Indian Steel Market Weekly Snapshot

Further the participants believed that, spot trades likely to remain at similar level in the coming week due to festive mood in the country amid absence of labors.

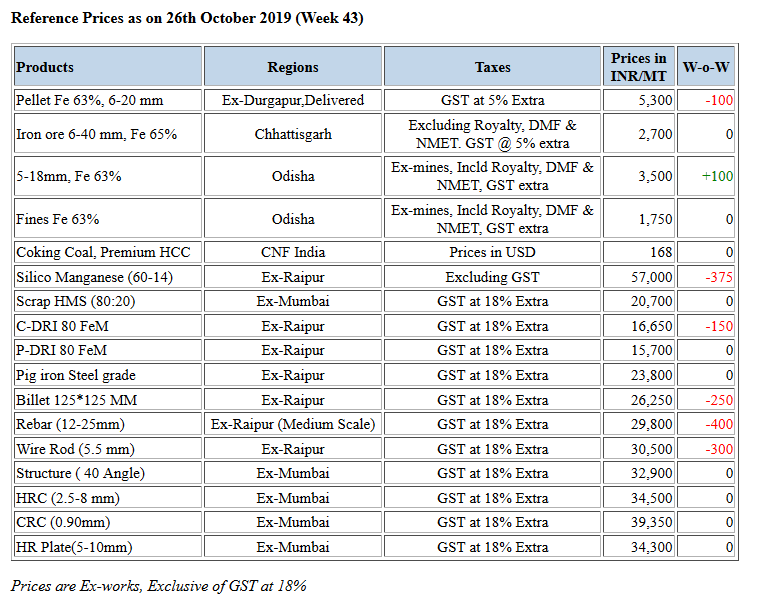

As per SteelMint assessment, this week prices of Semi Finished & Finished long steel products have declined by INR 100-500/MT (USD 1-7). While the Flat steel prices remained stable amid fewer trade activities.

IRON ORE & PELLETS

Odisha Mining Corporation (OMC) had scheduled its iron ore fines e-auction on 21st Oct’19 and received higher bids from Koira mines by INR 450-500/MT over the set base price, however for Daitari & Gandhamardhan mines, bids increased by over INR 100-150/MT. Total quantity offered was 276,000 MT.

-- PELLEX stable at INR 5,900/wmt (DAP Raipur) amid fewer transactions reported.

-- Durgapur SteelMint’s reference, pellet price down to INR 5,300/MT (ex-Durgapur, GST extra), against INR 5,400-5,500/MT in the beginning of this week. The deal for 5,000 MT pellets reported in Durgapur at INR 5,300/MT.

-- Southern India (Bellary) based pellet makers kept offers at INR 6,100-6,300/MT (ex-Bellary) this week.

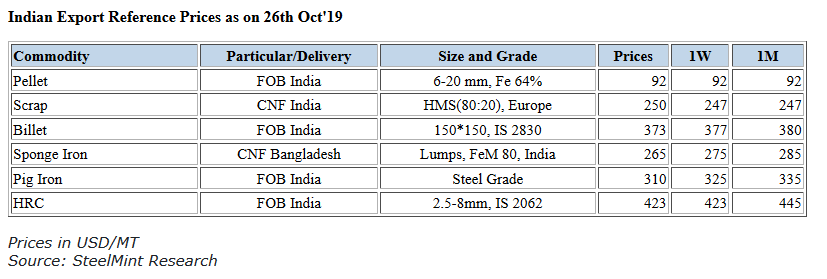

-- No pellet export deal reported in this publishing window. SteelMint Pellet Exports assessment stands for Fe 64% (3% Alumina) at around USD 91-92/MT, FoB India.

COAL

Australian coking coal prices have remained largely unmoved this week as the Chinese market has been muted again for ongoing holidays after the Golden Week celebrations.

Chinese-delivered premium mid-volatile materials are being offered at a higher range, although spot trading was thin without any fresh deals observed, as most steel mills withheld from placing bids in anticipation of a lower price level. Meanwhile, other major Asia-Pacific markets outside China continue exhibiting subdued demand for the last several months.

-- Indian demand for spot shipments of seaborne coking coal has been dampened by the prevailing bearishness in the domestic steel sector, owing to slowdowns in automobile, manufacturing and property construction.

-- Latest offers for the Premium HCC grade are assessed at around USD 152.25/MT FOB Australia and USD 167.60/MT CNF India.

FERROUS SCRAP

Imported scrap offers to India moved up slightly this week against last week's report, following Turkish price trend, SteelMint learned from industry participants. Trades remain less active in containerized markets before the festival.

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 270-272/MT, CFR Nhava Sheva, increasing by USD 8-10/MT against last week's report. Few offers were heard at USD 265-268/ MT CFR levels. Although market participants reported gap between bids & offers, resulting in lower trade volumes.

SEMI FINISHED

On a weekly basis, Semi finished offers declined in major locations, in which Billet offers fell by INR 100-500/MT and sharp fall seen in Rourkela, Odisha by INR 400-500/MT. Meanwhile Sponge iron offers drop slightly by INR 100-300/MT.

-- Jindal Steel is offering granulated pig iron (panther shots) at INR 22,000/MT ex-plant, Odisha.

-- Indian sponge iron export offers drop this week by about USD 5/MT and stood at around USD 250-255/MT CPT Benapole (dry port of India & Bangladesh), this is equivalent to USD 265-267/MT CFR Chittagong.

-- Indian mid sized mills export offers to Nepal is hovering at USD 360/MT for Billet & USD 410-415/MT for Wire rod, ex-mill at Durgapur, eastern India.

-- Indian pig iron prices marginally fluctuates in this week and offers for steel grade stands at INR 23,700-23,900/MT in Raipur, INR 23,000-23,400/MT ex-Durgapur & INR 22,800-23,000/MT ex-Bokaro (Jharkhand).

FINISH LONG

Indian Finish long steel market shows thin trades during the week over uncertain direction and lack of presence notified by trade participants as well as work force in the major regions.

Inline traders and retailers procurement also measured down, as per the market requirement.

As per weekly assessment, Finish long steel price range has been contracted by INR 100-500/MT in most of the locations except in western India where prices more or less firm this week.

Meanwhile, inventory level is maintained on average basis amid adjusted production level and market participants are anticipating that price range will remain range bound for near term.

-- Current trade reference rebar prices (12-25 mm) through secondary mills assessed at INR 29,700-29,900/MT Ex-Raipur (central region) & INR 30,900-31,200/MT Ex-Jalna (western region).

-- Central region, Raipur based structure manufacturers have plunged the prices by INR 400-800/MT in light and heavy sizes and maintaining the trade discount on heavy structure of INR 800-1,100/MT. The current trade reference prices hovering at INR 33,400-33,800/MT(200 Angle) ex-work, Raipur.

-- Trade discounts in Raipur wire rod stood at INR 1,000-1,200/MT and trade reference prices stood at INR 30,300-30,500/MT ex-Raipur and INR 29,900-30,000/MT ex-Durgapur, size 5.5 mm.

FINISH FLAT STEEL

This week domestic HRC prices remain largely stable in the domestic market over limited buying.

As per SteelMint's price assessment current trade reference prices in traders segment for HRC (IS2062,2.5-8 mm) is at INR 34,000-35,000/MT (Ex-Mumbai), INR 34,000-34,500/MT (ex-Delhi) and INR 35,000-36,000/MT (ex-Chennai). Prices mentioned above are basic and extra GST@ 18% will be applicable.

Currently domestic CRC (0.9 mm, IS 513) trade reference prices on a weekly basis are hovering around INR 39,200-39,500/MT (ex-Mumbai), INR 37,800- 39,000/MT (ex-Delhi) and INR 38,000-39,500/MT (ex-Chennai). Prices mentioned above are basic and extra GST@ 18% will be applicable.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts