China's Shagang Steel Cuts Scrap Purchase Price by USD 6

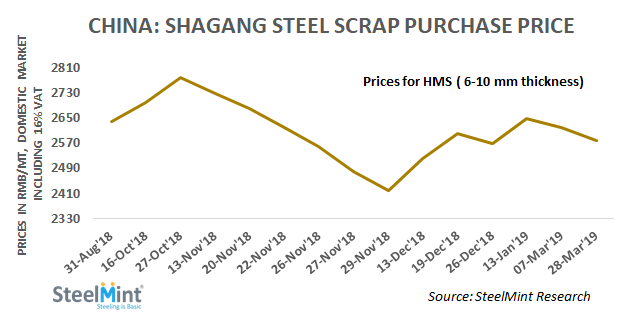

As per updates, Shagang Steel is paying RMB 2,580/MT (USD 383) inclusive of 16% VAT for HMS (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai in China, down RMB 40/MT against the last report of RMB 2,620/MT on 7th Mar’19. Along with all grades of steel scrap, prices have moved down by RMB 50-80/MT for some of the crushing materials, raw materials blocks and shredding raw materials as per the latest revision.

Prior to this, in the last price revision made on 7th Mar’19, the company lowered scrap prices by RMB 30/MT amid declining profit margins of EAF steelmakers between rebar and scrap and concerns of low finished demand in the domestic market.

Following China’s largest privately owned steel mill's lead, many leading scrap consumers in Maanshan, Xuancheng, Shanghai, Taizhou origins have lowered scrap purchase prices by RMB 30-40/MT recently in China.

What could be the reason behind this price cut? A trade source shared that the downward pressure on steel scrap price in China lies in its relatively higher price previously and the price of finished steel which is under pressure presently. Scrap prices might have lowered amid mills' willingness to demand is lower and due to cost control. In April it is expected that mills' capacity will gradually release due to the uplifting of heating season restrictions, which is a negative signal to finished steel price. Some mills are not intended to buy scrap in large volume while the perspective of finished steel price is uncertain or under pressure.

Shagang Steel increased finish long prices for end-March shipments - Shagang is selling HRB400 16-25 mm dia rebar at RMB 4,050/MT (USD 602) over the 21st-31st March period, up RMB 50/MT against the last set of prices for mid-Mar’19 shipments on decent demand. While that for HPB300 6.5 mm dia wire rod holds at RMB 4,140/MT (USD 616), up RMB 40/MT over the same period. All prices are on an ex-works basis, including 16% VAT.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts