What a difference a year makes: gloom and doom at Metals Week

At last year’s LME Week, the industry was mostly optimistic. This time, things are looking bleak.

The outlook for some key metals is at the weakest since the financial crisis as the U.S.-China trade war and a synchronized global slowdown pummel consumption and investor sentiment. Economic bellwether copper is flashing warning signals, with demand growth stalling this year as manufacturing contracts.

The only standout in the group is nickel, which has surged amid concerns about tight supply.

For more, listen to this mini-podcast on the weakness in metal markets

Overall, though, there’s “a no-growth picture for the commodity markets for the foreseeable future,” said Mark Hansen, chief executive officer of metals trader Concord Resources Ltd. The trade war “has dragged on now so long that it is impacting people’s willingness to make investments and have confidence in the foreseeable future.”

Here are five charts that show how things have turned bleak for most metals, with nickel as the clear exception:

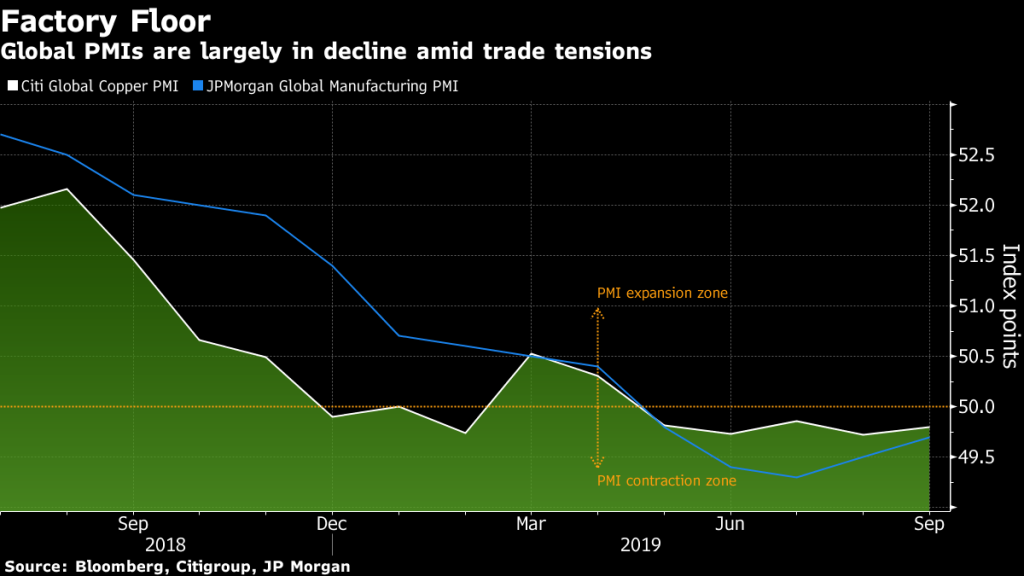

1. PMI pain

Copper is especially vulnerable to a global manufacturing slowdown because it’s used in such a wide range of products and industries, from plumbing to power cables and car radiators to high-tech electronics.

The International Copper Study Group expects the market will swing into a surplus next year as new capacity is added in China and some smelters and refineries ramp up after operational setbacks.

2. Demand stalls

Global copper demand — total consumption of refined metal and direct use of scrap — will probably decline 0.2% this year, due to a contraction in Europe and a slowdown in the U.S., according to Wood Mackenzie.

“Given the size of the market, it’s essentially flat year-on-year,” said Wood Mackenzie analyst Eleni Joannides. “But that means that the growth is at its weakest since the global financial crisis.”

To be sure, the supply outlook has tightened this month as civil unrest in top supplier Chile disrupted some mines and halted others. More widely, limited new mine supply is among the factors helping support copper prices despite the gloomy demand outlook — futures on the London Metal Exchange have fallen less than 1% this year.

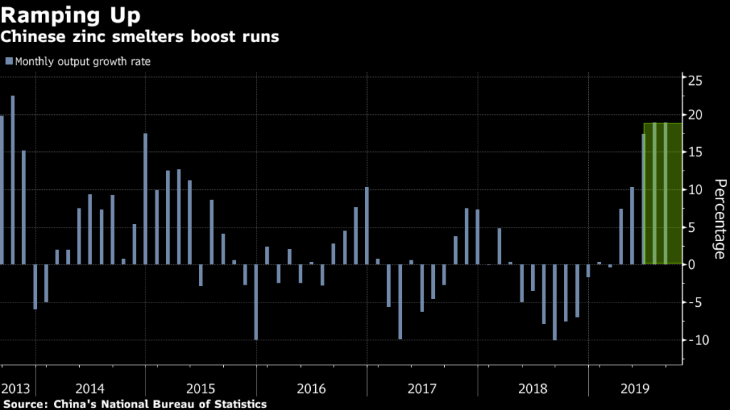

3. Chinese capacity

Chinese production has been ramping up, with refined copper rising to a record in September, and the country’s zinc smelters are also accelerating production.

While disruptions elsewhere are preventing a surplus and supporting prices for now, increased Chinese domestic output means that an excess of zinc metal still looms, according to Morgan Stanley analysts including Susan Bates.

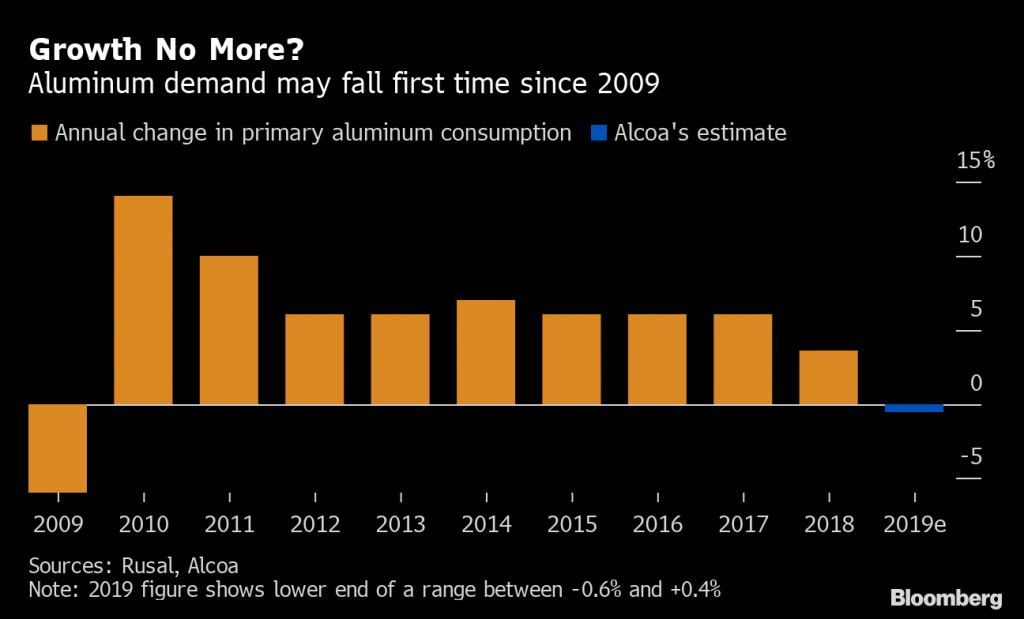

4. Glut ahead

In the aluminum market, stockpiles are close to a decade low and a global deficit is forecast in 2019. However, analysts including at HSBC Holdings Plc, expect a slight surplus next year, which may widen into 2021.

Prices for the metal used in cars, airplanes and drinks cans have fallen about 6% this year, headed for a second annual drop. Large producers are also sounding a warning, with Alcoa Corp. and Norsk Hydro ASA forecasting demand may decline this year for the first time since 2009.

“It’s a pretty rough situation, and the question is when the industry is going to reach its worst point, when all the bad news is priced in,” said Ingrid Sternby, a commodities strategist at Valent Asset Management.

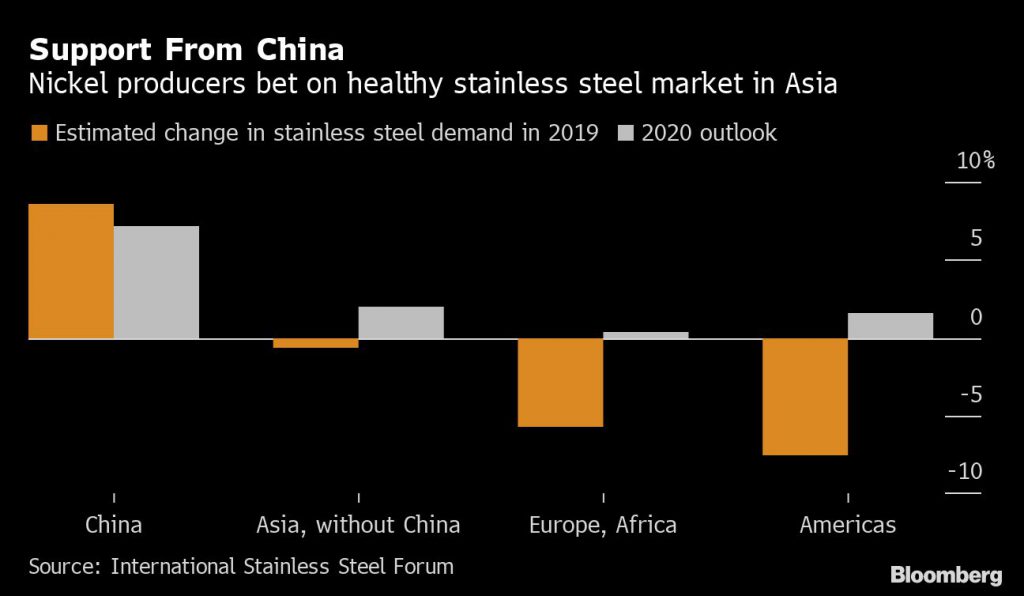

5. The superstar

While other major metals flounder, nickel has surged after a surprise decision by Indonesia to accelerate a ban on unrefined exports spurred a buying spree on the LME.

Nickel demand will rise 5% this year, according to the International Nickel Study Group.

While production of stainless steel — one of the main uses of the metal — has fallen in Europe and the Americas, the decline is being offset by a surge in Chinese output, according to Anton Berlin, head of analysis and market development at Russia’s MMC Norilsk Nickel PJSC.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts