Weekly: Chinese Steel Market Highlights

According to the General Administration of Customs, the total iron ore and pellet imports by the country recorded at 176.8 MnT for Jan-Feb’20 up by 1.5% as compared to 174.3 MnT in Jan-Feb' 19. Meanwhile, China’s finished steel exports tumbled by 27% Y-o-Y in the first two months of CY '20 to 7.8 MnT as compared to 10.698 MnT in Jan- Feb’19.

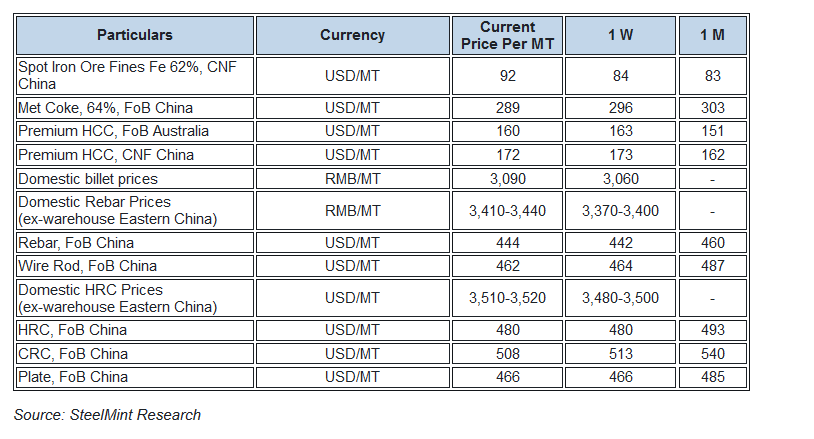

Spot iron ore prices fell towards weekend after an increase in mid-week-

-- Chinese spot iron ore fines price opened up this week at USD 88.85/MT, CFR China and increased to USD 91.9/MT, CFR China but later towards weekend prices fell to USD 89.5/MT, CFR China amid an expected rise in demand due to governmental measures in China.

-- In an announcement made by the State Council of China late Tuesday, the government “adopted a host of policies for facilitating the restart of business activities in the logistics sector, to help smooth the flow of economic activity.”

-- As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports dropped to 126.25 MnT as of 5th Mar as against 126.95 MnT assessed a week ago.

Spot pellet premium dropped W-o-W-

-- Spot pellet premium for Fe 65% grade pellets assessed at USD 29.70/MT, CFR China as against USD 32/MT, CFR China last week. Pellet premium witnessed a fall amid a shift towards comparatively less expensive products. This is because the end-users are not willing to pay a premium for improved efficiency at this point in time.

Spot lump premium gains over tight supplies-

-- Spot Lump premium for the weekend witnessed the rise to 0.3215/dmtu as against USD 0.2750/dmtu, week before. Lump premium depicted increase for the week on the back of tight supply and increasing lump utilization over pellets by end-users.

Seaborne coking coal prices decline marginally-

-- Seaborne coking coal prices fell this week in a recent deal concluded on Thursday amid lower bids and offers to hover in the Asian spot market.

-- In China, the spot seaborne market remained quiet as buyers adopted a cautionary approach since they are expecting seaborne prices to soften further on improved domestic supply.

-- Latest offers for the Premium HCC grade are assessed at around USD 159.50/MT FOB Australia, compared with USD 162.75/MT FoB basis a week ago.

-- Nevertheless, it is also possible that some steel shall restock which may support spot prices in the short run.

Domestic billet prices strengthen over improving sentiments-

-- This week, the country’s domestic billet market was settled at RMB 3,090/MT, ex-Tangshan, including VAT, up by RMB 30/MT against last week. The country’s market sentiments are recovering gradually.

HRC export offer remains stable weekly premise-

-- The Chinese HRC export offer remained stable on a weekly premise since the nation’s steelmakers are largely focusing on export trades owing to scarce demand in the domestic market.

-- However, importers are anticipating downside in HRC export offers amid competitive HRC offers from South Korea and Japan.

-- Currently, the HRC export offer stands around USD 470-490/MT FoB China, which was USD 475-485/MT in the previous week.

-- Meanwhile, the domestic HRC prices increased by RMB 20-30/MT to RMB 3,510-3,520/MT (Eastern China) in comparison with RMB 3,480-3,500/MT (Eastern China) a week ago.

Rebar export offers remain firm-

-- The current week Rebar export offers stood at USD 440-446/MT FoB China in line with USD 440-445/MT FoB basis a week ago. The gradual increase in the domestic market kept the export offers supported.

-- Meanwhile, the domestic market price ascended by RMB 40/MT and stood at RMB 3,410-3,440/MT (Eastern China) as compared to RMB 3,370-3,400/MT (Eastern China) in the preceding week on improved demand and optimistic sentiments in the domestic market.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts