South Korea: Hyundai Steel Books Bulk Scrap Cargo from US and Russia

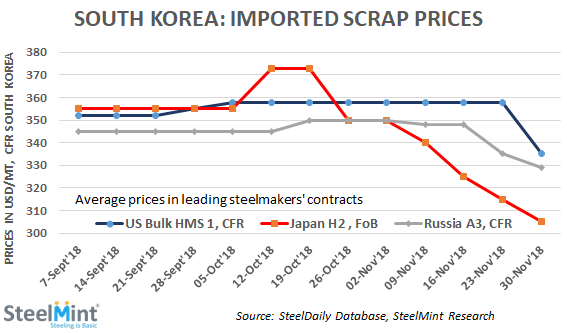

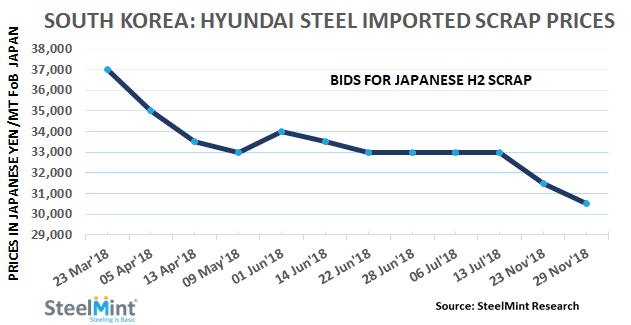

Last week, the steelmaker contracted US bulk scrap cargo for end January shipment. One of the leading supplier in US, SIMS metal sold the cargo comprising total 45,000 MT of HMS 1 at an average price of USD 335/MT, CFR. It was a drop of USD 23/MT as against last deal concluded for US bulk scrap at USD 358/MT during the early October.

In line with this, Hyundai Steel also contracted about 10,000 MT Russian A3 grade ferrous scrap recently. The contract price reported at USD 329/MT, CFR as against USD 335/MT, CFR levels during end-Nov'18.

It seems that the steelmaker has signed a series of consecutive US and Russian steel scrap bulk deals in preparation for the reduction of steel scrap in winter. Usually in winter season, supplier markets observe sharp fall in collection rate and scrap supply decreases.

In addition, global scrap prices have moved down sharply which could have attributed to these bulk deals.

Hyundai Steel cuts domestic scrap purchase price further - South Korean domestic scrap prices show no signs of bottoming out. Southern steelmakers scrap inventories have been saturated for more than four weeks. Supply is estimated to have remained high compared to consumption following which Hyundai Steel lowered scrap purchase price successively at Pohang works by KRW 10,000/MT (USD 9).

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%