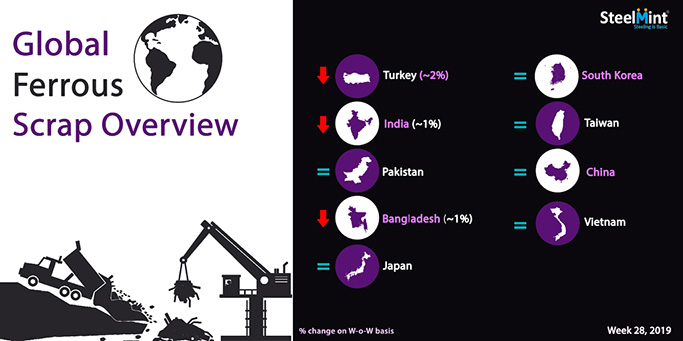

Global Ferrous Scrap Market Overview - Week 28, 2019

Japanese Kanto monthly scrap export tender fetched bids low by USD 8/MT however domestic prices remained stable with no price revision announced by Tokyo Steel, also South Korea’s Hyundai Steel held bids unchanged for Japanese scrap. Pakistan and Bangladesh remained comparatively active than India where domestic support has remained very poor for yet another week.

Turkey - Turkish imported scrap prices softened this week amid extending standoff between buyers and sellers. Very limited trades have weighed down prices further this week. While sharp fall of around USD 15-20/MT in finished steel prices pulled scrap buying interest down further among steelmakers.

--SteelMint’s assessment of US origin HMS 1&2 (80:20) scrap lowered to USD 292/MT, CFR Turkey, down USD 7-8/MT against the last week while European HMS 1&2 assessed at around USD 285-286/MT, CFR Turkey.

--In a deal reported, Marmara based steelmaker booked US origin cargo comprising HMS 1&2 (80:20) at USD 294/MT, Shredded at USD 299/MT and Bonus scrap at USD 304/MT, CFR Turkey.

Japan - Japanese monthly Kanto tender was announced this week on 10th July’19, with a total of 20,000 MT H2 scrap being awarded at an average price of JPY 28,060/MT (USD 258 ), FAS. Average bid in Jul’19 tender moved down by JPY 907/MT (USD 8 )against an average bid of JPY 28,967/MT (USD 267), FAS in Jun’19, while dropping by around JPY 5,950/MT (USD 55) since Mar’19.

-- Tokyo Steel kept its scrap purchase price unchanged this week, looking for more clarity on the domestic market trend, with H2 scrap price delivered to Utsunomiya plant remaining at JPY 26,000/MT (USD 239). Most of the participants indicate that Japanese scrap prices to have reached the bottom and may remain stable in the near terms.

South Korea - South Korean leading EAF steel mill Hyundai Steel kept bids unchanged for Japanese scrap purchase this week, amid indications that the prices may have bottomed out, with recent Japanese monthly Kanto Tender’s average bids being above the current prices.

-- The company's current bids stand at JPY 27,000/MT (USD 259), FoB Japan for H2 scrap, while no major bookings by the company were reported this week.

Vietnam - Vietnamese scrap prices remained almost stable while buyers turned active for Japanese scrap buying to take advantage of price competitiveness. Japanese H2 traded to South Vietnam in bulk quantity at USD 298/MT, CFR while Hong Kong origin HMS 1&2 (50:50) at USD 299-300/MT, CFR.

-- A north region based steel mill booked Japanese high-grade scrap, Shindachi at around USD 320/MT, CFR. After the conclusion of monthly export tender at slightly higher level than current market, Japanese suppliers seemed to have turned active.

Taiwan - Taiwanese domestic scrap & rebar prices stopped downtrend this week while imported scrap prices witnessed stability on a weekly basis. Imported scrap prices stand in the range USD 275-278/MT, CFR Taiwan for US origin HMS 1&2 80:20.

-- The leading steelmaker Feng Hsin steel has rolled over its domestic scrap buying prices at TWD 8,700/MT (USD 280) for HMS 80:20 delivered to plant. Few recent trades for rebar at higher prices pulled sentiments up in the country.

India - Imported scrap market remained silent throughout the week with very limited viability amid cheaper availability of domestic alternatives. On account of low finished steel sales and successive production cuts, no considerable buying interest for imported scrap was observed in the market. While imported offers inched down following global slowness on a weekly basis.Global

-- Assessment for containerized Shredded scrap from Europe, UK and USA stands at USD 315-320/MT, CFR Nhava Sheva, down USD 3-5/MT W-o-W, but no major deal was reported. HMS 1&2 offers from Dubai & South Africa origin were reported in the range of USD 305-315/MT, CFR Nhava Sheva, while UK origin HMS scrap assessed at USD 280-285/MT, CFR. Trades for HMS 1&2 from West Africa in limited quantity reported at USD 285-290/MT, CFR.

-- Despite slight volatility shown, domestic scrap prices remained majorly cheaper over landed imported scrap.

Pakistan - Imported scrap offers remained mostly stable this week, while market witnessed less trade activity in comparison to last week with participants remaining watchful.

-- Assessment for containerized Shredded 211 scrap from US and UK fell to USD 315-320/MT, CFR Qasim. Few UK yards were heard offering at a premium of USD 3-4/MT on tight supply. Dubai origin HMS 1 offers slightly down at around USD 312-315/MT, CFR and South African HMS 1&2 offers stand at USD 315-317/MT, CFR Qasim. Shredded scrap bids were also reported in the range of USD 310-312/MT towards the closing of the week.

-- The domestic market has remained similar to last week, with rebar prices getting stabilized after addition of 17% FED last week, even as many steelmakers still awaiting clarity. Local scrap equivalent to Shredded dropped by around 2,500/MT and to PKR 67,000-67,500/MT (USD 424-427) ex-works inclusive of taxes.

Bangladesh - Imported scrap trade activity picked up this week with deals in healthy quantity being concluded, while the marginal drop in offers was observed on a weekly basis.

-- Assessment for containerized Shredded scrap from Europe and North America stand rangebound at around USD 330-335/MT CFR Chittagong, while offers inched down towards closing of the week amid lower buying interest. Containerized HMS offers of South American origin inched down over the week, currently standing at USD 315-320/MT, CFR, with several deals being reported. European HMS 1&2 stands at around USD 314/MT, CFR while limited offers of Brazilian P&S at USD 340/MT.

-- The domestic market showed improvement with the expected hike of finished steel prices by around BDT 2,500/MT (USD 30) on newly imposed advance tax. Local shipyard scrap stands in the range of BDT 35,500-36000/MT (USD 420-426).

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts