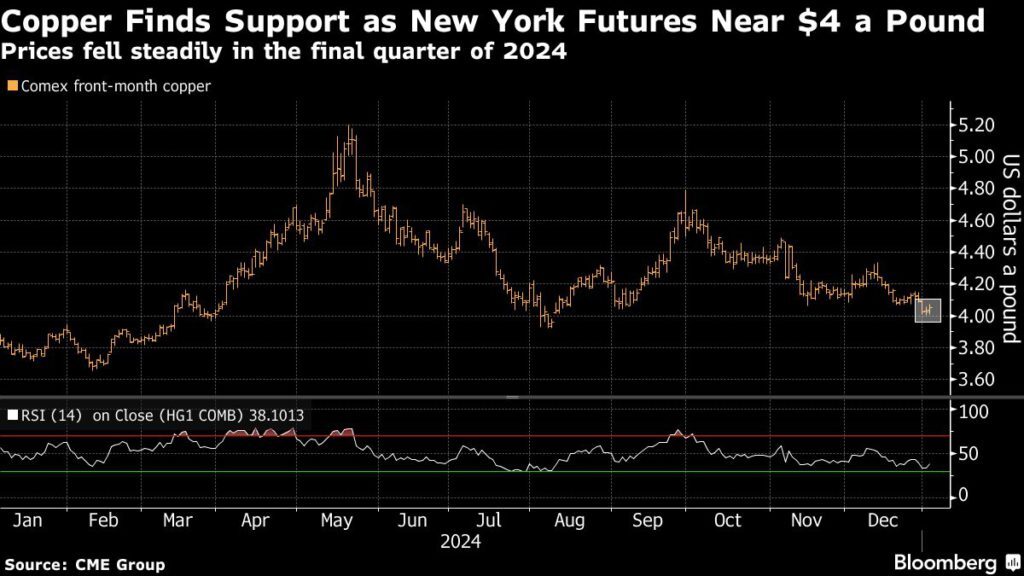

Copper lures buyers as New York futures hover above $4/lb

According to me-metals cited from mining.com, New York futures were up about 1% at $4.065 a pound as the US trading session got underway Friday, bouncing back from losses that earlier took prices close to the psychological support level of $4. Copper also rose on the London Metal Exchange, as analysts pointed to renewed buying appetite in China.

“Lower prices have boosted demand in China,” Dan Smith, head of research at Amalgamated Metal Trading Ltd., said by email. “While the broader narrative for China is quite negative, fundamentals are giving the market a lift.”

Copper fell more than 10% in the final quarter of 2024, with initial optimism about a raft of Chinese stimulus measures giving way to mounting anxiety about demand in the world’s top commodities consumer. A slump in China’s currency has heaped further pressure on metals by eroding buyer power for importing manufacturers.

It’s unlikely that policymakers will implement any major announcements that could help boost sentiment until the annual, so-called Two Sessions legislative meeting in March.

Traders will be looking to that meeting for more concrete details on how China will boost its property sector, with hints given for more support during last month’s Central Economic Work Conference. They’ll also be bracing for the potential impact of fresh tariffs from the US after Donald Trump’s inauguration this month.

Copper was 0.8% higher at $8,876.50 a ton as of 4:35 p.m. local time on the London Metal Exchange, extending a rebound from a nine-month low seen at the close of trading Dec. 31. Aluminum, zinc and lead were lower, while nickel and tin rose.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

Emirates Global Aluminium unit to exit Guinea after mine seized

South Africa mining lobby gives draft law feedback with concerns

EverMetal launches US-based critical metals recycling platform

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study