Weekly: Global Ferrous Scrap Market Overview

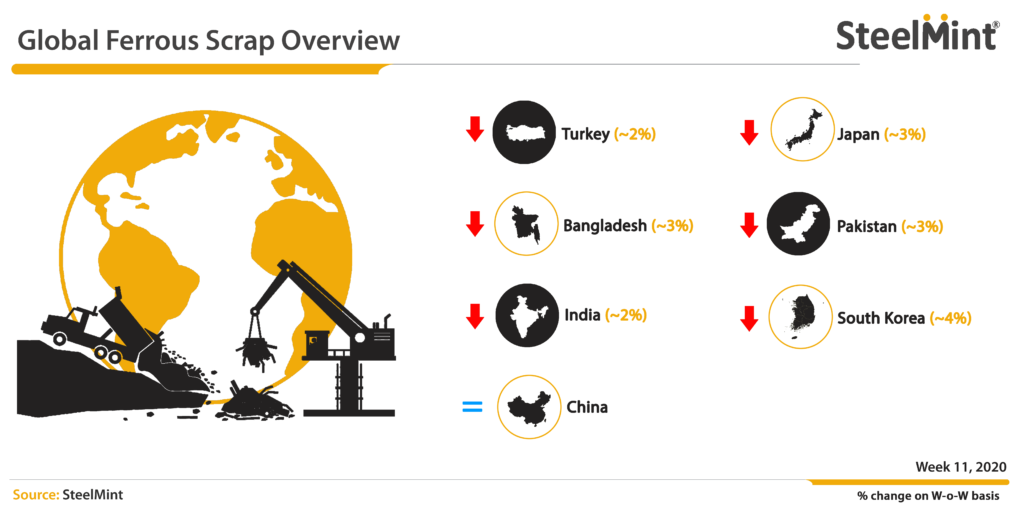

Turkey – Some more clarity on imported scrap prices to Turkey was reported after several bookings were concluded in the latter half of the week, following a period of silence for more than a week prior to that.

Among the latest confirmed bookings, a Lithuania based scrap recycler sold a 40,000 MT cargo to an Aegean region based mill, comprising of HMS 1&2 (80:20) at USD 268/MT and bonus grade at USD 278/MT CFR Turkey, lower by USD 8/MT against last Baltic origin bookings by Turkish mills, while shipment is expected for Apr '20. Another USA origin Bulk cargo was concluded to a Turkish mill at USD 275/MT for HMS 1&2 (80:20) and USD 280/MT for Shredded, CFR Turkey basis, for April shipment.

Assessment for USA origin HMS 1&2 (80:20) now stands at USD 273/MT CFR Turkey, down by USD 4-5/MT against last week’s assessment, while in comparison to last conclusive bookings, the prices have moved down by USD 7-8/MT CFR. Meanwhile assessment for European origin stand at USD 267-268/MT CFR Turkey.

South Korea - Hyundai Steel cut its purchase price for Japanese scrap this week by JPY 1000/MT (USD 9), amid low domestic market fundamentals in Korea as well as continued fall Japanese scrap price levels. The company’s current bid for Japanese H2 stands at JPY 22,000/MT FOB (USD 212), in comparison to JPY 23,000/MT (USD 221) bid last week.

In just a span of one month, the Japanese H2 bids by Hyundai Steel have now returned back to the previous low of JPY 22,000/MT during mid-Feb '20.

Japan - Tokyo Steel further lowered its scrap purchase price this week by JPY 500/MT (USD 5) at its Kyushu works, while keeping its bids unchanged for the remaining four works, from 12th March’20.

The company is now paying JPY 18,000/MT (USD 175) for H2 scrap delivered to its Kyushu works in the western region. For H2 scrap delivered to Tahara plant in the central region, Utsunomiya works located in the Kanto region the prices remain unchanged at JPY 20,500/MT (USD 194) and JPY 19,500/MT (USD 186) levels respectively.This is the fourth successive price cut observed by the company in Mar '20.

Earlier in the week, Japan’s Kanto export tender for Mar’20 was concluded, where 30,000 MT of Japanese H2 scrap was awarded at an average price of JPY 22,655/MT (USD 217), FAS marginally down by JPY 96 (USD 1) against Feb' 20. However Yen appreciation against USD supported the market. JPY is currently trading at 107.9 against USD versus 109 in Feb'20

India - Imported Scrap trades to India turned slow towards the end of the week, with buyers turning cautious on account of ongoing fall in prices at the global level as well as the sharp hike in rates of containers.

Steelmint’s assessment for Shredded scrap from US/Europe stands at USD 300/MT CFR Nhava Sheva. Earlier in the beginning of the week, few bookings were reported for Shredded at around USD 302-303/MT CFR, post which the buyers are mostly waiting for more clarity on the global market. Offers for Shredded scrap now stand at USD 298-300/MT, CFR Nhava Sheva which is lower by USD 6-7/MT W-o-W.

HMS !&2 (80:20) offers from UK stand at USD 270/MT CFR levels, while Australian origin HMS 1&2 (80:20) is being reported at around USD 278/MT CFR. Dubai origin HMS 1 (no ci gi) offers are now down to USD 290/MT CFR, while HMS 1&2 from Dubai is assessed at USD 285/MT CFR

Also, SteelMint learned that Port Health Organization (Govt of India) has issued a notification regarding cargo vessels clearing at JNPT which are coming from COVID-19 impacted countries like China, Thailand, Hong Kong, Singapore, Japan, South Korea, etc and the vessels will be screened and declared 'suspect' or 'healthy' by the govt.

Pakistan - At week’s opening, 7 steelmakers as a consortium booked a 40,000 MT of Shredded cargo at USD 297/MT CFR Qasim earlier this week, meanwhile container trades slowed down in spite of successive drop in offers last week.

Assessment for Shredded scrap in containers from UK/Europe stands at USD 300/MT CFR, while few bookings concluded at USD 301-302/MT CFR earlier in the week. Current offers from most UK yards range from USD 298-301/MT for Shredded, with few premium yards offering at up to USD 305/MT CFR. Meanwhile US suppliers are offering at a slightly lower level, with few offers of USD 296/MT also being reported.

HMS offers to Pakistan remain mostly stable this week, with HMS 1 super (no ci gi) being offered at around USD 295/MT CFR, with slight dip in interest from buyers.

Meanwhile, Pakistan’s domestic market stood stable this week, after a slight upturn in prices recorded last week. In the northern region, rebar’s average offer prices were reported at around PKR 106,000-107,000/MT, ex-works (USD 688-694), same as last week.

Bangladesh - SteelMint’s assessment for Shredded scrap from USA/Europe currently stands at USD 310/MT CFR Chittagong. Shredded bookings to Bangladesh picked up last week after a rather slow Feb’20, due to recent hike in domestic steel prices.

Several shredded bookings in containers getting concluded at around USD 310-315/MT CFR Chittagong. A steelmaker recently booked 5,000 MT of containerized Shredded scrap in total from US and New Zealand origin at around USD 310-313/MT CFR.

Latest offers for Shredded scrap to Bangladesh have come down to USD 310/MT from US/Europe and USD 305 from Aus/NZ, while many buyers are targeting USD 300-305/MT levels for Shredded. Few offers of HMS 1 from Brazil were also reported at USD 290/MT. PnS offers stand range-bound at USD 305-310/MT depending on origins and delivery terms.

Bulk market to Bangladesh remained active, as after 3 bulk cargo bookings last week, 2 more USA origin Bulk vessels (32,000 MT mixed cargoes each) were contracted this week, at USD 290/MT and USD 283/MT CFR for Shredded, respectively by 2 mills in Chittagong at USD 290/MT and USD 283/MTCFR respectively for Shredded.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts