Pakistan: Imported Scrap Prices Inch Up

Trades remain limited as suppliers majorly stand-in ‘wait and watch’ mode and non-desperate to offer in the large quantity in the market. Overall inventories of scrap remain deficient thus turning an outlook positive for scrap imports in the short term.

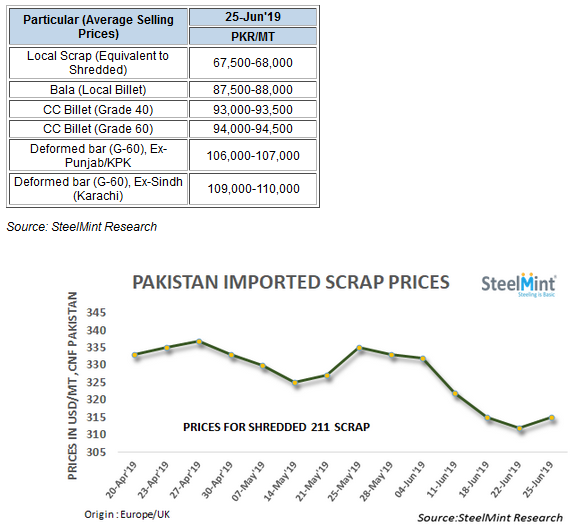

SteelMint’s assessment for containerized Shredded 211 scrap from US and UK stands at USD 312-315/MT, CFR Qasim observing a slight recovery from the deals reported at USD 308-312/MT, CFR levels last week. Few deals for Shredded scrap in containers reported in the range of USD 312-315/MT, CFR recently, thus, the assessment remains more or less stable against the report a week ago. Few leading supplier yards in UK and Europe continued offering Shredded scrap in the range USD 315-317/MT, CFR Qasim.

Assessment for Dubai origin HMS 1 remains rangebound around USD 320/MT, CFR amid slower activities while HMS 1 of UK origin reported at around USD 310/MT, CFR and South African HMS 1&2 at around USD 317-318/MT, CFR Qasim.

It is being expected that global ferrous scrap prices likely to have bottomed out now and may remain stable or increase in the near terms. SteelMint’s assessment of imported HMS 1&2 (80:20) stands at USD 280-281/MT, CFR Turkey up marginally against last week close.

Over the last week, Pakistani Rupee showed a sharp recovery to 151-152 levels on 22nd-23rd June from 157-158 levels a week ago while it has devalued again to the levels of 157-158 against USD today keeping domestic steel prices supportive.

Local steel prices to jump further on budget impact from July 1st - After witnessing a sharp jump in local steel prices last week amid currency depreciation and jump in utility bills, Pakistani steelmakers are expecting for another jump in prices with the implementation of 17% FED takes effect from July 1st which have been imposed in the recent budget. Also, the rise in gas prices and issues with transporters may pull input costing for steelmaking further up in the country.

The overall cost of construction is being estimated to go up by around 35% with rising steel, cement and other construction related material prices. Association of Builders and Developers (ABAD) has been intimated for up to PKR 120,000/MT (USD 763) price of rebar from July 1st onwards after implementation of new taxes on the steel sector.

Rebar prices in the Northern region are being assessed at around PKR 106,000-107,000/MT, ex-works (USD 674-680) meanwhile, asking rates of rebar by Southern region (Karachi) steel mills have been stabilized at around PKR 109,000-110,000/MT, ex-works inclusive of local taxes which was PKR 96,000-97,000/MT almost 1.5 months back.

SteelMint’s assessment of local billet stands at PKR 87,500-88,000/MT (USD 556-559) ex-works. CC billet G-40 and G-60 reported at an average selling price of PKR 93,000-94,000/MT, ex- works. Domestic scrap prices equivalent to Shredded remained flat with very limited availability at PKR 67,500-68,500/MT (USD 429-436) ex-works inclusive of taxes.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts