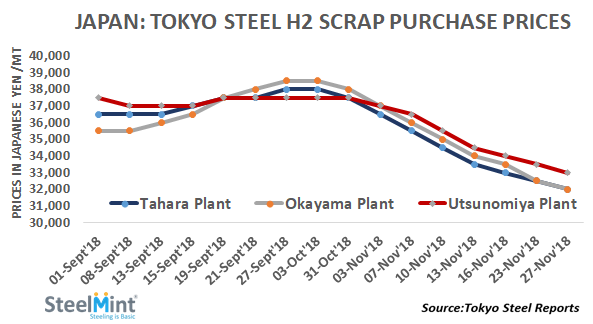

Japan: Tokyo Steel Cuts Scrap Prices; Utsunomiya Work Prices at 7-Month Low

Japan’s leading EAF steel mini-mill - Tokyo Steel has slashed scrap purchase prices for seventh time in Nov’18. As per new price circular released, prices reduced by JPY 500/MT (USD 4) at all five works of the company in Japan. New prices shall be effective from tomorrow.

Tokyo steel’s H2 prices stand at JPY 32,000/MT (USD 282) for largest plant Tahara in central Japan and for Okayama works in western Japan. Bids for the same grade noted at JPY 31,000/MT for its Takamatsu steel center, JPY 33,500/MT for Kyushu plant and at JPY 33,000/MT for Utsunomiya plant located in the Kanto region. Similar price levels for H2 in Utsunomiya works were last seen in Apr'18.

While prices for Shredder A and Shredder C grades at Tahara works kept unchanged in recent price revision.

Central Japan’s EAF steelmaker, Chubu Steel cut scrap purchase price by additional JPY 500/MT on 23rd last week. Its H2 purchase price stood in the range JPY 32,000-32,500/MT.

According to port sources, domestic scrap prices continue to remain weak on the ongoing difficult situation for new export contracts. Following which export offers have also come under pressure and stand in the range JPY 32,000-32,500/MT (USD 282-287), FoB.

In addition, Topy Industrial Toyohashi Seisakusho restarted operation last week, but their buying interest seems limited only for newly cutting scrap, and the supply and demand still remains tight.

JPY slightly devalued over the past few day as USD/JPY rate stands at 113.5 today as against 113 on 22nd Nov’18.

South Korean Dongkuk Steel books bulk Japanese H2 scrap - As per SteelDaily’s report, Dongkuk Steel has booked around 18,000 MT Japanese H2 at JPY 34,000/MT, CFR from the spot market. The shipment is scheduled for Jan’18 delivery. Bids stand equivalent to JPY 31,500-32,000/MT, FoB Japan at which Hyundai Steel’s last contract was confirmed.

Leading EAF steelmakers are preparing for upcoming winter season amid which limited demand for Japanese scrap persists in the market. Domestic scrap purchase prices fell successively on oversupply situation in South Korea. Many of the participants are expecting that there is still a room for further price drop as no signs of bottoming out of prices seen yet.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook