria will provide the financing, which is likely to be in the hundreds of millions of dollars, one of the people said, declining to be named, citing the private nature of the information.

The move is intended to provide greater transparency on the profits made by metal traders for the Zambian government, which has long suspected that too large a share of the gains from its copper have gone to foreign companies. In February, a senior economic adviser to the president told Bloomberg the country wanted to get involved in copper trading, complaining that “a lot of financial engineering, call it creative accounting” was reducing the government’s earnings.

Trading houses are working to tie up access to metals vital to the energy transition. For Mercuria and others, that means heavy investments in African countries such as Zambia, the continent’s No. 2 copper producer.

“You will see us very present in Africa and putting our money where our mouth is in respect of the Copperbelt” region, Bintas said in October.

IDC has a 60.3% stake in ZCCM Investments Holdings Plc, which owns minority interests in major copper projects run by global mining companies including First Quantum Minerals Ltd. and Vedanta Resources Ltd.

The tie-up with Mercuria will help “position Zambia as a key player in international markets,” IDC chief executive officer Cornwell Muleya said in the statement.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

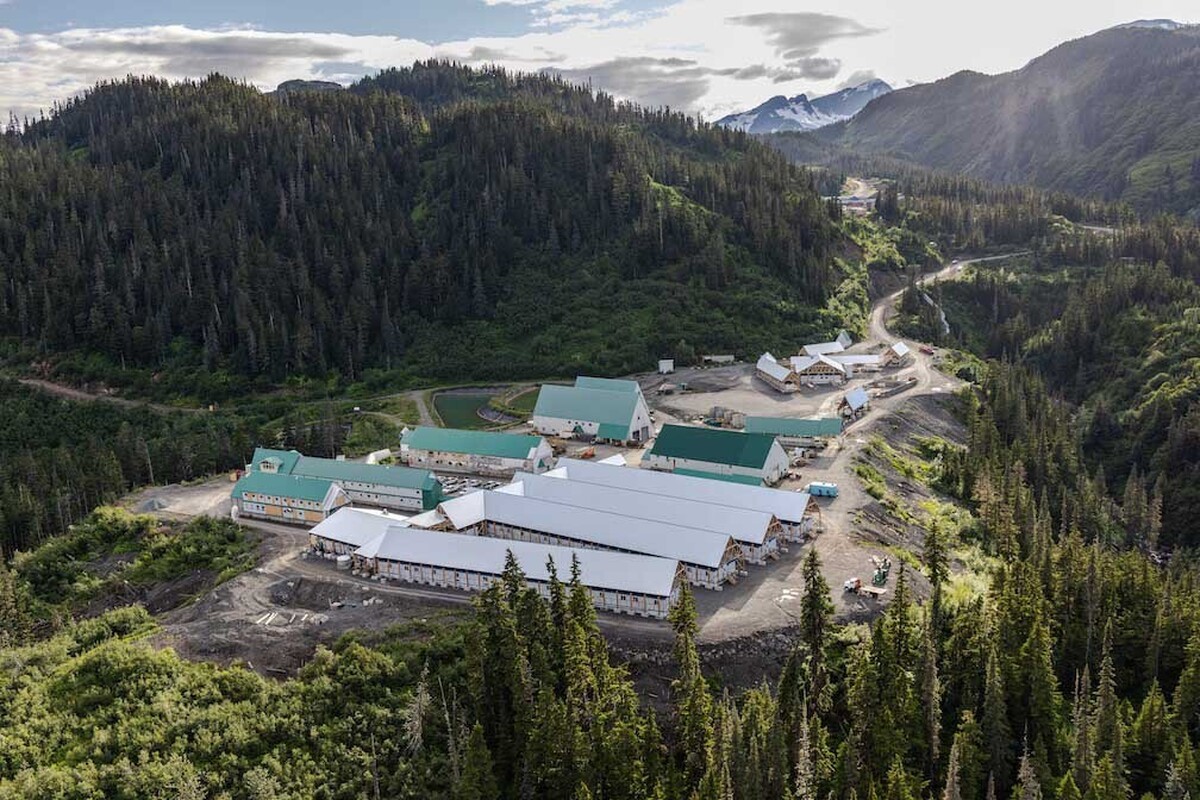

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

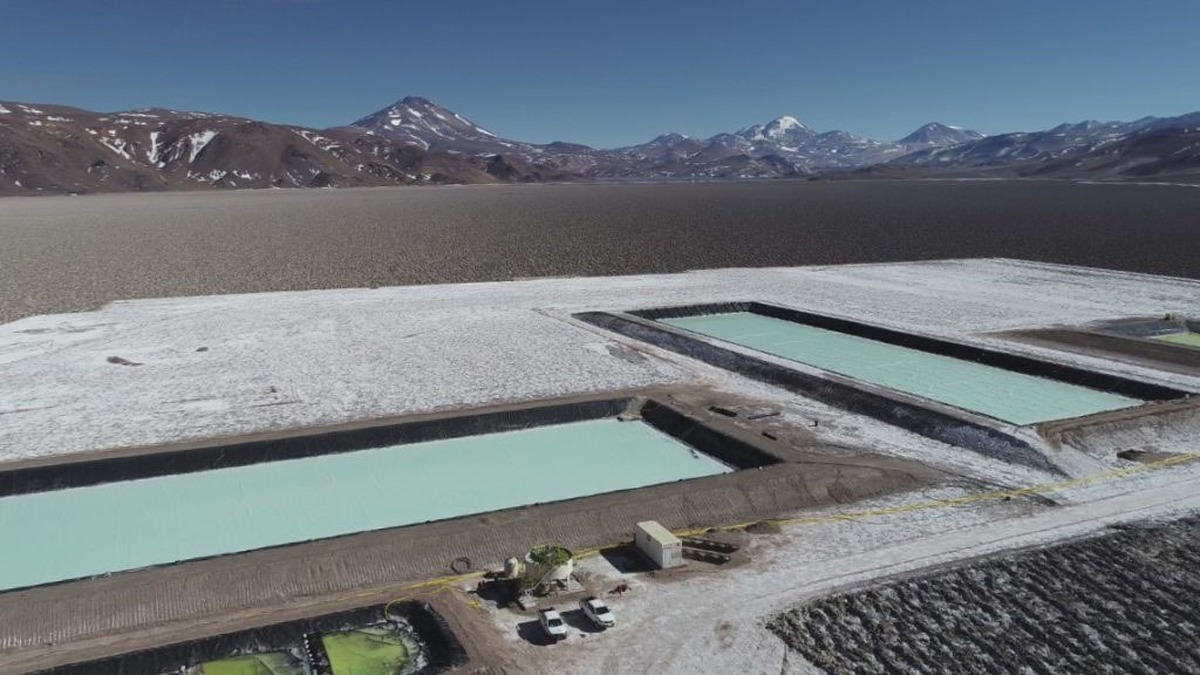

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts