Japan: Kanto Monthly Scrap Export Tender for December Fetches Bid Lower by USD 39

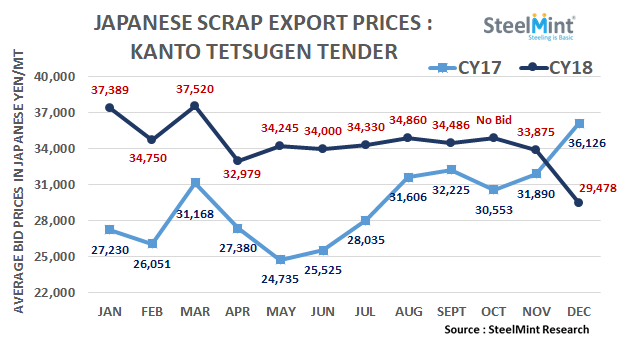

Average bids for Kanto tender dropped below JPY 30,000/MT for the first time since JPY 28,000/MT levels last in Jul’17.

On monthly premises, bids in Dec’18 tender have edged down by JPY 4,397/MT (USD 39) M-o-M as against the average bids fetched at JPY 33,875/MT (USD 297), FAS in Nov’18. Monthly around 20,000 MT H2 get auctioned through this tender. It is also to be noted that FoB prices for the same are higher by around USD 9-10/MT than FAS (free alongside ship) prices.

In the Dec'18 tender, first winning bid fetched H2 at JPY 30,000/MT, FAS and second winning bid was at JPY 29,510/MT, FAS. The third-place retained by two winning bids each at JPY 29,200/MT, FAS.

What can we infer from Kanto Tender results?

According to reports, although Japan’s domestic scrap prices in the Kanto region have plummeted sharply it has been pointed out that bids remained slightly higher side than current market levels. This may support factor for the Kanto region’s price.

On the other side, H2 purchase scrap prices in Tokyo bay region stand in the range of JPY 28,000-29,000/MT levels. Following which Tokyo steel’s H2 purchase price at Utsunomiya work in Kanto which currently stands at JPY 31,500/MT is likely to fall further by JPY 1000-1500/MT anytime soon. However, participants are waiting for signs of bottoming out in the market.

What happened in Japan’s domestic and export scrap market in last 1 month?

Japan’s leading EAF steelmaker Tokyo Steel observed successive price cuts resulting in the total price drop of USD 50-60/MT for domestic scrap in a months’ time.

South Korean steelmakers continued buying limited scrap from Japan amid high inventories in hand. However, on sharply declined Japanese prices, Hyundai Steel resumed bids for H2 lowering it down by a total of JPY 3000/MT (USD 27). It also booked H2 scrap after almost 4 months’ time.

In last one month’s time, JPY kept hovering in the range 112.5 low to 113.8 high against USD which also put a pressure on overall scrap exports. Today USD/JPY rate stands above 113 levels which were trading at 113.8 levels on 11th Nov’18.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%