India: P-DRI Manufacturers Reel Under Pressure on High Input Cost

The margins remained low from Raw Pellet to Sponge P-DRI in major markets like - Raipur & Durgapur for standalone manufacturers. SteelMint in data analysed that standalone sponge plants are experiencing gap of INR 1,500-2,000/MT between cost of production of sponge P-DRI and selling price in domestic market.

The sources here mentioned that, sponge demand is weak on account of lower exports & limited domestic demand which in turn has resulted in price fall in both raw pellet & sponge pellet which in turn has led to low margins.

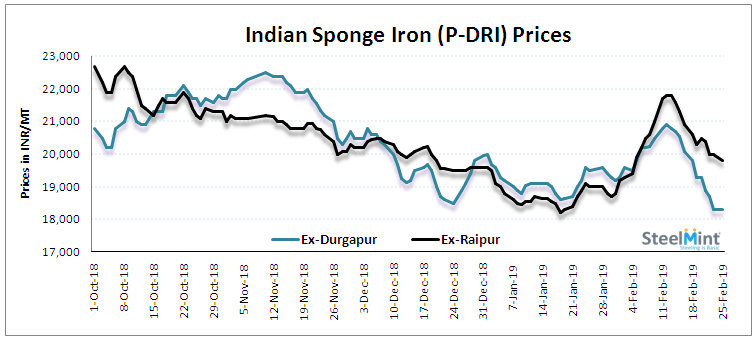

If we compare current cost of productions, the selling price of Sponge P-DRI should be not less than of INR 21,500/MT ex-Raipur & INR 20,500/MT in Durgapur.

However as per assessment, presently the trades are happening at INR 19,700-19,900/MT ex-Raipur & INR 18,100-18,300/MT in Durgapur, which are lower by INR 1,500-2,000/MT (USD 21-28) than the cost of productions of standalone sponge plants.

For an outlook purpose a key price trend setter in Durgapur, East India stated “there is no scope for further major fall in prices, if we looking current input cost against cheaper sponge trade price. However as the buyers purchase interest is almost nil, we are reluctant to cut offers.”

Manufacturers from Southern India quoted, “We are planing to curtail production to meet demand-supply chain as high stock is forcing us to reduce offers day-by-day. We are unable to run units with current cost of production versus lower selling prices.”

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery