Weekly: Chinese Steel Market Highlights

However, HRC export offer fell on sparse trading and competitive offers from major overseas nations. Rebar export offers gained upward momentum with robust domestic demand. Meanwhile, coking coal prices increased on supply concerns.

-- Baoshan Iron & Steel (Baoshan Steel has lowered HRC prices by RMB 50/MT and heavy plate prices remain unchanged. CR prices have been reduced by RMB 100 (USD 14) and hot-dipped galvanized steel prices have also been reduced by RMB 100/MT.

Spot iron ore prices increase-

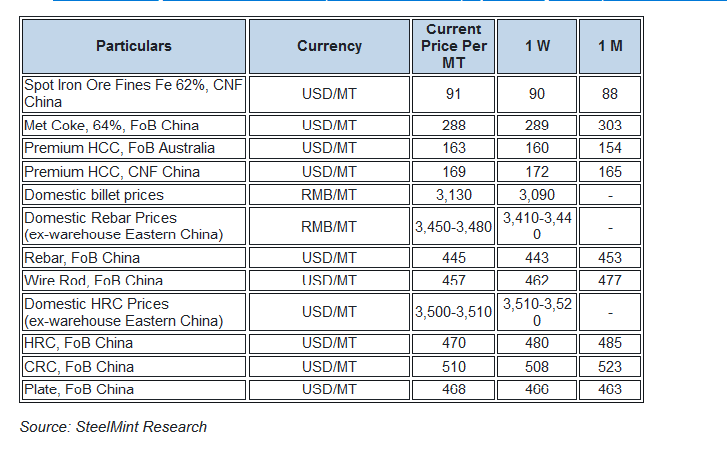

-- Chinese spot iron ore prices opened up this week at USD 87.20/MT, CFR China and increased to USD 91/MT CFR China towards weekend amid an expected rise in demand due to governmental measures in China.

-- The week witnessed fall in shipment from Brazil due to heavy rainfall leading to scarcity of iron ore in the market. Also, during the week, Chinese President Xi's visit to Wuhan sent a strong signal that the corona-virus outbreak is approaching its end in China, which in turn led to recovering demand in by Chinese mills.

-- As per data compiled by Steel Home consultancy, Iron ore inventory at major Chinese ports recorded at 126.3 MnT as of 12th Mar as against 126.25 MnT assessed a week ago.

Spot pellet premium picked up W-o-W-

-- Spot pellet premium for Fe 65% grade pellets assessed at USD 30.85/MT, CFR China as against USD 29.70/MT, CFR China last week.

-- There is still quite a moderate demand for pellets in the market. However, few end-users are not willing to pay a premium for improved efficiency at this point in time.

Spot lump premium declines on a weekly premise-

--Spot Lump premium for the weekend witnessed at USD 0.3100/dmtu as compared to USD 0.3215/dmtu a week before.

Seaborne coking coal price rises on supply concerns-

-- Seaborne coking coal prices for the premium low-volatile segment reported increase this week on stronger bids for April and May laycan cargoes in the Asia-Pacific markets.

-- Higher firm bids were observed as buyers anticipated prices to be firm until tight supply, with Australian key port terminals being closed until Sunday due to weather-related disruptions.

-- Latest offers for the Premium HCC grade are assessed at around USD 163/MT FOB Australia, compared with USD 159.50/MT FoB basis a week ago.

-- The China market observed little demand with mixed sentiments in the spot market as the steel market has yet to show significant improvement.

Domestic billet price ascends W-o-W-

-- In recent, China was reported to book 60,000 MT billets from Indonesia. The deal value was reported to be between USD 405-410/MT CFR China, and the shipment is scheduled for Apr’20. Looking at the current deal, assuming deal value to be USD 405/MT (USD 405 x currency rate 6.9 x 1.02 import tax x 1.13 VAT) + RMB 35 (logistic cost) = RMB 3,298/MT approximately. Meanwhile, the Chinese domestic billet prices are standing at RMB 3,130/MT inclusive of 13% VAT.

-- However, the current domestic billet prices in China are quite reasonable than imports, but, considering the recovering rate of the Chinese domestic market, the marketers believe the above-mentioned import deal is a good move.

HRC export offer declines on sparse trading-

-- The HRC export offers tumbled by USD 10/MT on the back of slow trades happening in the foreign market. Also, competitive offers from other major exporting nations pulled down nation’s HRC export offers.

-- The current HRC export offer stands at USD 460-480/MT FoB China, compared with USD 470-490/MT FoB basis a week ago.

-- Meanwhile, the domestic HRC price stood at RMB 3,500-3,510/MT (Eastern China), declining slightly by RMB 10/MT from RMB 3,510-3,520/MT (Eastern China) in the previous week. However, the government efforts to speed up industrial production and induce buying have bolstered the sentiments in the market.

Rebar export offers moved up marginally-

-- This week, rebar export offers inched up by USD 2-4/MT followed by better demand in the domestic market.

-- Currently, Chinese Rebar export offers assessed at USD 442-470/MT Fob China, which was USD 440-446/MT FoB basis in the preceding week.

-- Meanwhile, domestic rebar prices ascended by RMB 40/MT to RMB 3,450-3,480/MT (Eastern China) as compared to RMB 3,410-3,440/MT (Eastern China) a week ago. Increased trading activities with the resumption of construction projects along with improved end-user demand can be attributed to the increase in domestic prices.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts