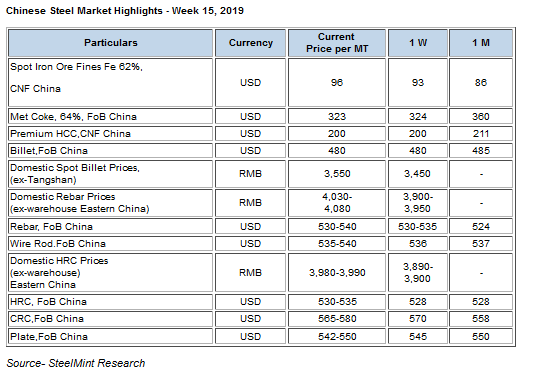

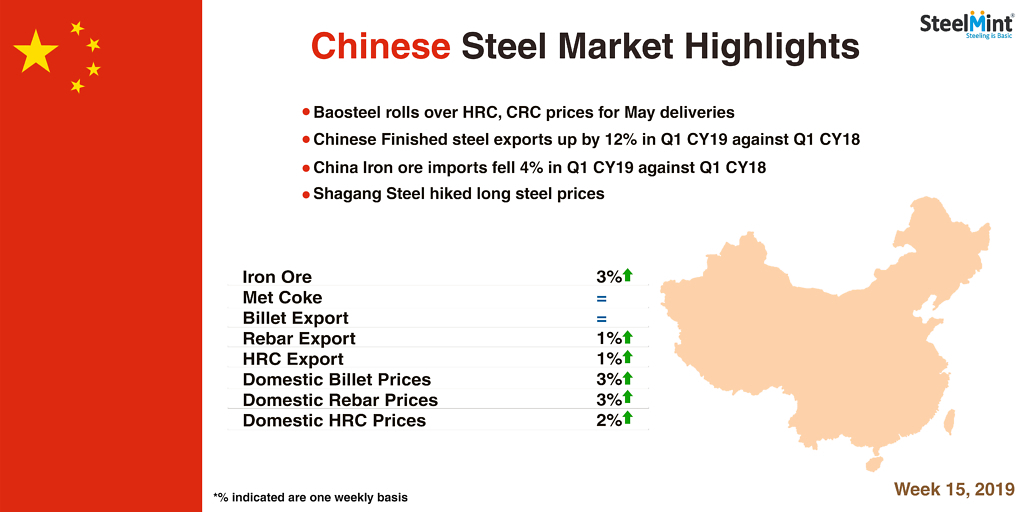

Chinese Steel Market Highlights - Week 15, 2019

According to General Administration of Customs, Chinese iron ore imports fell by 4% in to 260.8 MnT in Q1 CY19 against 270.4 MnT in Q1 CY’18. Meanwhile finished steel exports exports moved up by 12% in Q1 CY19 against Q1 CY18.

Baosteel kept HRC, CRC prices unchanged for May deliveries. However Shagang Steel hiked long steel prices in mid April.

Chinese spot iron ore prices moved up over limited supply- -Chinese spot iron ore prices opened up this week at USD 95.05/MT, CFR China and increased to USD 95.8/MT towards the weekend amidst supply concerns in global market. Also, April is marked by highest construction activities in China lead to restocking by Chinese mills. Iron ore inventory at major Chinese port dropped to 143.9 MnT this week as against 148.6 MnT towards last weekend.

Spot lump premium witness drop this week : Spot lump premium witnessed dropped to USD 0.3150/DMTU, CFR China as against USD 0.3200/DMTU, CFR China a week ago owing to availability of cheaper substitutes since mills were replacing lumps with pellets.Lump inventory at major Chinese ports reduced to 16.6 MnT as assessed on 12th Apr as against 16.9 MnT on 5th Apr.

Spot pellet premium up by USD 3.05/DMT, port stock reduce-: Spot pellet premium for Fe 65% grade pellets have dropped to USD 28.40/DMT, CFR China this week, against 25.35/DMT a week before. Pellet inventory at major ports have dropped to 5 MnT this weekend against 5.25 MnT a week before. The steel making hub of China, Tangshan has extended steel production curbs till Sep this year which is expected to escalate pellet demand.

Coking coal offers remained steady this week - Seaborne coking coal prices remained steady this week amid sluggish trades from end users in China

Thus, latest offers for the Premium HCC grade are assessed at around USD 201.75/MT FOB Australia which was reported USD 199/MT FoB basis last week.

Chinese billet prices surge in domestic market - Chinese billet prices in domestic market inched up on weekly premises and was assessed at RMB 3,550/MT (including VAT).

Chinese HRC export edged up over gains in domestic market- Chinese HRC export offers moved up this week following surge in domestic HRC prices.

Prices in domestic market moved up by RMB 90/MT on weekly basis. Domestic prices in eastern China (Shanghai) stood at RMB 3,980-3,990/MT which was RMB 3,890-3,900/MT inclusive of VAT taxes.

However nations HRC inch up by USD 5/MT on weekly basis. Currently nation’s HRC export offers is assessed at around USD 535/MT FoB basis. Last week the prices stood at USD 525-530/MT FoB basis.

Chinese mills are trying to focus in domestic market amid strong demand rather than lowering their export offers for overseas buyers.

Chinese rebar prices surge significantly in domestic market - This week rebar prices witness significant increase in domestic market amid surge in higher iron ore prices.

Domestic rebar prices surged by RMB 130/MT on W-o-W basis and is assessed at RMB 4,030-4,080/MT in (Eastern China) inclusive of VAT taxes.However last week the prices stood at RMB 3,900-3,950/MT inclusive of VAT taxes.

Thus Chinese mills are turning towards domestic market amid higher profit margins.Rebar prices have started taking pace by the end of Lunar new year holidays in Feb’19 and have recorded high compared to Hot rolled prices.

Shagang Steel raised finished steel prices for mid April. Shagang is selling HRB400 16-25 mm dia rebar at RMB 4,200/MT (USD 625) over the end March period, up RMB 150/MT .

However nation’s rebar export offers are at USD 530-540/MT FoB China. Last week also the offers were at USD 525-530/MT FoB basis.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts