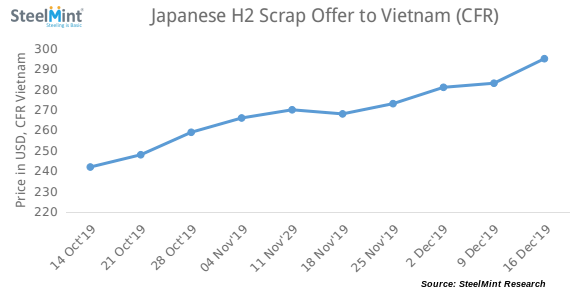

SE Asia: Imported Scrap Offers Up Following Global Uptrend

Japanese H2 scrap offers in bulk cargoes have continued to move up this week, and stood at around USD 295/MT CFR Vietnam against USD 282-283/MT CFR Vietnam last week. Current offers for H1/H2 scrap is at around USD 300/MT CFR Vietnam, up USD 10/MT W-o-W.

Shindachi scrap of Japan origin was reported at almost same levels as last week, at around USD 315/MT CFR Vietnam, on the other hand, the other higher grade - HS scrap from Japan observed a surge in offers, reaching USD 320/MT CFR North Vietnam.

HK 50/50 from Hong Kong is being offered at around USD 285/MT CFR South Vietnam. Offers from USA for containerized HMS 1&2 (80:20) was reported in the range of USD 278-280/MT CFR Vietnam.

Offers to Thailand inch up : Imported scrap offers to Thailand witnessed an increase this week, with HMS 1&2 (80:20) from Central America being reported in the range of USD 270-273/MT CFR Thailand, up by USD 5-10/MT CFR levels last week, following the global uptrend. Whereas, no offers for shredded scrap were reported.

Indonesia buyers await clarity on new import regulations: After the new regulations imposed on import of ferrous scrap- from 23rd Nov’19, trades for deep sea cargoes have yet not started in the country. Buyers are looking for more clarification on the same, while few buyers are bidding for scrap from nearby origins including bids for P&S scrap at USD 300/MT CFR level from Singapore.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts