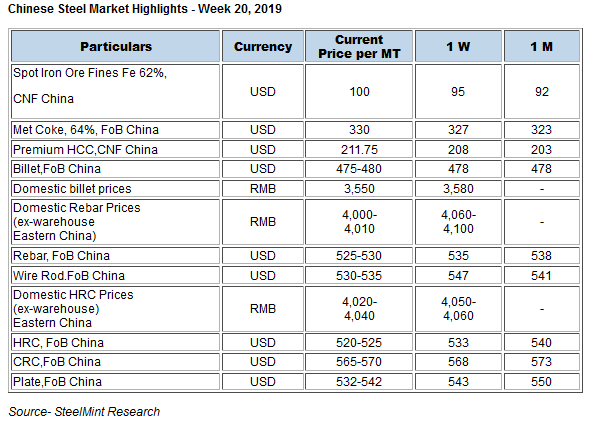

China Steel Market Highlights - Week 20, 2019

Nation’s HRC and rebar export offers reported fall on weekly basis. Spot iron ore prices recorded 5 years high.Meanwhile coking coal offers also witnessed increase on weekly basis.

As per the recent data released by NBS (National Bureau of Statistics), Chinese crude steel output recorded at 6 months high at 85.03 MnT in Apr’19. Prior this last record was made in the month of Oct’18 at 82.55 MnT.

Hebei province’s Tangshan city has set higher iron and steel capacity cuts target for 2019. Chinese government has set a target to achieve reduction of steel making capacity of 10.06 MnT, iron making capacity of 8.04 MnT, coal production capacity of 500,000 tonnes.

Tangshan city, by 2020 will reduce the steel production capacity down to about 100 MnT and steel enterprises will be reduced to less than 30, completing the relocation of steel mils situated in urban areas and those environment vulnerable areas.

Chinese spot iron ore prices hit 5 years high- Chinese spot iron ore prices opened up this week at USD 94.4/MT,CFR China and increased to USD 100.4/MT towards the weekend.

The prices picked up amid Vale forecast of Sul Superior dam rupture in next week due to vibration being identified at the North Slope of the Gongo Soco mine. Also, low inventory at Chinese mills further pushed the prices.

Iron ore inventory at major Chinese port dropped to 131.7 MnT this week as against 133.35 MnT towards last weekend.

Spot lump premium witnessed decline W-o-W basis- Spot lump premium witnessed decline W-o-W basis at USD 0.3300/DMTU CFR China this week, up as against USD 0.3250/DMTU CFR China towards last weekend.

The increase is supported due to constraint supply of lumps. However, amid high costs, mills in Tangshan have reduced lump usage and are shifting to cheaper substitute.

Spot pellet premium dropped W-o-W-: Spot pellet premium for Fe 65% grade pellets dropped to USD 31.40/DMT, CFR China as against USD 33.40/DMT, CFR China a week before. At such pellet premium levels and rising steel margins, mills are seen attracted towards pellet as raw material feed. Pellet inventory at major Chinese ports have witnessed a fall to 5.15 MnT as against 5.20 MnT a week ago.

Coking coal offers inched up on weekly basis- Seaborne premium hard metallurgical coal prices witness increase on weekly basis.

Latest offers for the Premium HCC grade are assessed at around USD 212.50/MT FOB Australia. Previous week the offer was hovering at USD 209/MT FoB basis.

Chinese billet prices decline on weekly basis- The ex-factory price of general carbon billet in Tangshan, Changli and Qian’an areas was learned to be around RMB 3,550/MT which was RMB 3,580/MT in previous week.

Chinese HRC export offers decline on weekly basis - Chinese HRC export offers reported fall this week amid increased trade tensions between USA and China.USA have increased trade tariffs from 10% to 25% on various products from China which will be implemented from 1st June’19.

Meanwhile weaker Yuan against USD also lead to falling steel prices in China.This lead to bearish sentiments in nation’s domestic market resulted to falling export offers in overseas market.

Currently nation’s HRC export offer is assessed at around USD 520-525/MT FoB basis. Last week the offers stood at USD 530-535/MT FoB basis.

Meanwhile prices in domestic market stood at RMB 4,000-4,020/MT fell by 50/MT on W-o-W basis and stood at RMB 4,050-4,060/MT in eastern China (Shanghai).

Meanwhile prices at Northern China stood at RMB 3,900-3,910/MT decline by RMB 50/MT W-o-W basis and stood at RMB 3,940-3,950/MT in Northern China (Tangshan).

However trading activity remains moderate as market participants in China expect prices to drop in long run as more and more production lines are getting installed this year.

Chinese rebar export offer fell on weaker Yuan- Nation’s rebar export offers fell on weakening Chinese currency Yuan against USD.

Currently nation’s rebar export offers are at USD 525/MT FoB China. Last week the offers were at USD 535/MT FoB basis.

However domestic rebar prices stood at RMB 4,030-4,060/MT (Eastern China) fell by RMB 40/MT W-o-W against previous week prices which stood at RMB 4,060-4,100/MT inclusive of VAT taxes.

And prices at Northern China stood at RMB - 3,960/MT basis in Northern China (Tangshan) which was RMB 3,930/MT inclusive of VAT taxes.

However towards the weekend domestic rebar prices reported increase amid active trading spot market. However trade activities in domestic market continued to remain moderate.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts