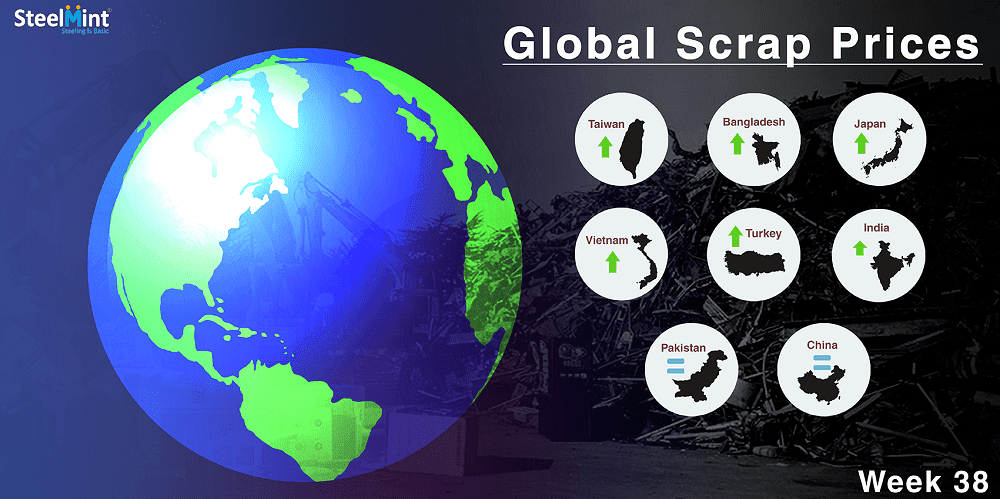

Global Ferrous Scrap Market Overview - Week 38, 2018

India witnessed more number of trades at inched up prices as compared with Pakistan and Bangladesh amid Muharram holidays. Japan’s Tokyo Steel raised prices thrice this week while Kansai Tetsugen tender recorded marginal decrease in average bids fetched for September. South Korea's Hyundai Steel continued buying through individual negotiation. China’s scrap prices likely to move up amid restocking however, Shagang Steel scrap purchase prices remained unchanged.

Turkish mills resume bookings after short break - Turkey scrap importers resumed buying after a short break for IREPAS conference. 2-3 fresh bulk cargoes booked at further increased prices amid slightly improving rebar prices. A steelmaker in the Iskenderun region booked a Baltic Sea cargo comprising 10,000 MT of Bonus or HMS 1&2 (95:5) at USD 335/MT, CFR normalizes to USD 325/MT CFR and another 30,000 MT cargo comprising 25,000 MT HMS 1&2 (80:20) at USD 322.5/MT and 5,000 MT Bonus at USD 335/MT, CFR. Thus, price assessment for USA origin HMS (80:20) scrap stands at around USD 325-326/MT, CFR Turkey up USD 5-6/MT on W-o-W basis.

Japan’s Kansai tender fetches bid down USD 3/MT in Sept'18 - The average bids for ‘Kansai Tetsugen'- monthly ferrous scrap export tender in Sept’18 were recorded at JPY 34,450/MT (USD 306), FAS down by JPY 330/MT (USD 3) M-o-M as against the average bids fetched at JPY 34,780/MT (USD 309), FAS in Aug’18. In Sept’18 auction, total 5,200 MT of Japanese H2 scrap was awarded to winning bid placed.

Japan’s Tokyo Steel raises scrap purchase price thrice in a week’s period - Japanese market observed three days of consecutive holidays from 15th to 17th Sept. last week and it is likely to witness Autumnal holidays in between 22nd to 24th Sept. Thus, EAF steelmakers plan to increase the production volume by intensive operation during the weekend amid cheap electricity prices. Now, Tokyo Steel’s H2 scrap prices stand at JPY 38,000/MT (USD 339) for Okayama and Kyushu, which have surpassed prices at two major plants Tahara and Utsunomiya at JPY 37,500/MT the first time. While bids for the same grade remained at JPY 37,500/MT for its Takamatsu steel center in Southern Japan.

Hyundai Steel continues with individual negotiation for Japanese scrap - South Korea’s leading EAF steelmaker, Hyundai Steel cut domestic scrap prices amid high inventories in hand. Hyundai likely to continue special steel scrap purchases from Japan through individual negotiation instead of bidding for H2.

India imported scrap market observed thin trades at slight increased prices - Indian imported scrap market witnessed more number of trades as compared with Pakistan and Bangladesh amid Muharram holidays this week. However, depreciated currency kept trade volumes limited at inched up prices in containers and no bulk inquiry heard.

Offers for UK origin Shredded scrap in containers heard at around USD 365/MT, CFR Nhava Sheva. Offers from Dubai based suppliers remain at USD 355/MT for HMS 1 and for South Africa HMS 1&2 at around USD 350/MT, CFR. Offers for HMS 1&2 (80:20) heard at USD 345-350/MT from UAE, UK and other origins while few deals for West African HMS 1&2 in containers is learned mostly at around USD 340/MT, CFR Nhava Sheva. Currently, local HMS 1&2 (80:20) basic prices assessed at INR 27,800-28,000/MT (USD 385-388) up INR 500/MT W-o-W, ex- Mumbai. Local HMS (80:20) prices assessed at INR 27,000-27,300/MT, up INR 1,300/MT W-o-W, ex- Chennai.

Pakistan steel market slows down on religious holidays; prices stable – No active buying for imported scrap observed despite of stability in offer levels. Few deals for prompt need were booked at stable prices amid low inventories in hand. Prices for containerized Shredded remain in the range of USD 357-358/MT, CFR Qasim for Europe origin and at around USD 360-362/MT, CFR for UK origin. HMS 1&2 from South Africa assessed at around USD 350-353/MT, CFR and HMS 1 from UAE at USD 353-355/MT, CFR. Everyone expects for release of funds towards construction projects at earliest. Local steel market in Pakistan remained almost stable W-o-W and it is expected to get improved further after Muharram holidays.

Bangladesh scrap market turns less working amid high offers - Bangladesh market observed further increase in imported scrap offers by USD 5-7/MT W-o-W amid high Indian sponge prices. Shredded 211 scrap in containers from UK & USA suppliers was being offered at around of USD 375-378/MT, CFR. Buyers were getting offers at USD 340-350/MT for HMS 1&2 (80:20) from Brazil, Chile and UK. Local scrap being cheaper over imported witnessed further downtrend in prices amid weak finish steel demand. Local rebar and ship breaking scrap prices moved down further ahead of religious holidays. Also Indian sponge iron export offers remained firm at USD 390-395/MT, CFR Chittagong with limited deals.

Indonesia and Taiwan witness marginal rise in scrap prices - Price assessment for US origin HMS (80:20) stands at USD 332/MT, CFR Taiwan in containers amid limited trades. Indonesian offers for P&S and Busheling from Singapore heard at USD 385-392/MT, CFR Jakarta and USA origin Shredded scrap in containers reported at around USD 365/MT, CFR Jakarta.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%