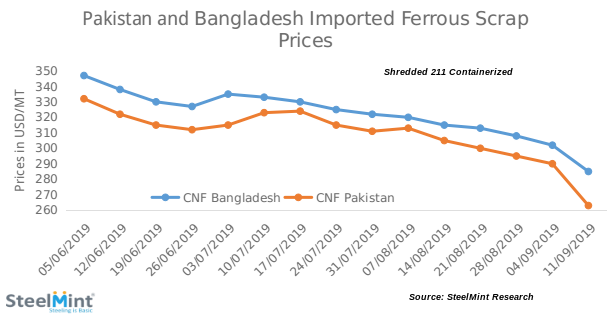

Pakistan: Imported Scrap Prices Decline Post Muharram Holidays

With Pakistan market remaining closed earlier this week on Muharram holidays, trades have remained limited, while domestic market sentiments remain mostly unchanged from last week.

SteelMint’s assessment for containerized Shredded 211 scrap from UK/Europe stand at USD 261-265/MT, CFR Qasim, down by a further USD 10/MT against the closing of the last week. Few bookings for Shredded scrap were reported at USD 263-264 earlier today after the market opened, however, the continuous downtrend has made buyers a little cautious for larger bookings.

Few global suppliers were reported to have mostly sold out for September month, on the expectation of further downturn in prices, while few other suppliers have reportedly withheld their offers for this week amid uncertainty. However, most market participants predict further drop in before bottoming out.

As per data maintained by SteelMint, the assessment for Shredded scrap to Pakistan has reached lowest levels in almost 3 years, as prior to this the price had dropped to USD 257/MT, CFR in October 2016,

For imported HMS scrap, buying interest remain very weak, as very little gap between prices of HMS and Shredded due to 3% additional duty, coupled with stricter custom clearance has kept HMS scrap less viable for Buyers.

Although Dubai origin HMS scrap has further reduced by USD 10/MT this week, with HMS 1 (Super) being offered at around USD 265-268/MT, very limited bookings were reported. European origin HMS scrap was assessed at around USD 260/MT, CFR Pakistan.

Pakistani Rupee has remained more or less stable over the last 2 weeks, currently standing around 156 levels against USD. Domestic market remained closed for the first 2 days of the week on Muharram and sentiments will be clearer in the coming 1-2 days.

Bangladesh - Following the global price decline in the last 2-3 days, Bangladesh offers for imported scrap also dropped sharply, amid few trades being reported, while the domestic market is yet to fully return from holidays.

Assessment for containerized Shredded 211 scrap from USA and UK/Europe stands at around USD 283-285/MT CFR Chittagong, with limited deals being reported. At the closing of last week, prices stood at around USD 290-293/MT, thus dropping further USD 7-8/MT in last 3 days.

HMS 1&2 (80:20) from Brazil is now being offered in the range of USD 265-268/MT CFR Chittagong while HMS 1 from Australia and South Africa stood at around USD 270-272/MT CFR. With the current downward trend in the market, buyers are usually going for lower quantity deals.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts